Whereas many corporations face tariff-related headwinds, sure shares stand poised to climate—and even profit from—the storm.

The potential winners in a tariff-heavy surroundings will likely be corporations with home provide chains, pricing energy, and important merchandise.

In search of actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

As President Donald Trump’s sweeping tariff measures take impact Wednesday, traders are scrambling to reposition portfolios for what could possibly be a chronic interval of commerce tensions. Certainly, the market response to Trump’s tariffs has been extreme, with main indices experiencing substantial declines.

Supply: Investing.com

As world markets brace for the influence of Trump’s tariff insurance policies, sure corporations are positioned not simply to climate the storm however probably thrive on this altering commerce panorama. Let’s look at 5 shares that would profit from the shifting financial surroundings.

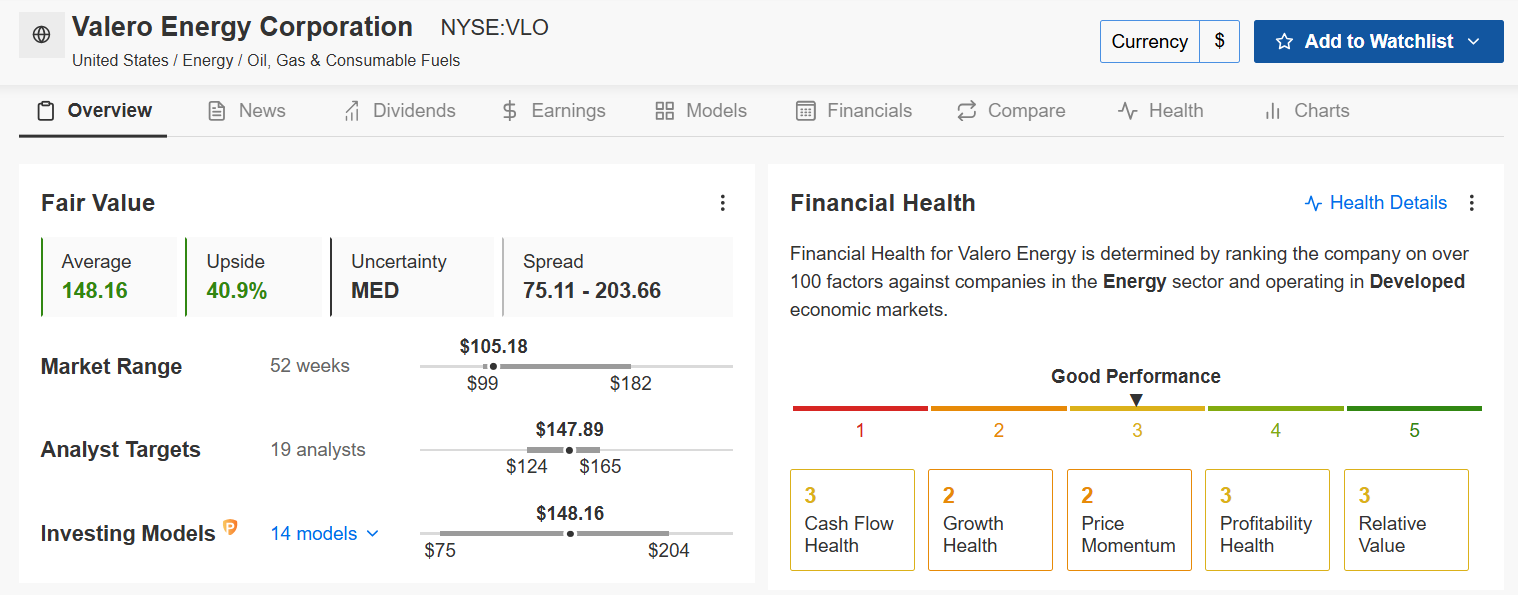

1. Valero Power

Honest Worth: $148.16 (+40.9% upside potential)

Monetary Well being: GOOD (Rating: 2.74)

P/E Ratio: 12.3x

Dividend Yield: 4.30%

Valero Power (NYSE:) is a number one refiner and marketer of transportation fuels and petrochemical merchandise. Headquartered in San Antonio, Texas, Valero operates 15 refineries throughout america, Canada, and the UK, with a mixed throughput capability of roughly 3.2 million barrels per day.

As Trump’s tariffs influence world commerce flows, Valero’s heavy U.S. footprint makes it much less weak to import tariffs, as most of its is sourced domestically or from tariff-exempt areas. Its refining capability additionally advantages from potential disruptions to international rivals, positioning it as a home power winner in a protectionist local weather.

Supply: InvestingPro

With a “GOOD” Monetary Well being rating of two.74 and buying and selling at simply 12.3x earnings, Valero seems considerably undervalued with a Honest Worth estimate of $148.16—suggesting 40.9% upside potential. The corporate’s 4.3% dividend yield affords compelling worth for defensive traders searching for each revenue and potential appreciation throughout commerce disruptions.

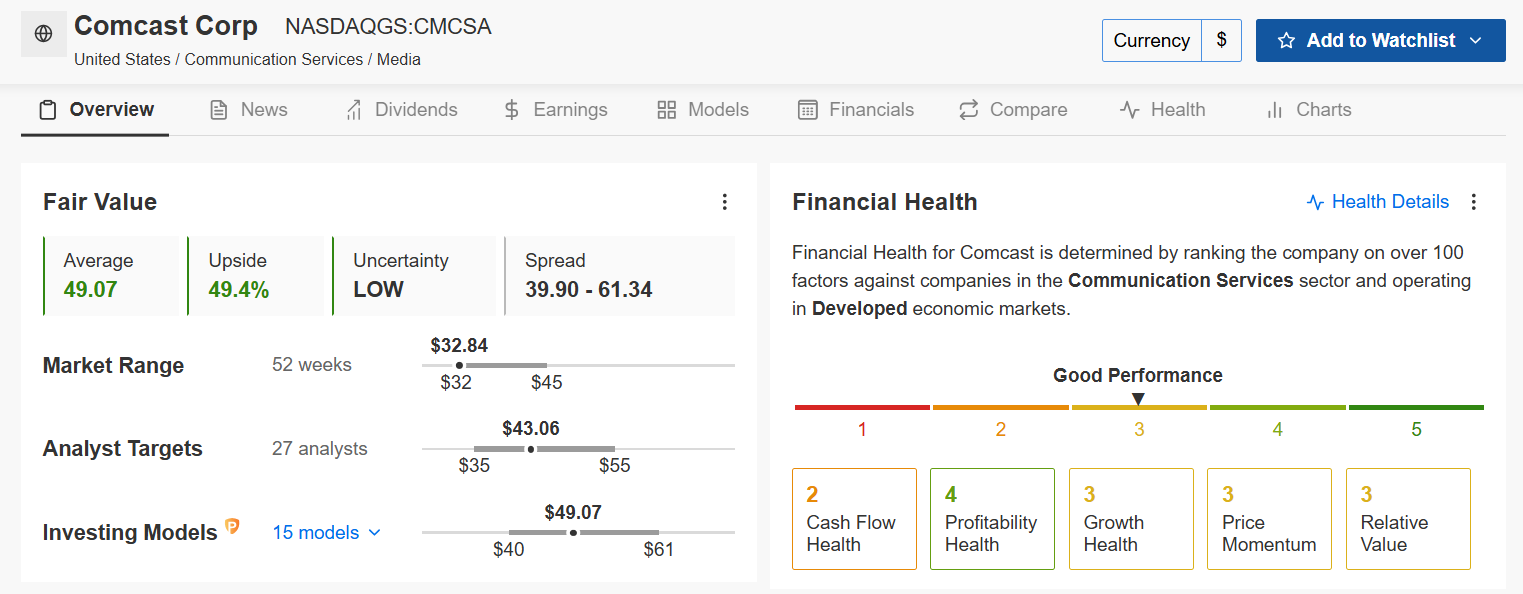

2. Comcast

Honest Worth: $49.07 (+49.4% upside potential)

Monetary Well being: GOOD (Rating: 2.77)

P/E Ratio: 7.9x

Dividend Yield: 4.02%

Comcast (NASDAQ:) is a world media and expertise firm primarily identified for its cable tv, broadband web, and promoting companies. With a stronghold within the U.S. media panorama, Comcast operates by way of its numerous segments, together with NBCUniversal and Sky.

As a primarily home service supplier, Comcast’s core operations are much less uncovered to worldwide commerce tensions, shielding them from the direct influence of commerce wars. Moreover, Comcast’s important companies nature supplies defensive traits much like Verizon (NYSE:) and AT&T Inc (NYSE:), which have seen share value will increase as traders search stability.

Supply: InvestingPro

With a “GOOD” Monetary Well being rating of two.77 and buying and selling at a modest 7.9x earnings, Comcast seems considerably undervalued in opposition to its Honest Worth estimate of $49.07—suggesting 49.4% upside potential. The corporate’s 4.02% dividend yield and robust money circulate technology capabilities present stability throughout financial turbulence.

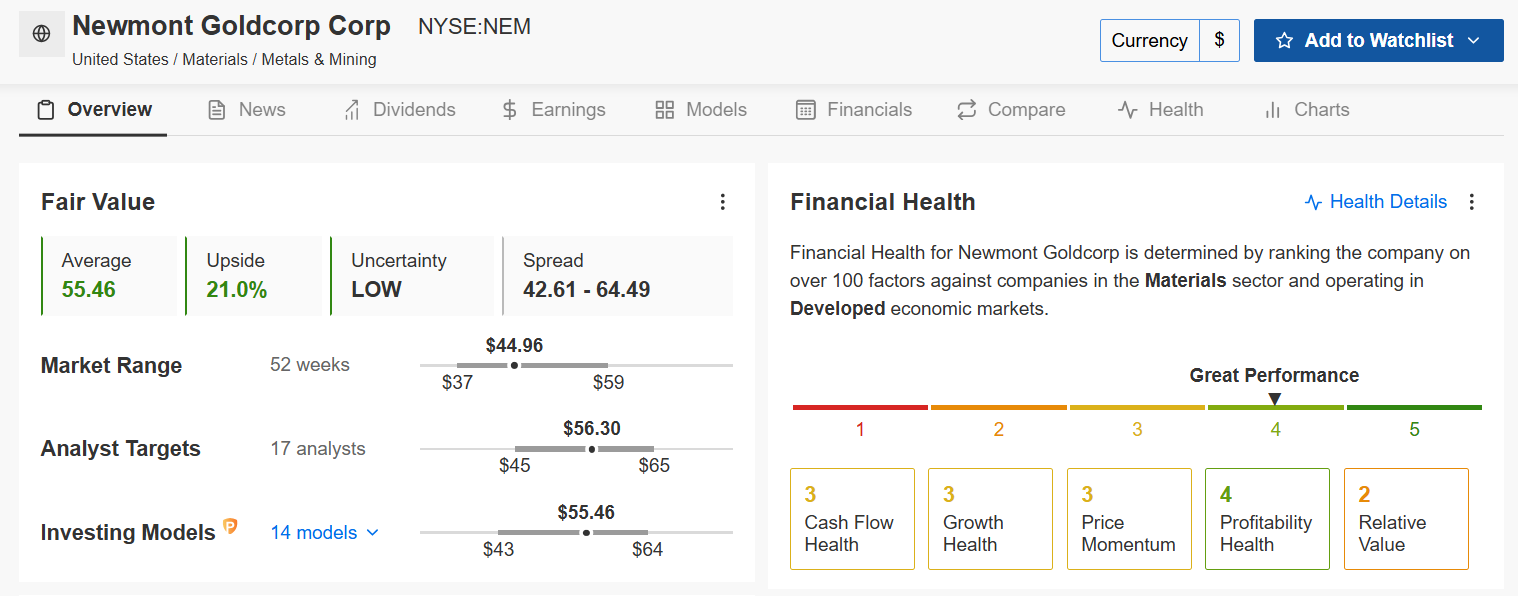

3. Newmont Gold

Honest Worth: $55.46 (+23.4% upside potential)

Monetary Well being: GREAT (Rating: 3.21)

P/E Ratio: 15.7x

Dividend Yield: 2.22%

Newmont (NYSE:) is the world’s largest mining firm, extracting gold, , silver, and different metals from mines throughout North America, South America, Australia, and Africa. It produces over 6 million ounces of gold yearly, thriving on the metallic’s standing as a safe-haven asset.

costs typically surge throughout financial uncertainty, and Trump’s tariffs may gasoline such circumstances by stoking inflation and commerce disputes. Newmont stands to learn as traders flock to gold, particularly with its robust U.S. operations decreasing tariff publicity. Its scale and profitability make it a dependable decide if world commerce wars intensify.

Supply: InvestingPro

With a “GREAT” Monetary Well being rating of three.21 and a Honest Worth estimate of $55.46, indicating 23.4% upside potential, Newmont supplies each defensive traits and progress potential. The corporate’s 2.22% dividend yield provides an revenue part uncommon amongst gold miners, making it significantly engaging throughout unsure financial durations.

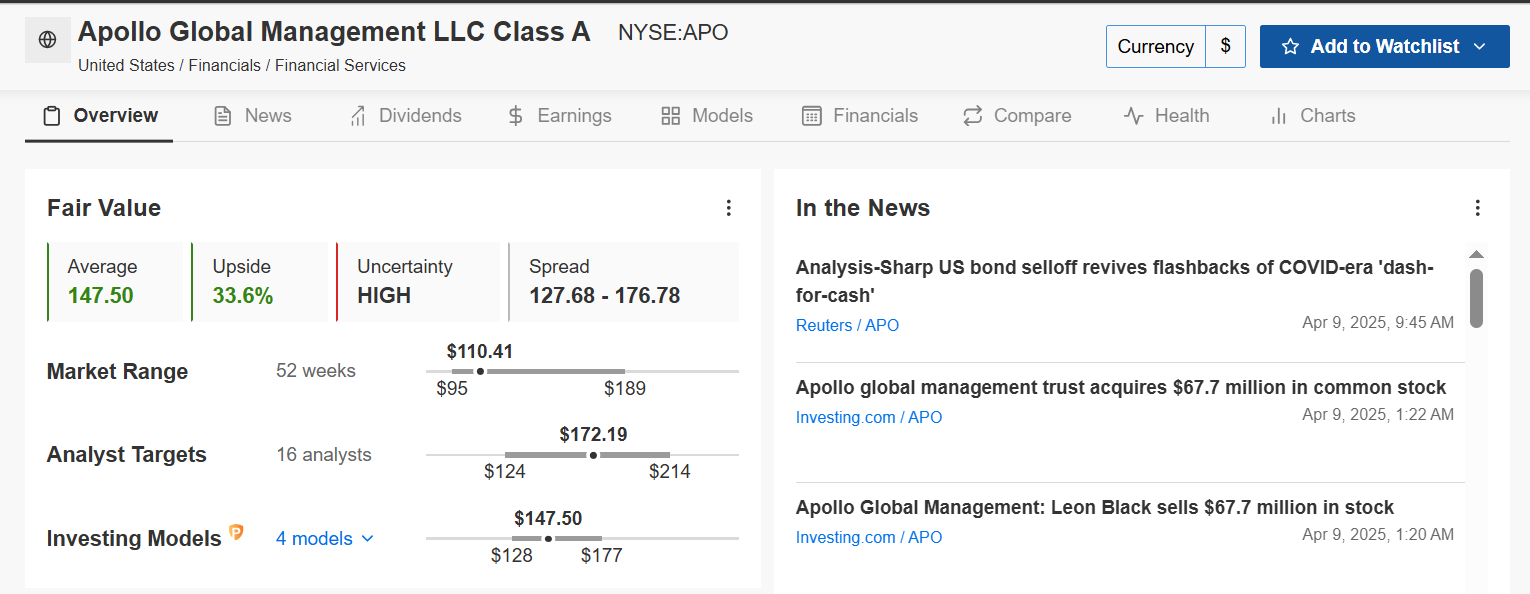

4. Apollo World Administration

Honest Worth: $147.50 (+33.6% upside potential)

Monetary Well being: UNAVAILABLE

P/E Ratio: 14.8x

Dividend Yield: 1.68%

Apollo World Administration (NYSE:) is a significant various asset supervisor, overseeing investments in personal fairness, credit score, and actual belongings, with a concentrate on distressed debt, infrastructure, and company turnarounds. Launched in 1990 by Leon Black, Apollo has grown right into a $600 billion-plus asset administration titan.

With a various portfolio and a concentrate on opportunistic investments, Apollo is well-positioned to navigate the complexities of a commerce warfare. The corporate’s experience in figuring out and capitalizing on market dislocations may show to be a power as Trump’s tariffs reshape world commerce and funding flows.

Supply: InvestingPro

Buying and selling at 14.8x earnings with a Honest Worth estimate of $147.50 suggesting 33.6% upside potential, Apollo affords compelling worth. Whereas its Monetary Well being rating is unavailable, the corporate’s robust observe file in navigating advanced market environments makes it price consideration as commerce tensions escalate.

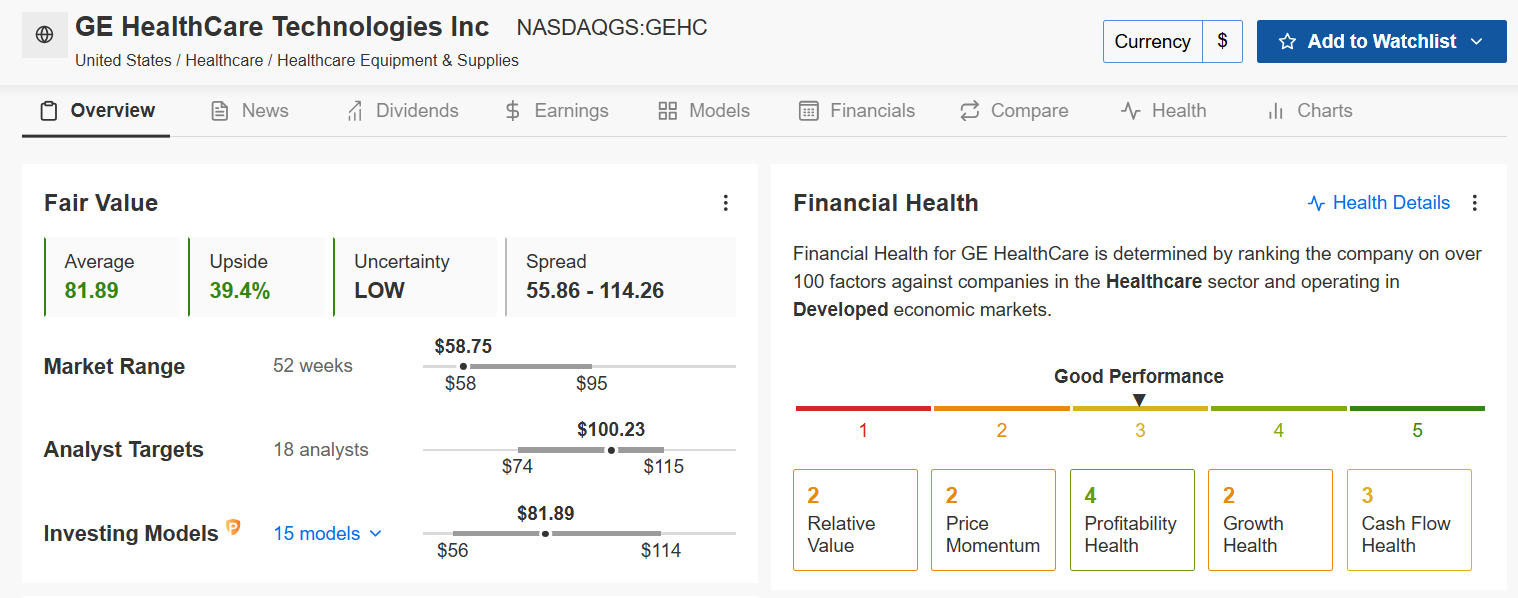

5. GE Healthcare Applied sciences

Honest Worth: $81.89 (+39.4% upside potential)

Monetary Well being: GOOD (Rating: 2.78)

P/E Ratio: 19.7x

Dividend Yield: 0.2%

GE HealthCare Applied sciences (NASDAQ:) supplies medical imaging, diagnostics, and healthcare IT options, together with MRI machines, ultrasound programs, and affected person monitoring instruments, serving hospitals and clinics worldwide. Spun off from Common Electrical (NYSE:) in 2023, GE Healthcare generates billions in income, with a powerful U.S. base complemented by world operations.

Whereas tariffs may elevate prices for imported elements, GE Healthcare’s home manufacturing presence mitigates a lot of that threat. Healthcare stays a non-cyclical sector, insulated from commerce warfare fallout, and demand for its crucial gear persists no matter financial turbulence. Its progress potential and defensive nature make it a standout as tariffs kick in.

Supply: InvestingPro

With a “GOOD” Monetary Well being rating of two.78 and buying and selling at 19.7x earnings, the corporate seems undervalued in comparison with its Honest Worth estimate of $81.89—suggesting 39.4% upside potential.

Conclusion

These 5 corporations share a number of traits that make them compelling issues as tariffs take impact: home income focus, robust monetary positions, engaging valuations, and enterprise fashions that would profit from—or no less than face up to—commerce disruptions.

Whereas no funding is with out threat, significantly in periods of financial uncertainty, these shares supply attention-grabbing alternatives for traders trying to place portfolios defensively whereas sustaining upside potential.

You’ll want to try InvestingPro to remain in sync with the market development and what it means on your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed observe file.

InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for the very best shares based mostly on a whole bunch of chosen filters, and standards.

Prime Concepts: See what shares billionaire traders corresponding to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m quick on the S&P 500 and Nasdaq 100 by way of the ProShares Quick S&P 500 ETF (SH) and ProShares Quick QQQ ETF (PSQ).

I usually rebalance my portfolio of particular person shares and ETFs based mostly on ongoing threat evaluation of each the macroeconomic surroundings and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.