deepblue4you

Market Overview

The primary quarter of 2025 noticed notable shifts in international financial momentum. Escalating tariff threats and commerce tensions—which have compounded even additional because the finish of the quarter—cloud the financial outlook globally whereas intensifying inflationary pressures. This creates a difficult surroundings for central banks tasked with managing inflation whereas countering slowing development.

Germany’s fiscal paradigm shift has generated a optimistic, near-term market response, whereas the financial response could take longer. Consequently, European equities outperformed this quarter led by long-term protection and infrastructure commitments and comparatively decrease valuations in comparison with U.S. equities. In the meantime, China’s near-term development has been buoyed by rising personal sector confidence and developments in synthetic intelligence, comparable to contributions from DEEPSEEK, a brand new Chinese language AI Giant Language Mannequin.

Canadian equities outperformed U.S. equities this quarter, largely as a result of continued surge in gold costs, which considerably benefited Canada’s mining sector. The rise in gold was pushed by international financial uncertainty, elevated central financial institution demand for diversification away from U.S. greenback (USDOLLAR,DXY) holdings, and restricted provide development.

Regardless of this optimistic momentum, Canada faces challenges from U.S. tariffs and political uncertainty throughout the federal election marketing campaign. Enterprise confidence has been dampened as commerce tensions dominate the political discourse. Ongoing rate of interest cuts by the Financial institution of Canada have been meant to counteract the financial softness however have but to completely restore confidence.

The continuing commerce disputes underscore the significance of sustaining a diversified portfolio that balances development alternatives with threat administration, significantly as conventional sector leaders face headwinds and new market dynamics emerge.

How Did We Do?

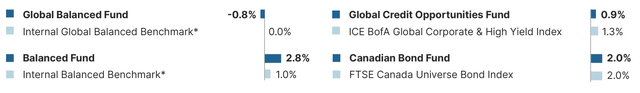

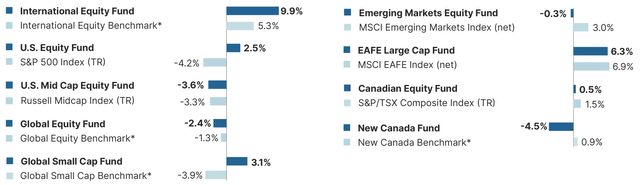

Efficiency has been introduced for the O-Collection Mawer Mutual Funds in Canadian {dollars} and calculated gross of administration charges and internet of working bills for the 3-month interval ending March 31, 2025.

Click on to enlarge

Maybe surprisingly given the backdrop, the primary quarter of 2025 delivered optimistic returns for Mawer Balanced Fund buyers. Relative efficiency versus the benchmark was sturdy, pushed primarily by elements that had exhibited tougher relative returns in 2024. Our U.S. fairness technique benefited from our deal with high-quality, secure enterprise fashions whereas avoiding some high-flying know-how and shopper shares comparable to Nvidia (NVDA), Tesla (TSLA), and Apple (AAPL). Our international small cap fairness technique exceeded expectations this quarter on account of its underweight publicity to the U.S. and larger emphasis on worldwide markets the place valuations stay extra favorable.

Mounted earnings belongings additionally performed their conventional function successfully in our balanced methods. Canadian bonds offered earnings and stability whereas partially hedging in opposition to fairness market volatility. Equally, these invested in our international credit score alternatives technique noticed optimistic returns because of falling authorities bond yields and coupon earnings, although widening credit score spreads offset some features.

The spot worth of gold continued to rise all through the quarter pushed by growing demand for the valuable metallic and restricted provide development. One of many largest components that detracted from relative efficiency in Canada was a scarcity of publicity to gold mining shares.

Balanced and Mounted Earnings: Chart A: Q1 2025, Collection O, Gross of charges

A few of our stronger performing worldwide fairness holdings this quarter have been defense-related: Germany’s Rheinmetall (OTCPK:RNMBF) more-than-doubled throughout the quarter, whereas France’s Thales (OTCPK:THLEF), UK’s BAE (OTCPK:BAESF), and Italy’s Leonardo (OTCPK:FINMF) additionally skilled stellar returns. A quickly evolving geopolitical panorama and rising protection spending in Europe have considerably elevated demand expectations. Moreover, all 4 firms stand to learn from the important significance of their merchandise, and a long time of consolidation and underinvestment in areas the place they maintain key aggressive benefits.

A risky backdrop proved helpful for a number of of our alternate companies in driving larger curiosity in general hedging exercise and better buying and selling volumes. Deutsche Boerse has been a beneficiary of larger rate of interest volatility and volumes on its platforms, as have TMX Group (OTCPK:TMXXF) and Intercontinental Trade (ICE), each of which have benefited from larger volumes on their vitality platforms.

There have been additionally sturdy performing companies within the financials sector. Within the insurance coverage brokerage trade, holdings comparable to Arthur J. Gallagher (AJG), Marsh & McLennan (MMC), and AON, delivered regular natural development and margin enhancements throughout the previous quarter. Canadian-based Intact Monetary (OTCPK:IFCZF) confirmed spectacular earnings development, pushed by sturdy underwriting efficiency along with benefitting from favorable market situations which led to a 5% enhance in premiums.

One other enterprise that carried out nicely this quarter was AltaGas (OTCPK:ATGFF), a utility operator and midstream firm. AltaGas continued to generate sturdy returns throughout its two major enterprise strains. Notably, its midstream pipeline operations in Canada seem well-positioned to capitalize on alternatives arising from the continued commerce tensions with the U.S.

Nevertheless, a few of our semiconductor holdings took a breather this quarter after an excellent few years prior. Main producer TSMC (TSM) and single wafer atomic deposition supplier ASM Worldwide (ASML) suffered partly on account of considerations in regards to the sustainability of AI development and the way tariffs could disrupt the worldwide provide chain. CGI was additionally affected by information south of the border as unfavourable sentiment from potential Division of Authorities Effectivity (DOGE) value chopping measures weighed on many consulting companies. CGI has comparatively modest publicity to the U.S. authorities and most of its contracts are for software program that integrates and manages important capabilities like procurement and finance.

Some monetary holdings, together with Financial institution of Nova Scotia (BNS), Royal Financial institution, and Brookfield Company (BN), additionally noticed a pause after a powerful 2024. In distinction, TD Financial institution (TD) carried out nicely this quarter, pushed by the accelerated transition of CEO Raymond Chun and important board modifications which have been positively acquired by the market. Nevertheless, we stay cautious on the broader banking sector on account of headwinds from slowing mortgage development and rising credit score losses amid potential financial challenges in Canada.

Equities: Chart B: Q1 2025, Collection O, Gross of charges

Trying Forward

The worldwide financial and geopolitical backdrop continues to evolve quickly, marked by important transitions and heightened uncertainty. The dramatic escalation in commerce obstacles, Germany’s C1 trillion dedication to protection and infrastructure spending, and the regular stream of government orders from the Trump administration spotlight the dimensions of those modifications. Nevertheless, this uncertainty evokes a way of hesitation throughout customers, central banks, and corporations alike—akin to a four-way site visitors cease the place all events await others to behave.

Canada’s financial outlook stays blended because the Financial institution of Canada (BoC) faces mounting challenges. Whereas rate of interest cuts have been made to help family spending and enterprise funding, weak shopper and enterprise confidence is clear in larger financial savings charges, lowered spending, and cautious funding plans. Inflation expectations are rising, with many companies planning to cross on worth will increase, making a dilemma for the BoC. The BoC could proceed to ease modestly however could pause if inflation expectations rise greater than anticipated. Including to this uncertainty is the upcoming federal election on April 28, which comes amidst escalating commerce tensions with the U.S., threats to Canadian sovereignty by President Trump, and competing visions from occasion leaders. The election’s consequence might considerably reshape fiscal coverage and financial priorities in Canada.

At occasions like these, temperament issues as a lot as evaluation. The temptation to react impulsively—to slam on the brakes or to speed up too rapidly—may be pricey. Whereas transitions create uncertainty, additionally they generate alternative for many who stay clear-eyed.

The street forward can have its twists, however our method stays the identical: prioritize resilience over response and self-discipline over distraction. Our North Star: a deal with attractively valued, well-run companies that may face up to turbulence by, fairly merely, promoting an excellent or a service their purchasers worth at a worth that more-than-covers the price of capital by advantage of a aggressive benefit, thereby creating wealth.

Similar to at a busy intersection, apply the fitting stability of focus, persistence, and decisiveness.

Complete Gross Returns (Collection O): For durations ending March 31, 2025

Fairness Funds

YTD

3-Mo

1-Yr

3-Yr

5-Yr

10-Yr

Since

Inception*

Mawer Worldwide Fairness Fund

9.9

9.9

17.9

12.2

11.1

8.4

9.6

Worldwide Fairness Benchmark*

5.3

5.3

13.0

9.5

11.2

6.3

6.4

Mawer U.S. Fairness Fund

2.5

2.5

13.6

12.3

15.8

13.3

11.1

SGP 500 Index (TR)

-4.2

-4.2

15.1

14.3

18.9

13.9

11.1

Mawer U.S. Mid Cap Fairness Fund

-3.6

-3.6

1.6

9.6

–

–

5.3

Russell Midcap Index (TR)

-3.3

-3.3

9.1

9.7

–

–

7.0

Mawer World Fairness Fund

-2.4

-2.4

2.1

8.1

12.2

10.6

12.7

World Fairness Benchmark*

-1.3

-1.3

14.0

12.1

15.4

10.3

11.5

Mawer World Small Cap Fund

3.1

3.1

-2.6

3.8

7.7

8.2

11.5

World Small Cap Benchmark*

-3.9

-3.9

6.0

6.5

14.0

7.8

7.3

Mawer Rising Markets Fairness Fund

-0.3

-0.3

12.9

11.4

9.4

–

6.9

MSCI Rising Markets Index (internet)

3.0

3.0

15.3

6.3

8.2

–

6.2

Mawer EAFE Giant Cap Fund

6.3

6.3

7.2

9.0

–

–

9.6

MSCI EAFE Index (internet)

6.9

6.9

11.7

11.2

–

–

10.7

Mawer Canadian Fairness Fund

0.5

0.5

11.8

7.3

14.9

8.6

10.3

SGP/TSX Composite Index

1.5

1.5

15.8

7.8

16.8

8.5

8.2

Mawer New Canada Fund

-4.5

-4.5

0.6

4.2

14.6

8.5

12.9

New Canada Benchmark*

0.9

0.9

11.1

1.7

20.1

5.8

6.3

Balanced Funds

Mawer World Balanced Fund

-0.8

-0.8

4.2

6.4

8.2

7.4

9.0

Inner World Balanced Benchmark*

0.0

0.0

11.4

8.4

9.0

6.9

8.5

Mawer Balanced Fund

2.8

2.8

9.9

6.9

8.5

6.9

8.1

Inner Balanced Benchmark*

1.0

1.0

11.1

6.7

9.9

6.3

6.5

Mawer Tax Efficient Balanced Fund

2.8

2.8

9.9

6.9

8.5

6.8

8.0

Inner Tax Efficient Balanced Benchmark*

1.0

1.0

11.1

6.7

9.9

6.3

6.4

Earnings funds

Mawer World Credit score Alternatives Fund

0.9

0.9

5.7

–

–

–

5.6

ICE BofA World Company G Excessive Yield Index

1.3

1.3

4.8

–

–

–

4.3

Mawer Canadian Bond Fund

2.0

2.0

8.0

2.8

1.3

2.0

3.8

FTSE Canada Universe Bond Index

2.0

2.0

7.7

2.5

0.9

1.8

3.7

Mawer Canadian Cash Market Fund

0.8

0.8

4.2

3.8

2.3

1.6

1.5

FTSE Canada 91 Day TBill Index

0.8

0.8

4.5

4.0

2.5

1.8

1.7

Click on to enlarge

*Seek advice from www.mawer.com/funds/efficiency/ for Fund Inception Dates and Benchmark Historical past.

Mawer Mutual Funds are managed by Mawer Funding Administration Ltd. O-Collection returns for the Mawer Mutual Funds are reported in Canadian {dollars} and calculated earlier than administration charges and after working bills have been deducted. Compared, index returns don’t incur administration charges or working bills.

Click on to enlarge

Complete Internet Returns (Collection A): For durations ending March 31, 2025

Fairness Funds

YTD

3-Mo

1-Yr

3-Yr

5-Yr

10-Yr

Since

Inception*

Mawer Worldwide Fairness Fund

9.6

9.6

16.4

10.7

9.6

6.9

8.0

Worldwide Fairness Benchmark*

5.3

5.3

13.0

9.5

11.2

6.3

5.6

Mawer U.S. Fairness Fund

2.2

2.2

12.3

11.1

14.5

12.0

8.9

SGP 500 Index

-4.2

-4.2

15.1

14.3

18.9

13.9

10.8

Mawer U.S. Mid Cap Fairness Fund

-3.9

-3.9

0.2

8.1

–

–

3.9

Russell Midcap Index (TR)

-3.3

-3.3

9.1

9.7

–

–

7.0

Mawer World Fairness Fund

-2.7

-2.7

0.8

6.7

10.7

9.2

11.2

World Fairness Benchmark*

-1.3

-1.3

14.0

12.1

15.4

10.3

11.5

Mawer World Small Cap Fund

2.7

2.7

-4.3

2.0

5.8

6.4

9.6

World Small Cap Benchmark*

-3.9

-3.9

6.0

6.5

14.0

7.8

7.3

Mawer Rising Markets Fairness Fund

-0.6

-0.6

11.2

9.7

7.7

–

5.3

MSCI Rising Markets Index (internet)

3.0

3.0

15.3

6.3

8.2

–

6.2

Mawer EAFE Giant Cap Fund

5.9

5.9

5.8

7.5

–

–

8.2

MSCI EAFE Index (internet)

6.9

6.9

11.7

11.2

–

–

10.7

Mawer Canadian Fairness Fund

0.3

0.3

10.6

6.1

13.6

7.4

9.2

SGP/TSX Composite Index

1.5

1.5

15.8

7.8

16.8

8.5

8.7

Mawer New Canada Fund

-4.8

-4.8

-0.7

2.8

13.1

7.0

12.5

New Canada Benchmark*

0.9

0.9

11.1

1.7

20.1

5.8

7.4

Balanced Funds ception

Mawer World Balanced Fund

-1.0

-1.0

3.1

5.2

7.0

6.3

7.9

Inner World Balanced Benchmark*

0.0

0.0

11.4

8.4

9.0

6.9

8.5

Mawer Balanced Fund

2.6

2.6

8.9

6.0

7.5

5.9

8.0

Inner Balanced Benchmark*

1.0

1.0

11.1

6.7

9.9

6.3

7.8

Mawer Tax Efficient Balanced Fund

2.6

2.6

8.9

6.0

7.5

5.9

7.7

Inner Tax Efficient Balanced Benchmark*

1.0

1.0

11.1

6.7

9.9

6.3

7.8

Earnings Funds

Mawer World Credit score Alternatives Fund

0.7

0.7

4.8

–

–

–

4.7

ICE BofA World Company G Excessive Yield Index

1.3

1.3

4.8

–

–

–

4.3

Mawer Canadian Bond Fund

1.9

1.9

7.3

2.2

0.6

1.3

5.0

FTSE Canada Universe Bond Index

2.0

2.0

7.7

2.5

0.9

1.8

5.9

Mawer Canadian Cash Market Fund

0.6

0.6

3.7

3.3

2.0

1.2

3.0

FTSE Canada 91 Day TBill Index

0.8

0.8

4.5

4.0

2.5

1.8

3.8

Click on to enlarge

*Seek advice from www.mawer.com/funds/efficiency/ for Fund Inception Dates and Benchmark Historical past.

Mawer Mutual Funds are managed by Mawer Funding Administration Ltd. A-Collection returns for the Mawer Mutual Funds are reported in Canadian {dollars} and calculated after administration charges and after working bills have been deducted. Compared, index returns don’t incur administration charges or working bills.

Click on to enlarge

This doc is for informational functions solely. Commissions, trailing commissions, administration charges and bills all could also be related to mutual fund investments. Please learn the fund details and prospectus earlier than investing. The indicated charges of return (aside from for a cash market fund) are the historic annual compounded whole returns together with modifications in unit worth and reinvestment of all distributions. The indicated charges of return for a cash market fund is an annualized historic yield primarily based on the seven-day interval ended as indicated and annualized within the case of efficient yield by compounding the seven-day return and doesn’t characterize an precise one-year return. The indicated charges of return don’t bear in mind gross sales, redemption, distribution or non-obligatory expenses or earnings taxes payable by any securityholder that will have lowered returns. Mutual funds should not assured, their values change incessantly and previous efficiency will not be repeated.

Mutual fund securities should not lined by the Canada Deposit Insurance coverage Company or by every other authorities deposit insurer. There may be no assurances {that a} cash market fund will have the ability to keep its internet asset worth per unit at a relentless quantity or that the total quantity of your funding might be returned to you. Mawer Mutual Funds are managed by Mawer Funding Administration Ltd.

Mawer Mutual Funds do not need trailing commissions. Should you bought items of the Mawer Mutual Funds via a third-party vendor, you could be topic to commissions or extra gross sales expenses. Please contact your vendor for extra data.

This Mawer Quarterly consists of sure statements which might be “ahead trying data” or “ahead trying statements” (collectively, “ahead trying data”) throughout the that means of relevant securities laws. All statements, aside from statements of historic truth, included on this report that deal with actions, occasions or developments that the portfolio advisor, Mawer Funding Administration Ltd., expects or anticipates will or could happen sooner or later, together with things like anticipated monetary efficiency, beliefs, plans, targets, aims, assumptions, data and statements about doable future occasions, situations, outcomes of operations, are ahead trying data. The phrases “could”, “might”, “would”, “ought to”, “consider”, “plan”, “anticipate”, “count on”, “intend”, “forecast”, “goal”, “will” and related expressions are supposed to establish ahead trying data.

Undue reliance shouldn’t be positioned on ahead trying data. Ahead trying data is topic to numerous dangers described within the Simplified Prospectus, uncertainties, and assumptions in regards to the Fund, capital

markets and financial components, which might trigger precise outcomes to range and in some cases to vary materially from these anticipated by the portfolio advisor and expressed on this report. Materials threat components embrace, however should not restricted to, basic financial, political and market components in North America and internationally, curiosity and international alternate charges, international fairness and capital markets, enterprise competitors, technological change, modifications in authorities rules, surprising judicial or regulatory proceedings, and catastrophic occasions. The foregoing listing of threat components is just not exhaustive.

All opinions contained in ahead trying data are topic to vary with out discover and are offered in good religion and are primarily based on the estimates and opinions of the portfolio advisor on the time the knowledge is introduced. The portfolio advisor has no particular intention of updating any ahead trying data whether or not on account of new data, future occasions or in any other case, besides as required by securities laws. Sure details about particular holdings within the Fund, together with any opinion, is predicated upon numerous sources believed to

be dependable, however can’t be assured to be present, correct or full and is topic to vary with out discover.

Index returns are provided by third events—we consider the information to be correct, nonetheless, can’t assure its accuracy.

Efficiency returns for the Mawer Mutual Funds and benchmarks are calculated by Mawer Funding Administration Ltd. These returns are historic easy returns for the three month, YTD, and 1 yr durations, and annualized compounded whole returns for durations after 1 yr.

Non-performance associated materials on this doc displays the opinions of the author, and doesn’t mirror truth or predictions of precise occasions or impacts, and can’t be relied upon for investing functions or as funding recommendation or ensures of any form.

The MSCI data could solely be used on your inside use, will not be reproduced or disseminated in any type and will not be used as a foundation for or a part of any monetary devices or merchandise or indices. Not one of the MSCI data is meant to represent funding recommendation or a suggestion to make (or chorus from making) any form of funding choice and will not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is offered on an “as is” foundation and the consumer of this data assumes your complete threat of any use fabricated from this data. MSCI, every of its associates and one another particular person concerned in or associated to compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties(together with, with out limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and health for a specific function) with respect to this data. With out limiting any of the foregoing, in no occasion shall any MSCI Celebration have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with, with out limitation, misplaced earnings) or every other damages.(www.msci.com)

London Inventory Trade Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a buying and selling identify of sure of the LSE Group firms. FTSE® is a commerce mark(s) of the related LSE Group firms and is/are utilized by every other LSE Group firm underneath license. “TMX®” is a commerce mark of TSX, Inc. and utilized by the LSE Group underneath license. All rights within the FTSE Russell indexes or information vest within the related LSE Group firm which owns the index or the information. Neither LSE Group nor its licensors settle for any legal responsibility for any errors or omissions within the indexes or information and no occasion could depend on any indexes or information contained on this communication. No additional distribution of knowledge from the LSE Group is permitted with out the related LSE Group firm’s categorical written consent. The LSE Group doesn’t promote, sponsor or endorse the content material of this communication.

Click on to enlarge

Unique Submit

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.