The potential for a commerce struggle looms massive, casting a shadow over company outlooks and investor sentiment.

I used the InvestingPro Inventory Screener to seek for firms forecasted to ship progress of over 25% in each EPS and gross sales.

In search of actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

Because the U.S. braces for the onset of the first-quarter earnings season, the faces its subsequent pivotal second towards the backdrop of a looming commerce struggle and financial uncertainty.

The newest forecasts recommend that S&P 500 earnings may have grown 7.0% year-on-year for the quarter ending March, as per FactSet information.

Supply: FactSet

Nonetheless, the optimism of those figures is tempered by the cloud of tariffs and their potential affect on company outlooks. Notably, firms with important worldwide publicity could face better challenges, as tariffs can straight have an effect on their provide chains and revenue margins.

Company America Braces for Tariff Influence

The earnings season kicks off with main monetary establishments set to launch their experiences. JPMorgan Chase (NYSE:) and Wells Fargo (NYSE:) are scheduled to announce their Q1 earnings on April 11.

The banking sector, typically among the many first to really feel the tremors of financial shifts, will present an early indicator of how firms are navigating the present challenges. Buyers shall be listening intently, figuring out that any trace of pessimism might ripple throughout the broader market.

Past the banking sector, traders are keenly observing developments throughout numerous industries to gauge the affect of tariffs and commerce negotiations on company efficiency and progress projections.

Subsequent week sees high-profile names like Netflix (NASDAQ:), Johnson & Johnson (NYSE:), United Airways (NASDAQ:), UnitedHealth (NYSE:), Taiwan Semiconductor (NYSE:), and ASML (NASDAQ:) report earnings.

Tesla (NASDAQ:), Boeing (NYSE:), AT&T (NYSE:), Verizon (NYSE:), GE Aerospace (NYSE:), Intel (NASDAQ:), IBM (NYSE:), American Airways (NASDAQ:), Caterpillar (NYSE:), are then due the next week.

The earnings season gathers momentum within the final week of April when the mega-cap tech firms, together with Microsoft (NASDAQ:), Alphabet (NASDAQ:), Meta Platforms (NASDAQ:), Amazon (NASDAQ:), and Apple (NASDAQ:) are all scheduled to launch their quarterly updates.

From expertise to manufacturing, every sector has its distinctive vulnerabilities to commerce disruptions, and the upcoming earnings season shall be a telling indicator of how these firms are adapting and forecasting future demand.

Concentrate on Ahead Steering

Past the reported earnings figures, traders are significantly within the ahead steering offered by firms for insights into how tariffs and financial uncertainties are impacting future outlooks. A dour forecast from a bellwether agency might amplify fears that the economic system is shedding steam.

Tariffs have been talked about over 800 occasions in investor occasions and calls throughout This fall – the very best quantity in 15 years and double the mentions throughout Trump’s 2018-2019 commerce struggle. Administration commentary on future earnings prospects, capital expenditures, and methods to mitigate tariff impacts shall be essential in assessing the resilience of companies.

Corporations that reveal adaptability and supply clear methods for navigating the present commerce setting could instill better confidence amongst traders.

Key Shares to Look ahead to Q1 Earnings Season

Wall Road is heading into the Q1 reporting season on a wobbly be aware because the imposition of tariffs has launched important volatility into the markets, resulting in issues a couple of potential recession.

Supply: Investing.com

From a technical standpoint, the S&P 500 stays at a crucial stage beneath its 200-day shifting common. After dropping beneath this key indicator in early March and hitting a low of 4,835 on April 7, the index staged a rally. Nonetheless, analysts warning this may increasingly solely be a technical rebound from oversold circumstances.

Given the present financial backdrop, I used the InvestingPro Inventory Screener to seek for firms which might be forecast to ship progress of greater than 25% in each earnings per share and income. In whole, simply 29 shares confirmed up.

Supply: InvestingPro

A number of the notable names to make the lower embrace Nvidia (NASDAQ:), Eli Lilly (NYSE:), Palantir (NASDAQ:), Boeing, Micron (NASDAQ:), Sea, Capital One Monetary (NYSE:), Truist Monetary (NYSE:), Marvell (NASDAQ:) Know-how, Cloudflare (NYSE:), AngloGold Ashanti, DraftKings (NASDAQ:), and Coterra Power (NYSE:).

The Backside Line

As firms start reporting, traders shall be scrutinizing not simply the numbers however ahead steering and administration commentary on tariff impacts.

With the S&P 500 down 10.5% year-to-date and markets briefly coming into bear market territory, this earnings season might decide whether or not we’re experiencing a short lived pullback or the start of a extra important downturn.

One factor is for sure –the market’s excessive sensitivity to commerce coverage developments suggests volatility will stay elevated within the coming weeks.

You should definitely take a look at InvestingPro to remain in sync with the market pattern and what it means on your buying and selling. Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

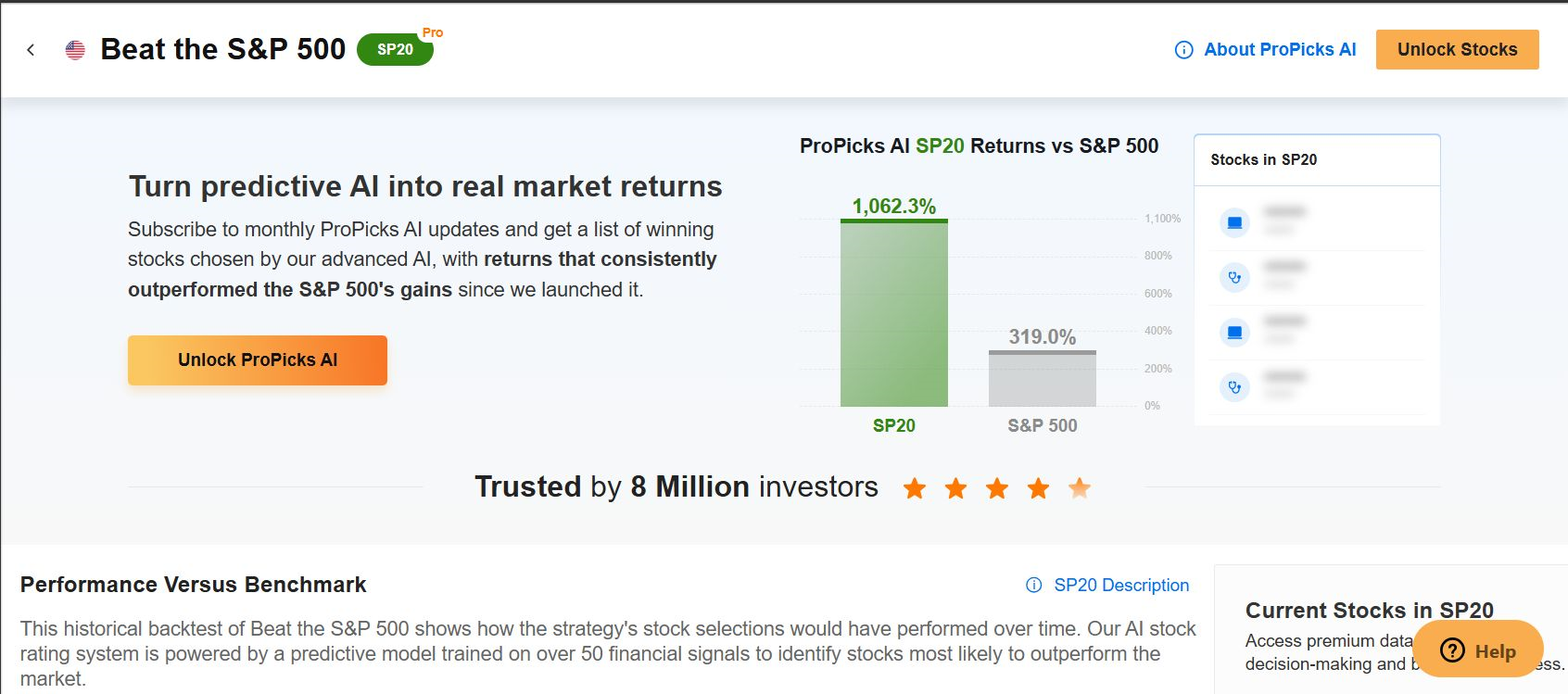

ProPicks AI: AI-selected inventory winners with confirmed monitor file.

InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for one of the best shares primarily based on lots of of chosen filters, and standards.

Prime Concepts: See what shares billionaire traders equivalent to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m brief on the S&P 500 and Nasdaq 100 through the ProShares Brief S&P 500 ETF (SH) and ProShares Brief QQQ ETF (PSQ).

I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and corporations’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.