JHVEPhoto

Thesis

A few months in the past, there have been lots of people saying to quick PulteGroup (NYSE:PHM) due to rising mortgage charges. Their thesis was that homebuilders’ earnings would fall sharply. Effectively, it seems to be like PulteGroup has been capable of develop earnings regardless of rising rates of interest. Nonetheless, they’ve seen the implications of the rise of their backlog. However up to now and in current months, administration has proven that it could actually function on this ‘new’ setting. So I might vote for a maintain in the mean time. Let me clarify within the subsequent chapters.

Brief Introduction

PulteGroup is the third largest homebuilder in america and operates in additional than 40 cities. The corporate is headquartered in Atlanta, Georgia. They function in an trade wherein there are numerous headwinds to cope with. Consequently, they’re at the moment valued at an EV/EBIT a number of of ~4.

Evaluation

Regardless of the difficult enterprise situations in 2022, PulteGroup was capable of enhance complete revenues from $13,926 million to $16,229 million. This was as a result of backlog constructed up in recent times. Nonetheless, within the fourth quarter, internet new orders have been down 41% and cancellations have been up 32%. On the finish of 2022, they nonetheless had a backlog of 12,1689 houses valued at $7.7 billion. It is going to be attention-grabbing to see how this performs out and whether or not they can develop revenues once more in 2023, when they may really feel a lot of the impression of rate of interest rises.

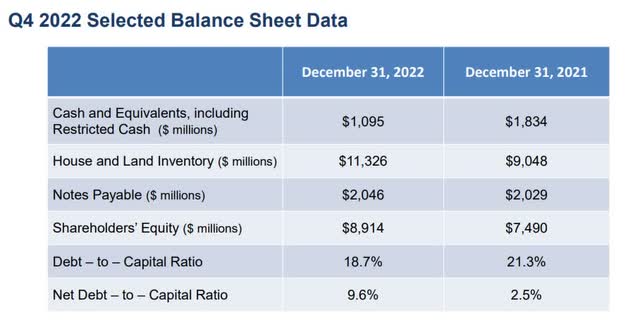

Pulte Group This fall Presentation

As you may see within the image above, they spent some money and invested in dwelling and land stock. However due to the weaker demand, they terminated some transactions the place they’d choices to amass the land. As we’ll see in a later chapter, there are opponents with higher steadiness sheets when it comes to money and debt.

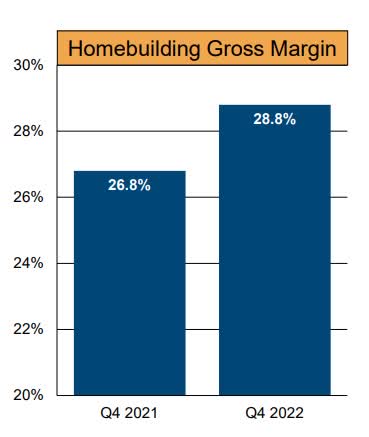

Pulte Group This fall Presentation

On the constructive aspect, they achieved a robust enhance in gross margins in a tough yr. At first look, greater margins and better gross sales appear like a great mixture.

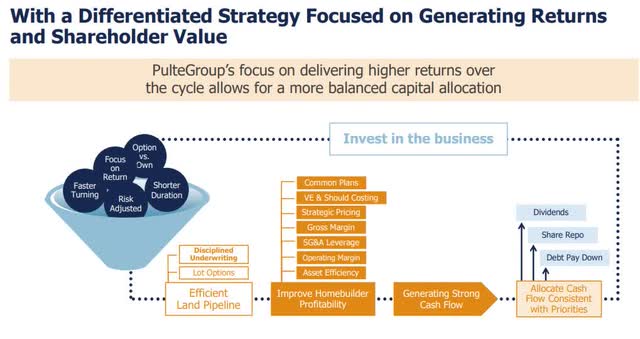

Pulte Group Presentation

The technique for the long run is to put money into the enterprise by means of land acquisition and growth, however they acknowledged within the final presentation that this determine will lower in 2023. Additionally they need to pay their dividend, which they elevated by 7% on a per share foundation, and plan to return extra capital to shareholders by means of buybacks. In 2022, they purchased again 10% of the excellent shares for $1.1 billion. Firms that purchase again shares aggressively is usually a actually good funding.

Pulte Group Presentation

Reverse DCF

Writer

Reverse DCF is my most well-liked technique of taking a look at what’s priced into the share worth. Assuming an EPS a number of of 9, which is in keeping with the historic a number of, and a reduction price of 10%, we get a priced-in progress price of 6% over the following 10 years. That is in keeping with the 10-year progress price of fundamental EPS over the past 10 years. If they’ll proceed to purchase again shares and develop earnings, they need to have the ability to exceed these expectations.

Peer Group

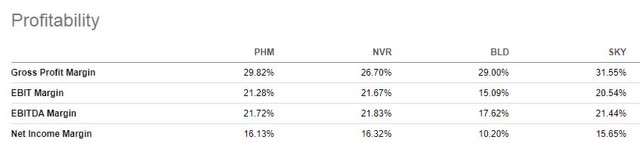

In search of Alpha Friends Tab

As a peer group I’ve chosen NVR, Inc. (NVR), TopBuild Corp., (BLD) and Skyline Champion Company (SKY). NVR and SKY particularly have an exceptional observe file of shareholder returns up to now. This demonstrates the attractiveness of the trade. Aggressive share buybacks, mixed with an asset-light mannequin, have been the success issue for NVR.

In case you examine the margins, you will note that PHM, NVR and SKY are virtually similar. When it comes to this metric, there is no such thing as a clear winner to be recognized.

In search of Alpha Friends Tab

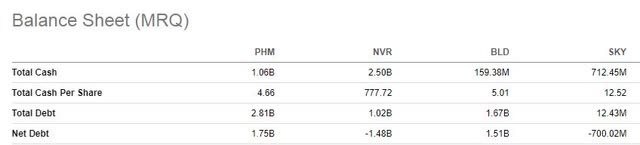

However when you have a look at the steadiness sheet, and particularly the money and debt positions, there are clear variations between the businesses. NVR and SKY have much more money than debt. PHM and BLD are rather more leveraged. And leverage is at all times a danger issue that it’s a must to have a look at. So when it comes to safety, the opposite two firms are safer. It’s a large benefit to not must depend on debt if rates of interest go up.

On a TTM P/E GAAP foundation, PHM has essentially the most room for margin enchancment.

PHM NVR BLD SKY 4,93x 10,37x 13,28x 9,52x Click on to enlarge

Market Development

They talked about within the Q3 outcomes name that they’ve entered many markets with engaging job progress, and as potential clients are at the moment favouring short-term supply charges, they’ve shifted their focus to spec houses. Except for that, there’s a scarcity of present houses on the market. It is going to be attention-grabbing to see how the demand scenario performs out.

Dangers

The dangers of the trade are well-known. Rising mortgage charges result in weaker demand for houses. However we’ve had intervals up to now when rates of interest have been as excessive as they’re now and homebuilders have been nonetheless capable of do enterprise and enhance. PulteGroup additionally has extra leverage than a few of its friends, which is at all times an element to think about. However they aren’t overleveraged at this level.

Conclusion

As they stated on the Q3 earnings name, the outcomes replicate pricing situations that existed 2-3 quarters in the past. So we is not going to see the total impression of rising charges for a couple of months. However to handle this, administration has applied applications to allow shoppers to buy houses even in right now’s greater price setting. These incentives elevated to 4.3% of gross sales, up from 2.2% within the third quarter of 2022. Nonetheless, nobody is aware of how the potential recession will play out and whether or not we could have a mushy touchdown. So it’s a dangerous setting for homebuilders, however even when they have been to lose important revenues and share costs have been to fall sharply, Individuals nonetheless have the dream of proudly owning their very own dwelling, so homebuilders ought to do properly as soon as the recession is over.

So due to their ROE and ROC figures, that are each shut to twenty% each year, and the potential for a number of expansions sooner or later, I feel this could possibly be a gorgeous funding when revenues are falling and the entire trade is in disaster. However on the identical time, it’s price trying on the opponents NVR and SKY and their particular person traits, as they could possibly be an much more engaging funding when the time comes.