Getty Photographs

Presently, Volkswagen AG’s market cap is €75 billion (OTCPK:VWAGY) (OTCPK:VLKAF) (OTCPK:VWAPY). Regardless of the latest P911 IPO, the corporate is continuous to be the foremost shareholder. Right here on the Lab, we already supplied numerous updates on Volkswagen Group and as a reminder in our sum-of-the-part valuation, we mentioned:

Mare Proof Lab’s earlier publication

Apart from the particular dividend already distributed, yesterday P911 introduced a core DPS of €1. Intimately, regardless of a sophisticated financial state of affairs, P911 confirmed the medium and long-term aims with a ROS between 17% & 19% and an anticipated turnover between €40 and €42 billion. At writing time, P911’s market cap stands at €100 billion and in Volkswagen SOTP valuation, we then derive a worth of €75 billion (which is already equal to its present market cap). If we value Traton (a listed firm) wherein Volkswagen has an fairness stake equal to 89.72%, we improve our price by a further €7.7 billion. Even when they’re non-public (nonetheless totally owned by Volkswagen), we also needs to point out Lamborghini and Bentley. Contemplating a 30% low cost in comparison with Ferrari, we must always (once more) add no less than a further €30 billion in fairness worth. Even assigning no worth to Audi, Volkswagen, Skoda, and Ducati (all in income), and contemplating the corporate’s money & money equivalents (€36.5 billion), we pretty assume that Volkswagen Is Actually Undervalued with no less than a reduction of 58%.

This autumn and FY outcomes

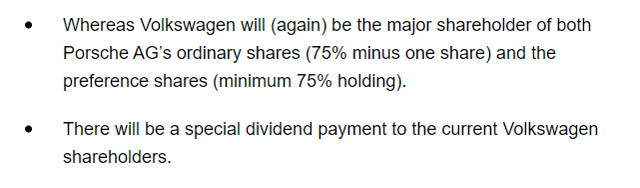

Trying on the carmaker’s financials, regardless of a lower in volumes (-7%), gross sales elevated by 12%. Taking place to the P&L, the corporate’s working revenue earlier than particular objects reached €22.5 billion and was up by 13% in comparison with the 2021 account, and demonstrated Volkswagen Group manufacturers energy, continued value self-discipline, and a stronger mannequin combine. On a adverse be aware, the corporate’s automotive division’s web money circulate considerably decreased to €4.8 billion resulting from increased working capital necessities for provide chain disruptions. Nonetheless, the administration be aware that this adverse impact will largely reverse in 2023. With an order ebook of roughly 1.8 million vehicles and a singular product portfolio, the corporate expects a optimistic 2023 and an easing in logistics bottlenecks.

Volkswagen 2023 steering

BEV and CAPEX

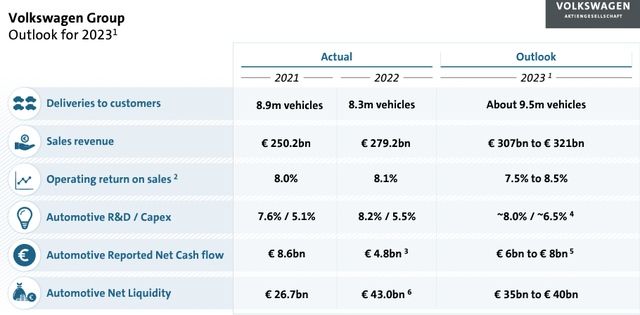

Electrical automotive deliveries accounted for 7% of VW output and elevated by 26% in comparison with 2021 for a complete of 572,100 items. With further fashions anticipated to be launched in 2023, Volkswagen Group will stay the EU BEV chief and by 2025, in accordance with the corporate’s estimates, one out of 5 VW vehicles might be electrical. In China solely, EVs elevated by 68%. Regardless of that, Volkswagen is able to speed up its electrical automotive investments. Between 2023 and 2027, the German big will make investments €180 billion in what it considers “probably the most worthwhile areas” of its enterprise: the manufacturing of battery cells, the digitization of China, the enlargement of its presence in North America, and the event of its flagship autos. The stable monetary place ought to enable the producer to “proceed to take a position” in these areas even “in an financial context stuffed with challenges”.

€15 billion will even be allotted to the development of a cell manufacturing facility referred to as PowerCo, a subsidiary totally lively within the battery enterprise. Yesterday, the corporate introduced the development of a gigafactory in Canada with exercise beginning in 2027. By 2030, PowerCo is anticipated to generate an annual turnover of over €20 billion. As for combustion engines, the group plans to proceed investing within the newest era fashions, with a peak in 2025 after which a gentle decline.

Volkswagen CAPEX plan

Conclusion and Valuation

Right here on the Lab, we’re assured within the worth recognition of VW’s high product portfolio and the Porsche IPO was a optimistic affirmation of its underlying energy, which amongst different property, as already talked about, additionally consists of the luxurious manufacturers Bentley and Lamborghini, and a premium model similar to Audi. Our inside crew continues to imagine that this present worth is underappreciated, and specifically, Volkswagen is positioned to be a quantity chief within the EV phase. Apart from our SOTP valuation, with a present P/E of 4x, we imagine that the German automotive producer is discounted. Our EPS estimates for 2023 stand at €32.70 and with a P/E of 6x, we totally confirmed our goal value of €202 per share.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.