Mlenny/iStock Unreleased through Getty Photographs

Introduction

The Norwegian-based Equinor ASA (NYSE:EQNR) reported its fourth quarter and full-year 2022 outcomes on February 8, 2022.

Notice: This text is an replace of my article revealed on January 10, 2023. I’ve adopted EQNR on Searching for Alpha since January 2017.

This text examines the corporate’s current historical past, together with the fourth-quarter earnings, and conjecture about what to anticipate in 2023 and tips on how to navigate the trade efficiently.

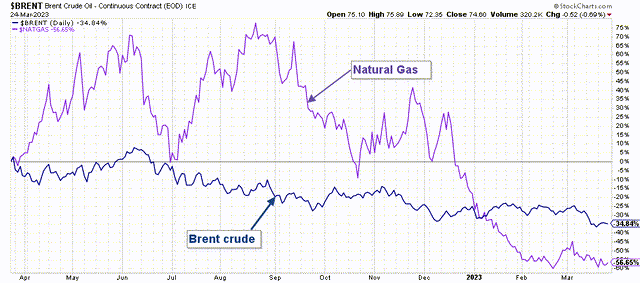

Equinor had an excellent yr in 2022 however is now dealing with powerful headwinds, with commodity costs retreating considerably from their highs, particularly pure fuel costs, representing a major a part of Equinor’s income.

1 – 4Q22 and full-year 2022 outcome Snapshot and commentary

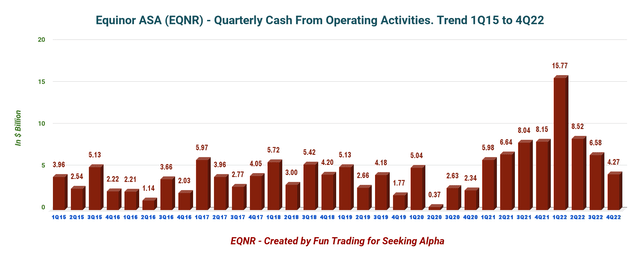

Equinor reported stable fourth-quarter outcomes. Earnings simply beat analysts’ expectations. Equinor generated $1.604 billion in generic free money circulation this quarter, and revenues had been $34.321 billion, up 5.3% from the 4Q21 revenues of $32.608 billion.

EQNR 4Q22 and full-year monetary outcomes (EQNR Presentation)

CEO Anders Opedal mentioned within the convention name:

2022 was our particular yr. The battle in Europe nonetheless causes human struggling and has disrupted the vitality markets contributing to inflation and price of dwelling disaster. In Europe, this yr marks a shift as we transfer ahead, not counting on Russian oil and fuel. Equinor responded rapidly and we’re nicely positioned to be part of the answer.

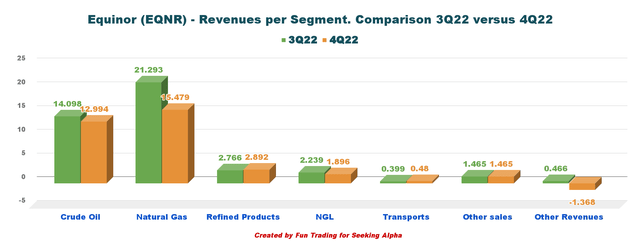

The built-in firm is primarily an oil and fuel producer with a strong crude oil section, as we will see under:

EQNR Quarterly Income element 3Q22 versus 4Q22 (Enjoyable Buying and selling)

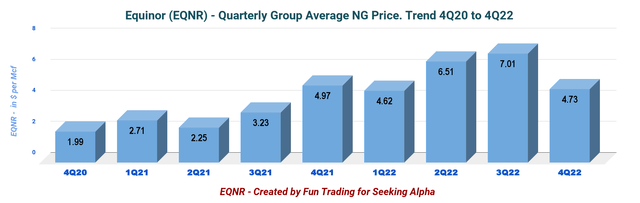

Thus, Equinor is the perfect play within the pure fuel section. It labored wonders for the corporate in 2022 as a result of pure fuel costs had been elevated, but it surely will also be seen as a curse if the commodity value flip bearish, as we have now skilled the previous few months.

The oil and pure fuel costs at the moment are considerably under what they had been a yr in the past.

EQNR 1-Yr chart Brent and NG costs (Enjoyable Buying and selling StockCharts)

2 – Inventory Efficiency

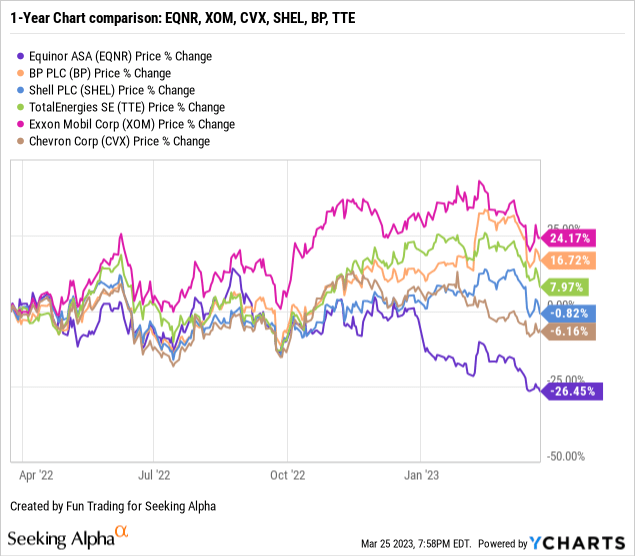

Equinor’s inventory has underperformed its friends with a 26.5% loss on a one-year foundation. It is likely one of the worst performers amongst its peer because of its publicity to the pure fuel sector.

Stability Sheet And Manufacturing historical past ending in 4Q22: The Uncooked Numbers

Equinor 4Q21 1Q22 2Q22 3Q22 4Q22 Revenues in $ billion 32.13 36.05 36.39 42.73 33.84 Whole Revenues and others in $ billion 32.61 36.39 36.46 43.63 34.32 Internet Earnings in $ million 3,368 4,710 6,757 9,384 7,897 EBITDA $ billion 17.76 19.51 22.22 28.54 15.65 EPS diluted in $/share 1.03 1.46 2.11 2.97 2.51 Money from working actions in $ billion 8.15 15.77 8.52 6.58 4.27 Capital Expenditure in $ billion 2.23 2.18 1.71 2.05 2.66 Free Money Circulate in $ billion 5.93 13.59 6.81 4.53 1.60 Whole money $ billion 33.28 44.57 45.69 44.34 39.31 Lengthy-term debt (+liabilities) in $ billion 32.68 30.47 29.84 28.55 28.50 Dividend per share in $ per share

0.20 (+0.20)

0.20 (+0.20)

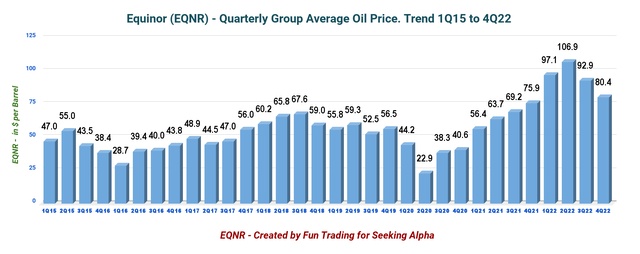

0.20 (+0.50) 0.20 (+0.70) 0.30 (+0.60) Shares excellent (diluted) in billion 3.249 3.237 3.197 3.157 3.144 Oil Manufacturing 4Q21 1Q22 2Q22 3Q22 4Q22 Oil Equal Manufacturing in Okay Boepd 2,158 2,106 1,984 2,021 2,046 Group common liquid value ($/b) 75.9 97.1 106.9 92.9 80.4 Click on to enlarge

Courtesy: Firm 4Q22 Press launch

Notice: The board of administrators declared an strange money dividend of $0.30 per share for the fourth quarter of 2022, up from $0.20 per share for the third quarter of 2022.

The board has determined to proceed the share buy-back program of $1.2 billion yearly, launched in 2021 as an built-in a part of capital distribution.

As well as, the board proposes a unprecedented money dividend of $0.60 per share for the fourth quarter of 2022. The board has additionally determined to extend the $1.2 billion share buy-back program by as much as $4.8 billion, leading to a program of as much as $6.0 billion in 2023.

Financials: Revenues, Free Money Circulate, Debt, And Manufacturing

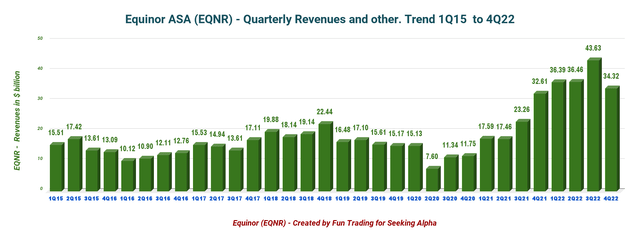

1 – Revenues and others had been $34.32 billion in 4Q22

EQNR Quarterly Revenues historical past (Enjoyable Buying and selling) Revenues and others had been $34.32 billion in 4Q22, up from $32.61 billion in the identical quarter a yr in the past and down 21.3% sequentially (please see the graph above).

Internet revenue was $7,895 million, or $2.51 per diluted share, up from $1.04 per diluted share in the identical quarter final yr.

Within the fourth quarter, the Norway common invoiced fuel value was $27.22 per million Btu for Europe ($28.52 final yr) and $4.73 for North America. The group common oil value was $80.4 per Boe.

EQNR Oil value historical past (Enjoyable Buying and selling) EQNR Quarterly Common fuel costs historical past (Enjoyable Buying and selling)

1.1 – Money from working actions was $4.267 billion in 4Q22.

The money from working actions is dropping rapidly and is a priority for the approaching 1Q23.

EQNR Quarterly Money circulation from operations historical past (Enjoyable Buying and selling)

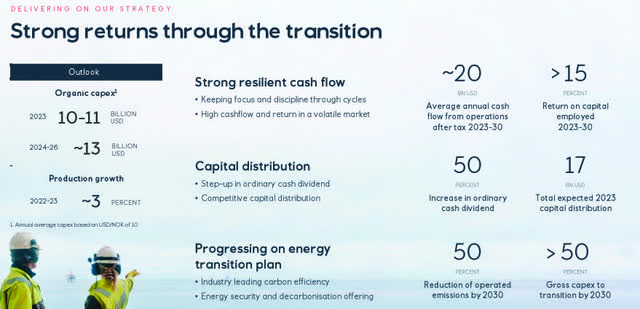

2 – 2023 Steerage and past

Natural CapEx is anticipated to be $10-$11 billion in 2023 and can enhance to ~13 billion in 2024-2025, with manufacturing progress of ~3% in 2023.

EQNR Outlook 2023 and past (EQNR Presentation)

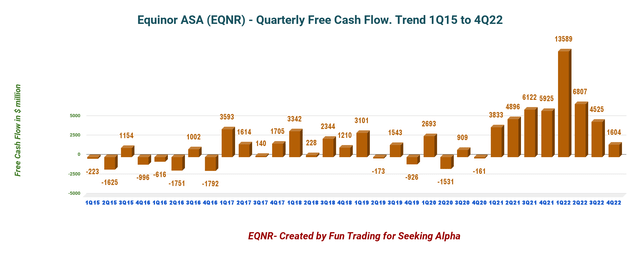

3 – Free Money Circulate was $1,604 million in 4Q22

EQNR Quarterly Free money circulation historical past (Enjoyable Buying and selling) Notice: I take advantage of the generic free money circulation, not together with divestitures. It’s the money circulation from operations minus CapEx. The corporate has a unique approach of calculating the free money circulation.

The corporate’s free money circulation was $1,604 million within the fourth quarter of 2022, with a trailing 12-month free money circulation of $26,525 million.

Equinor introduced a quarterly dividend of $0.30 per share, unchanged from 2Q22. Additionally, its board declared a particular quarterly money dividend of $0.60 per share for the fourth quarter of 2022.

EQNR Capital distribution defined (EQNR Presentation)

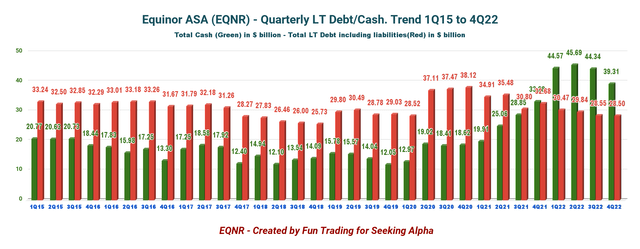

4 – No Internet Debt in 3Q22. Glorious profile.

EQNR Quarterly Money versus Debt historical past (Enjoyable Buying and selling)

Notice: The above debt within the graph is the gross interest-bearing debt plus liabilities.

As of December 31, 2022, Equinor reported $39,314 million in money, money equivalents, and securities. The corporate’s long-term debt amounted to $28.5 billion on the quarter-end. The corporate has no internet debt.

5 – Manufacturing Upstream and Funding in Renewables

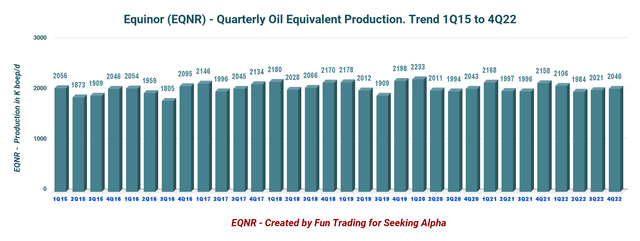

5.1 – Oil Equal Manufacturing

EQNR Quarterly Oil equal historical past (Enjoyable Buying and selling)

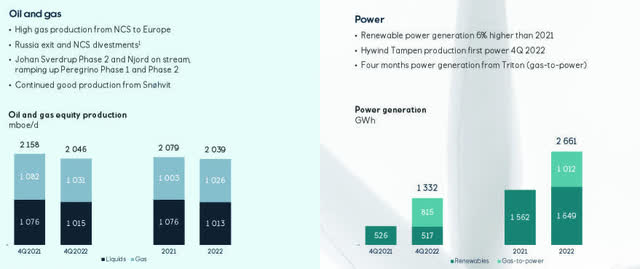

The fourth quarter manufacturing was 2,046K Boep/d, down from 2,158K Boep/d in the identical interval in 2021 and up 1.2% sequentially. Gasoline manufacturing was 1,015 Boep/d or about 49.6% of the whole output. Equinor share for energy era was 517 GWh this quarter, down from 526 GWh final yr. The corporate is advancing its shift to renewable.

5.2 – Presentation

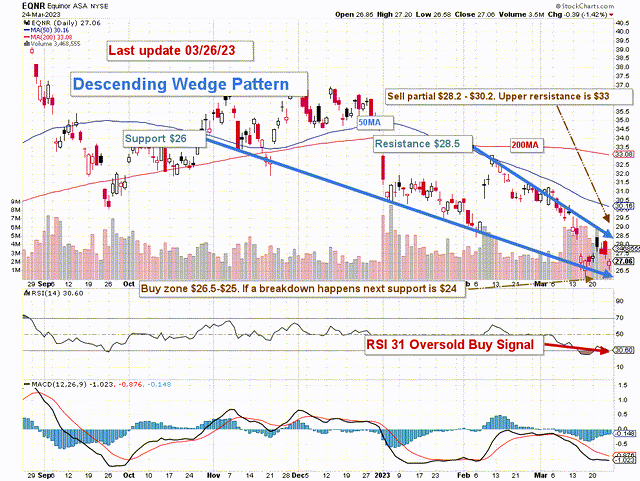

EQNR 4Q22 oil and fuel manufacturing (EQNR Presentation) EQNR TA Chart Quick-term (Enjoyable Buying and selling StockCharts)

Technical Evaluation And Commentary

Notice: The chart is adjusted for the dividend.

EQNR kinds a descending Wedge sample with resistance at $28.5 and help at $26. RSI is 31 and signifies that EQNR is oversold now and needs to be amassed.

The descending wedge is taken into account a bullish value sample during which bulls put together for an additional push upward. Briefly, any such sample usually ends with a breakout.

Nonetheless, 2023 has seen a dramatic retreat in oil costs and particularly pure fuel costs, and the next earnings outcomes will present decrease revenues and free money circulation, which can push EQNR even decrease.

Thus, the general technique I often promote in my market, “The Gold and Oil Nook,” is to maintain a core long-term place and use about 35%-40% to commerce LIFO whereas ready for a better remaining value goal to promote your core place at a major revenue.

The buying and selling technique is to promote about 35%-40% at between $28.2 and $30.2 with doable larger resistance at $33 and accumulate between $26.5 and $25 with doable decrease help at $24. Assuming no drastic new information, in fact.

As a reminder, EQNR relies upon extremely on oil and fuel costs, and your promoting or shopping for technique should think about these important parts. The Norwegian firm developed as Europe’s largest pure fuel provider in 2021 when Russia’s Gazprom minimize deliveries over the West’s help for Ukraine. Nonetheless, 2023 won’t repeat 2022, and buyers should be cautious.

Warning: The TA chart should be up to date continuously to be related. It’s what I’m doing in my inventory tracker. The chart above has a doable validity of a couple of week. Keep in mind, the TA chart is a instrument solely that can assist you undertake the precise technique. It isn’t a technique to foresee the long run. Nobody and nothing can.