Darren415

Earlier than we get too deep, let me begin from the highest by stating I consider that the Schwab U.S. Dividend Fairness ETF (NYSEARCA:SCHD) is the very best dividend centered ETF. To pursue its purpose, the fund typically invests in shares which might be included within the Dow Jones U.S. Dividend 100 Index.

SCHD is a superb fund, one which checks off a whole lot of bins for numerous sorts of traders. SCHD presents:

A large dividend yield

Robust Dividend Progress

Stable worth appreciation potential

That is all the pieces you need in any funding, centered on complete return. Let’s take a better have a look at the fund.

How SCHD Is Constructed

To be included within the fund, an organization should pay a dividend at the start. Nevertheless, not all dividend shares are up for inclusion. Shares that don’t make the listing embrace:

REITs Grasp Restricted Partnerships Most popular Shares

As I discussed earlier, the fund goals to largely monitor the efficiency and make-up of the Dow Jones US Dividend 100 Index.

Shares which might be up for inclusion will need to have not less than 10 consecutive years of dividend funds and a market cap of not less than $500 million.

From right here, the listing of potential shares are then dwindled down by evaluating the best dividend yielding shares primarily based on 4 fundamentals-based traits:

Money move to complete debt Return on fairness Dividend Yield 5-year dividend progress price

As soon as positions are chosen, no single place can symbolize greater than 4.0% of the index and no single sector, as outlined by the index supplier, can symbolize greater than 25% of the index, as measured on the time of index development, reconstruction and rebalance. The index composition is reviewed yearly and rebalanced quarterly.

A Stable Efficiency File

SCHD has a robust efficiency monitor document, one which stands up effectively to even the S&P 500 by way of complete return.

SCHD:

YTD -5% 1-Yr -7% 3-Yr +84% 5-Yr +76% 10-Yr +207%

S&P 500:

YTD +4% 1-Yr -11% 3-Yr +68% 5-Yr +67% 10-Yr +207%

As you possibly can see, SCHD has outperformed the S&P 500 in each interval, apart from 12 months so far 2023, and so they coincidentally have the identical complete return over the previous decade.

The New Look SCHD

As famous earlier, SCHD goes via what is named a reconstitution, one thing they do annually which includes new shares being added and a few outdated shares being lower out fully. That reconstitution simply came about just a few weeks in the past.

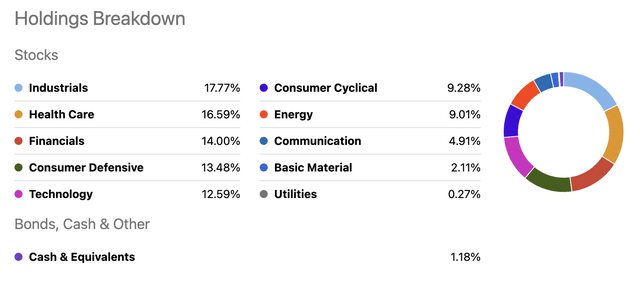

SCHD is a fund that very effectively diversified throughout numerous industries, which is one cause the fund has carried out effectively. Some ETFs which might be over prolonged to sure sectors could possibly be extra unstable relying on the financial system.

Here’s a have a look at the sector breakdown.

In search of Alpha

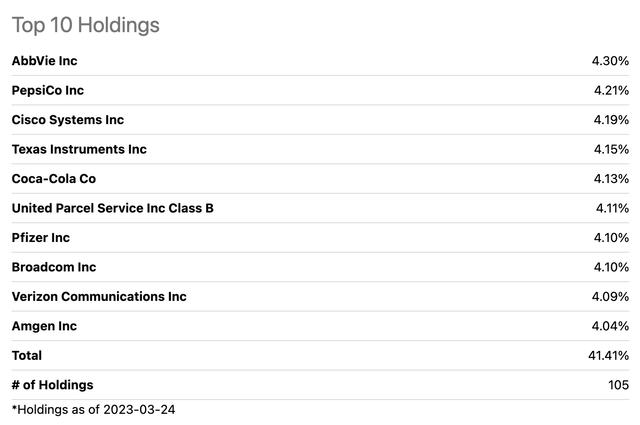

Now let’s check out the recent new high 10 positions for SCHD:

In search of Alpha

These high 10 positions make up 42% of the complete fund, which is made up of a complete of 105 positions.

AbbVie (ABBV), which occurs to be one among my favourite dividend shares through the years, is now the highest place within the fund. Not solely is ABBV the highest place, however it’s a wholly new place in SCHD as they’ve only in the near past crossed the ten 12 months mark for dividend funds. Different new positions throughout the high 10 as of this writing embrace: United Parcel Service (UPS), Pfizer (PFE), and Amgen (AMGN).

Shares that fell out of the highest 10 embrace: Merck (MRK), Lockheed Martin (LMT), and BlackRock (BLK).

I really like all 4 of the brand new positions, the one one I disagree with is LMT popping out of the highest 10. Lockheed is a strong firm that’s shareholder pleasant, however extra importantly, we’re going via a interval when nations everywhere in the world wish to bolster their navy. These navy contracts are massive and canopy quite a few years.

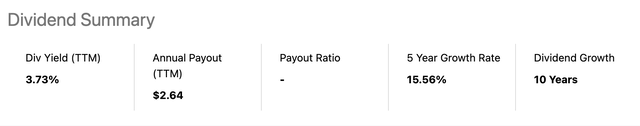

Now let’s shortly have a look at the ETF’s dividend.

Over the previous 12mo, SCHD has paid a dividend of $2.64, which equates to a dividend yield of three.7%. As well as, SCHD has a 5 12 months dividend progress price of 15.5%, which is sort of spectacular. The fund has paid a rising dividend for 10 consecutive years now.

In search of Alpha

Investor Takeaway

As we have now seen, there’s a lot to love about SCHD. The fund presents a strong yield, close to 4%, excellent dividend progress of greater than 15%, and a dividend that has grown yearly for the previous decade.

The fund’s efficiency has stood as much as and outperformed the S&P 500 over numerous intervals, and that is largely resulting from its effectively diversified portfolio amongst numerous sectors.

The fund went via its annual reconstitution, which resulted in ABBV being the brand new high place throughout the fund and a wholly new place at that.

What’s to not love about SCHD? It is a high-quality ETF that I look so as to add to regularly. Within the feedback part under, let me know what you consider the brand new look SCHD.

Disclosure: This text is meant to offer data to events. I’ve no data of your particular person objectives as an investor, and I ask that you simply full your personal due diligence earlier than buying any shares talked about or beneficial.