David Becker

Superior Micro Units (NASDAQ:AMD) inventory has outperformed its friends within the iShares Semiconductor ETF (SOXX) since its January lows.

We imagine the current AI frenzy additionally lifted AMD’s shopping for sentiment, given its information middle CPU benefits. The corporate has been main in efficiency and whole value of possession, or TCO, because it prepares to launch its 128-core cloud-optimized Bergamo CPU in H1’23.

DigiTimes estimates counsel that “AMD’s CPUs are at the very least 30% cheaper than Intel’s (INTC).” As such, it advantages firms needing to put in “CPUs in massive volumes.”

Therefore, there should not be any shock that AMD’s information middle CPUs are in demand with the main cloud hyperscalers. Accordingly, “30% of server orders” positioned by Google Cloud (GOOG) (GOOGL) and Microsoft Azure (MSFT) are for AMD’s CPUs.

AMD CTO Mark Papermaster highlighted in an early March convention why AMD’s clients helped propel AMD’s information middle market share over the previous yr, mitigating the slowdown in its client enterprise. Papermaster added:

Milan, the third-generation EPYC, continues to be the TCO benefit out within the market. The fourth era (Genoa) knocks it out of the park with a complete value of possession and a consolidation play. So it’s certainly a really, very, crucial ramp for us. It is a very purposeful ramp, and it is going proper on observe. (Morgan Stanley Expertise, Media & Telecom Convention)

As such, AMD noticed its server cargo share enhance from 11.2% in 2021 to fifteen.6% in 2022. As well as, the share acquire in opposition to Intel was important, as Intel noticed its cargo share drop to 77% in 2022 from 2021’s 84.7% share.

Notably, AMD is predicted to extend its share in 2023 to twenty.5%, with ARM-based processors additionally seeing share positive factors to eight.1%. It augurs properly for AMD’s goal of delivering 20% to 25% of information middle income progress in 2023.

Accordingly, business sources point out that AMD’s demand for superior packaging and testing with Taiwan-based OSAT gamers “stays regular.”

Subsequently, we imagine AMD’s outperformance relative to its SOXX friends seemingly mirrored the market’s optimism over the potential progress of its information middle cargo share.

Furthermore, the PC market additionally is predicted to backside in phases in 2023. There are “early indicators of restoration in industrial and gaming pocket book/monitor orders whereas client PC demand stays subdued.” Therefore, AMD bulls may justifiably argue that the worst is probably going over for AMD.

We agree. Because the market is forward-looking, it is laborious to imagine that AMD has not bottomed out after recovering almost 90% from its October 2022 lows.

Nevertheless, the crucial query is whether or not the market has factored in ahead earnings progress estimates into its valuation.

Accordingly, Wall Avenue analysts anticipate AMD to put up income progress of 0.44% in FY23, given the downstream headwinds. Nevertheless, it is anticipated to put up income progress of 17.4% in FY24.

As well as, AMD is also projected to ship an adjusted EPS progress of 42.7% in FY24. Nevertheless, traders want to think about that it is predicated in opposition to a decline of 13% in its adjusted EPS for FY23, leading to much less difficult comps.

As such, the savvy market operators have seemingly anticipated AMD’s restoration, despite the fact that the downstream headwinds stay unsure.

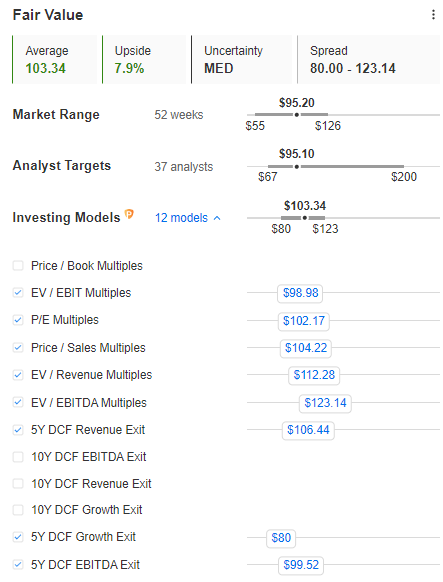

AMD blended honest worth estimates (InvestingPro)

AMD’s blended honest worth estimate signifies a lower than 10% potential upside to its implied honest worth of $103. Furthermore, its ahead adjusted P/E of 31x is considerably above the SOXX’s 18.5x.

It is also above the tech sector’s 22.5x, suggesting that near-term optimism over AMD could have been mirrored. Additionally, Trefis’ sum-of-the-parts or SOTP valuation estimates are extra pessimistic, valuing AMD at lower than $72.

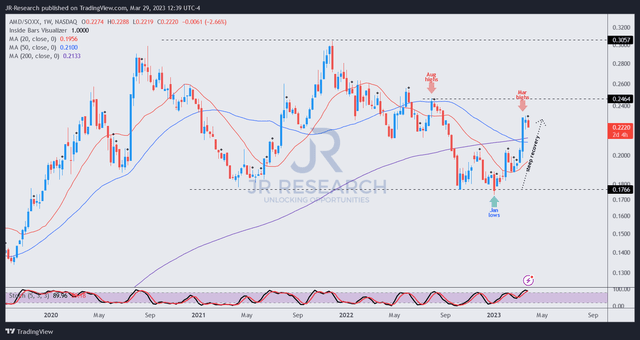

AMD/SOXX worth chart (weekly) (TradingView)

We imagine that nothing goes up in a straight line “endlessly.” As such, traders are inspired to purchase weak point, significantly if the valuation is not compelling.

As seen above, AMD has outperformed the SOXX since its January lows. Notably, astute patrons returned to defend these ranges earlier than lifting the momentum increased.

Momentum breakout merchants seemingly joined in just lately after the dip patrons scooped up the shares in the beginning of the yr when semi-stocks have been nonetheless in extremely pessimistic zones.

Nevertheless, we imagine the outperformance in opposition to the SOXX may stall within the close to time period, suggesting a pullback may very well be in retailer.

Coupled with a a lot much less compelling valuation than ranges seen over the previous three months, we’re transferring to the sidelines from right here.

Score: Maintain (Revised from Purchase).

Necessary be aware: Buyers are reminded to do their very own due diligence and never depend on the knowledge offered as monetary recommendation. The score can also be not supposed to time a particular entry/exit on the level of writing except in any other case specified.

We Need To Hear From You

Have you ever noticed a crucial hole in our thesis? Noticed one thing vital that we did not? Agree or disagree? Remark and tell us why, and assist everybody to study higher!