Ozgu Arslan/iStock through Getty Photos

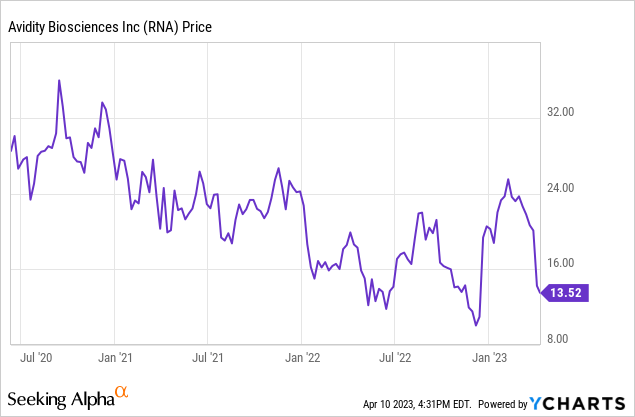

Avidity Biosciences (NASDAQ:RNA) is a scientific stage firm with a novel method to delivering RNA to human cells. Regardless of being early within the scientific trial course of, it at present carries a market capitalization close to $1 billion. That shows substantial investor expectations for the platform. But after the IPO in 2020 the inventory value went to over $30 per share and the market cap went effectively over $2 billion. This text is an replace to Avidity Biosciences: Dangers And Potential, revealed again in December of 2021. That article was based mostly on preclinical information. This text will give an replace targeted on new scientific information. That information is trending optimistic, however one affected person had a extreme side-effect or hostile occasion. The destiny of the primary remedy is dependent upon whether or not the FDA guidelines the remedy was accountable for the intense hostile occasion, or not. Earlier than diving into that I’ll briefly clarify the RNA-antibody platform and recap the monetary state of affairs utilizing the 2022 This fall reported outcomes.

Avidity Biosciences This fall 2022 Outcomes

In This fall 2022 Avidity Biosciences reported a little bit of income from collaborations, $2.8 million. The GAAP web loss was $50 million, whereas the GAAP EPS loss was $0.88. Presently losses are accelerating as new scientific trials come on-line. Losses could be anticipated till after the corporate receives its first FDA approval, which may very well be years away. Usually biotechs that get that first FDA approval don’t await income to ramp up, as an alternative instantly elevating more cash from traders so as to ramp up the R&D finances. Fortuitously, resulting from early backing and a profitable IPO again in 2020, Avidity ended the quarter with $611 million in money and no debt. If $50 million per quarter have been the quarterly run fee, there may be money to function for 3 years.

The AOC (antibody-oligonucleotide complicated) Platform

An AOC (antibody-oligonucleotide complicated) has three parts: a monoclonal antibody, a linker, and an siRNA (small interfering RNA). The concept is to resolve the issue of getting an RNA remedy into a selected cell kind exterior the liver, which present RNAi therapies goal. A number of RNA remedy firms together with Ionis (IONS) and Arrowhead (ARWR) are additionally engaged on focusing on cells exterior the liver. Within the AOC the antibody is engineered to search out and fasten to the goal cell kind. Then the siRNA is launched into the cell the place, hopefully, it fixes the issue inflicting the illness. The linker retains the AOC collectively till the goal cell membrane is reached.

Many genetically outlined illnesses have an effect on muscle cells, and to date, extra conventional RNA (RNAi and siRNA) and different varieties of therapies have had restricted success with these muscle illnesses. A essential resolution for brand spanking new pharmaceutical discovery firms, significantly these with novel approaches, is whether or not to choose illness targets which can be almost definitely to deliver early success, or to go after high-value targets (these with massive numbers of sufferers with excessive unmet medical wants). Avidity selected a targeted method.

Information for AOC 1001 for Myotonic Dystrophy Kind 1

On March 30, 2023 Avidity supplied a regulatory replace on AOC 1011 for myotonic dystrophy kind 1. Though the primary manifestation of this dysfunction is muscle weak spot, it has a number of different nasty results together with early onset of cataracts and coronary heart abnormalities. The illness is attributable to mutations within the DMPK gene, so it’s often inherited. About 30,000 folks have the situation in the US. The affected person’s situation will get worse with growing older, resulting in a life expectancy of about 50 years. There are at present no authorized therapies for the illness.

The continued Section 1/2 MARINA trial in adults with DM1 (myotonic dystrophy kind 1) dosed its first affected person with AOC 1001 in early November 2021. AOC 1001 has been given each Orphan drug designation and Quick Observe designation by the FDA and was additionally given Orphan designation in Europe. AOC 1001 makes use of its antibody to bind to transferrin receptor 1, delivering an siRNA focusing on DMPK mRNA. The topline information from the trial will likely be offered on April 27 on the AAN (American Academy of Neurology) annual assembly. Preliminary information launched in December 2022 confirmed that the drug efficiently delivered its RNA payload to muscle tissue in people. All sufferers within the research confirmed a significant discount in DMPK after dosing. The info confirmed splicing enhancements within the topics. There have been additionally early indicators of scientific exercise, or enchancment in signs, in some individuals. Security was good among the many 38 individuals apart from the one affected person who suffered a critical hostile occasion. The FDA initially categorised this occasion as drug associated.

In September 2022 the FDA positioned a partial scientific maintain on the trial, stopping new affected person enrollment. Sufferers already dosed have been allowed to proceed dosing and roll over into the Open Label Extension long-term comply with up trial. On the March 30, 2023, replace Avidity concluded that the intense hostile occasion was almost definitely resulting from an especially uncommon neurological occasion. This consisted of bilateral ischemia (blood vessel restriction) within the area of the lateral geniculate nuclei within the thalamus, with subsequent hemorrhagic transformation. In atypical apply this sort of occasion is extraordinarily uncommon. After intensive investigation, Avidity couldn’t establish a believable organic hyperlink to any element of AOC 1001, the transferrin receptor supply mechanism, or to discount in DMPK. Avidity famous that AOC 1001 doesn’t cross the blood mind barrier (and so shouldn’t have an effect on the lateral geniculate nuclei). The affected person was capable of go house however had some visible impairment. Nonetheless, the FDA has not ended its partial scientific maintain and discussions between the corporate and regulators are ongoing. “We do need to be clear we’re making progress,” in these talks, stated Avidity President and CEO Sarah Boyce. If decision is reached, Avidity plans to progress AOC 1001 right into a pivotal scientific trial.

AOC 1044 and AOC 1020

The opposite two potential therapies which can be in Section 1 trials are AOC 1044 and AOC 1020. The Section 1 trial of AOC 1044 for DMD (Duchenne Muscular Dystrophy) was launched in Q3 2022. DMD is a critical, genetically pushed explanation for muscle loss. It’s attributable to a mutation of the dystrophin gene. It’s the most typical of the muscular dystrophies, affecting about one in 3,600 males. Dying often happens by the mid-20s. A number of therapies from Sarepta (SRPT) are already authorized for subsets of the illness. They aim the skipping of exon 45 (casimersen); 51 (eteplirsen); and 53 (golodirsen). Avidity has indicated that AOC 1044 is focused at exon 44. Avidity’s pipeline web page signifies additionally it is in preclinical improvement of therapies focusing on exon 45 and exon 51. However Sarepta’s pipeline is way extra intensive and consists of exon 44 as considered one of its targets. For Avidity to succeed extra typically in treating DMD, it’ll have to indicate its therapies are safer or a minimum of as efficient as these of Sarepta.

AOC 1020 for folks with FSHD (Facioscapulohumeral Muscular Dystrophy) additionally entered a Section 1 scientific trial in Q3 2022. FSHD is notable for principally affecting facial muscle mass. It’s attributable to a mutation inflicting deregulation of the DUX4 gene. DUX4 protein in flip modulates different genes concerned in muscle perform. Genetic testing for the situation is offered. Whereas the illness will not be lethal, it will definitely disables sufferers to the extent they could require a wheelchair for locomotion. A number of varieties of therapies by rivals are in improvement, starting from small molecules to RNA therapies to gene remedy. In Q2 2021 Arrowhead offered promising preclinical information for ARO-DUX4 in facioscapulohumeral muscular dystrophy.

Dialogue

Clearly the AOC platform has a number of potential. Clearly, too, there may be a number of danger for traders. If the FDA doesn’t launch the scientific maintain, that’s the finish of AOC 1001. If it releases the maintain however a participant in a later trial suffers the same occasion, that’s the finish of AOC 1001. Worst of all can be if for some cause related critical hostile occasions happen within the AOC 1044 or AOC 1022 trials. That appears unlikely given the preclinical testing and outcomes up to now, but it surely can’t be excluded.

Whereas ready for the FDA resolution on the partial maintain for AOC 1001, I believe we must always concentrate on the potential of AOC 1044 and 1020 and the platform’s capacity to generate new remedy candidates. As I stated above, it’s a little bit of a race to search out methods to ship RNAi therapies exterior the liver. There could also be a number of winners.

Conclusion

Given all the chance, I might not advocate Avidity, at this level, to anybody apart from skilled biotech traders. Given an understanding of the chance and potential rewards, pricing of the inventory turns into paramount. Given the big money steadiness and three potential therapies already in scientific trials, I believe the market cap of close to $1 billion or $13.50 per share is cheap. As somebody who remains to be doubtless accumulating the inventory, I wish to value to be decrease. If the FDA removes the partial scientific maintain on AOC 1001 there may very well be a bump within the value. We’ll solely know the actual worth if Section 3 trial outcomes achieve FDA approval and we see what revenues the potential therapies produce. If the platform produces a number of profitable therapies, $1 billion in market cap may appear trivial. If we see failure after failure, traders will remorse shopping for on the present value. I imagine the momentary FDA maintain has created a possibility to purchase Avidity inventory at a beautiful value, with a possible bump if the maintain is lifted, however the hazard of a major additional decline if the trial must be terminated.