PM Photos

Federal Realty Funding Belief (NYSE:FRT) and Simon Property Group (NYSE:SPG) are two premier publicly traded retail REITs, as each boast very prime quality portfolios of retail actual property properties alongside very sturdy steadiness sheets and revered administration groups. SPG presents a better yield at current and has a better credit standing. Nevertheless, FRT has a extra defensive portfolio and has a way more spectacular dividend development historical past. On this article, we evaluate them after which supply our opinion on which is the higher purchase for the time being.

FRT Inventory Vs. SPG Inventory: Enterprise Mannequin

Each companies personal prime quality belongings positioned in extremely engaging areas. FRT’s portfolio consists primarily of open air buying facilities however is transferring more and more in direction of a mixed-use mannequin that additionally contains workplace house and residential models. Its most up-to-date outcomes illustrate simply how effectively its technique of redeveloping its properties is working. It generated FFO per share development of 6% in Q1, backed by same-property NOI development of three.6%, each of which have been coming off of very difficult comparisons with the earlier 12 months’s Q1 being a really sturdy one for the corporate.

FRT’s underlying fundamentals indicate that the sturdy development momentum is ready to proceed, with money leasing spreads of 11% in Q1 and new leases posting straight-line hire development of 24%, the strongest of such numbers in FRT’s lengthy and illustrious historical past.

SPG in the meantime owns primarily class A malls together with a portfolio of premium outlet properties. It’s also investing aggressively to redevelop and improve its belongings to leverage their engaging areas to draw blended use tenants. The aim is to extend money move by attracting a wider vary of shoppers, whereas additionally enhancing the longevity of the portfolio by lowering its publicity to e-commerce dangers. To date, SPG’s technique seems to be working fairly effectively, with NOI development of 4.0% throughout the U.S. portfolio, leading to 1.5% FFO per share development. That stated, 2022 FFO per share development was 3.8%, and we anticipate FFO per share enhancing from the gradual Q1 numbers over the course of the complete 12 months.

FRT Inventory Vs. SPG Inventory: Stability Sheet

Each steadiness sheets are in nice form, as evidenced by their lofty credit score scores: SPG boasts an A- credit standing and FRT has a BBB+ credit standing from S&P, which places them each among the many top-tier of REITs on this class.

FRT has loads of liquidity ($1.3 billion relative to an Enterprise Worth of $11.8 billion) and is ready to challenge inexperienced bonds for extra engaging rates of interest on a few of its debt. Furthermore, its ~6x internet debt to EBITDA ratio falls comfortably inside the vary essential to maintain its credit standing, whereas it’s engaged on rising its EBITDA to carry its leverage ratio into the mid-5x vary over the following 12 months alone. This might probably elevate it to its earlier A- credit standing that it loved earlier than the COVID-19 lockdowns harm its enterprise.

Furthermore, it enjoys a conservative 3.6x mounted cost protection ratio, which may also naturally enhance over the course of this 12 months as further rents come on-line from FRT’s redevelopment initiatives and different investments. Furthermore, 85% of its complete debt has mounted rates of interest, giving it fairly good safety in opposition to any additional will increase in rates of interest.

SPG in the meantime has $9.3 billion in liquidity, which is a really great amount, even in comparison with its massive $58.7 billion enterprise worth. Furthermore, its mounted cost protection ratio is a formidable 4.6x and its debt is ~95% mounted charge, giving it a really safe place within the face of rate of interest volatility. With such spectacular liquidity and robust credit score metrics, SPG’s steadiness sheet is clearly in sturdy form and may assist the corporate climate any economic-related challenges to the portfolio within the coming months and years.

FRT Inventory Vs. SPG Inventory: Dividend and AFFO Progress Outlook

FRT has an 89.2% 2023 anticipated dividend payout ratio, whereas SPG is anticipated to put up a 68% dividend payout ratio this 12 months. Shifting ahead, FRT is anticipated to develop its AFFO per share at a strong 9.5% CAGR by 2026 whereas SPG is anticipated to develop its AFFO per share at a considerably much less spectacular 3.2% CAGR over the identical time span. That stated, it seems that FRT is making an attempt to cut back its payout ratio to enhance the sustainability of its long-term 55-year dividend development streak as it’s only anticipated to develop its dividend by a measly 2.4% by 2026, whereas SPG is anticipated to develop its dividend at a really related CAGR of two.5%.

The explanation why FRT is anticipated to develop quicker than SPG regardless of SPG retaining much more money move than FRT is for the time being is as a result of SPG is having to take a position extra aggressively in its properties so as to hold them economically vibrant because of larger headwinds to mall and outlet tenants than for the tenants in FRT’s city mixed-use and prime quality open air buying facilities.

FRT Inventory Vs. SPG Inventory: Valuation

When it comes all the way down to valuation, FRT and SPG are buying and selling at close to an identical worth to NAV ratios. Nevertheless, SPG appears to be like vastly cheaper based mostly on the opposite valuation metrics. This distinction in money move and dividend yields is essentially because of the truth that SPG has a bit extra leverage on its steadiness sheet and SPG’s properties are merely valued at increased cap charges than FRT’s are because of their larger perceived danger.

Metric P/AFFO FWD Dividend Yield EV/EBITDA P/NAV FRT 18.26x 4.8% 17.52x 0.73x SPG 8.16x 7.8% 14.37x 0.74x Click on to enlarge

Investor Takeaway

Each of those REITs definitely match the outline of being exemplary and effectively run. FRT’s 55-year dividend development streak earns it the standing of Dividend King and is in actual fact the longest dividend development streak in the complete REIT trade. This alone speaks volumes in regards to the high quality of the belongings, the enterprise mannequin, the steadiness sheet, and in the end the administration crew.

That stated, SPG can also be one of many few survivors of the nice retail apocalypse that hit buying malls a lot tougher than different forms of retail actual property. In truth, regardless of weathering extreme COVID-19 and e-commerce headwinds, SPG’s steadiness sheet stays in distinctive form with an A- credit standing and thriving property-level fundamentals.

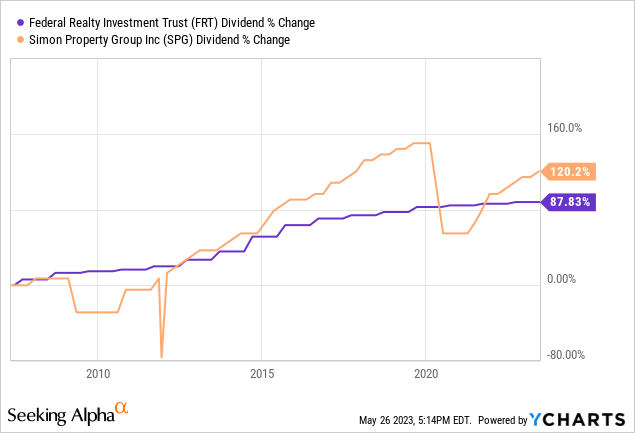

Finally, we predict that each of those REITs look very engaging for the time being, and we predict that holding them 50/50 in a portfolio makes quite a lot of sense. SPG seemingly has increased complete return potential because of its larger dividend yield and money move yield, however FRT has stronger development momentum and in addition is a little more defensively positioned because of its extra in-favor asset portfolio. It’s also value noting that – whereas SPG has a better dividend yield in the present day – it did have to chop its dividend a number of instances prior to now. Alternatively, regardless of these quite a few cuts and FRT’s steady year-over-year development, SPG’s total dividend development charge over the previous decade and a half has nonetheless outpaced FRT’s:

Finally, we charge each as Sturdy Buys given their massive reductions to NAV and engaging yield plus development profiles.