BrianAJackson/iStock through Getty Photos

Introduction

This text builds on prior sign occasion articles with extra explanations on how you can profit from one of the vital fashionable options of the Worth & Momentum Breakouts investing group. As extra information factors are collected, extra insights are gained. Normally I deal with publishing market topping indicators, however this time I’m sharing a really constructive growth that we now have not seen since January.

This previous February signaled the most important market topping sign since August 2022. Since then many sectors have declined with financials among the many hardest hit sector this 12 months. A banking disaster adopted instantly after the February adverse sign, and we now have been ready via Might for indicators of a broad constructive market sign. Whereas the Know-how sector has been led by just a few mega caps in sturdy constructive momentum, it has been a slim commerce that left each the DJIA and Russell 2000 indices in adverse territory via Might. This text serves to reply key questions concerning the present constructive sign and put together readers for the potential of extra positive aspects within the brief time period.

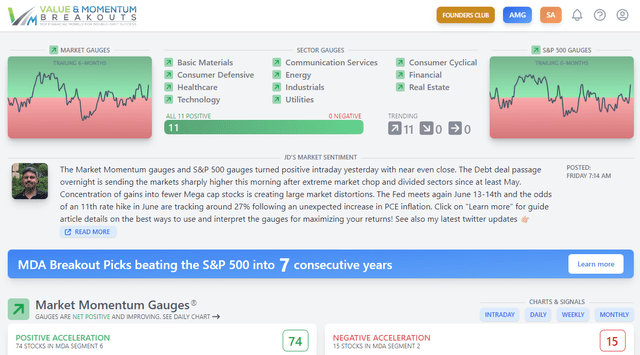

Momentum Gauges Dashboard

Market every day gauges, S&P 500, and sector gauges are extremely constructive within the first broad rally in months. All of the sectors turned constructive this week within the strongest broad market transfer since January. Cash flows to oversold sectors like financials, power, and fundamental supplies could speed up so long as the US greenback continues to say no from peak ranges in Might.

app.VMBreakouts.com

Information: Maximizing Market Returns With The Automated Momentum Gauges

Market Momentum

Momentum broke out above 70 on Friday after among the choppiest weeks on the indicators that we now have seen in years. This was largely resulting from frequent sector rotation with issues a few debt default. As I wrote about in my debt ceiling article linked beneath, this sample is in line with elevated volatility forward of all of the prior debt ceiling standoffs adopted by sturdy positive aspects after every deal concludes. This time nonetheless we’re in a unbroken Fed tightening program with 10 consecutive fee hikes and the most important QT program in US historical past.

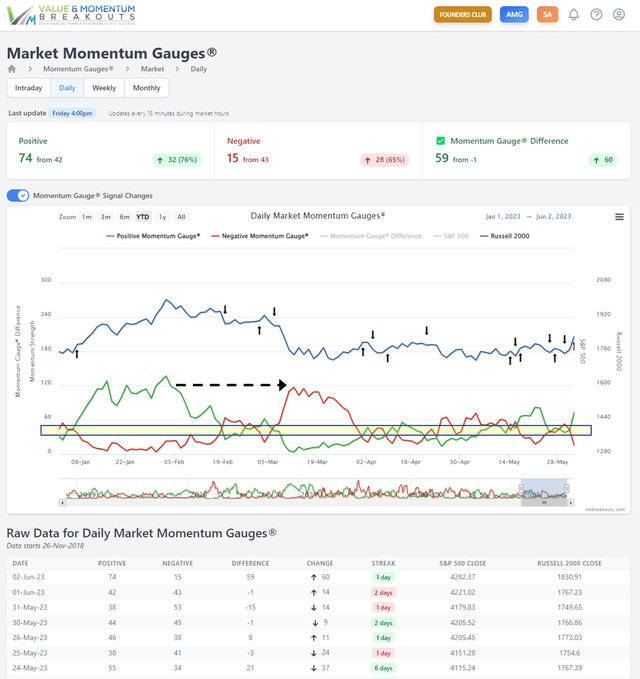

Each day Market Momentum Gauges YTD

Momentum cleared the uneven equilibrium vary (yellow) this week, however in contrast to the mid-Might soar, all of the sectors this week had been collaborating within the breakout. There’s a higher likelihood that this bounce will maintain for the oversold sectors.

app.VMBreakouts.com

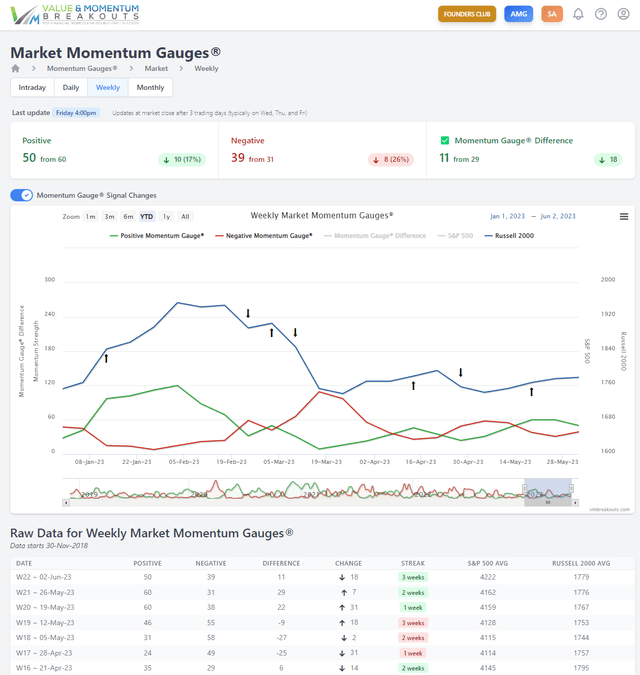

Weekly Momentum Gauges YTD are heading towards a 4th consecutive constructive week with a lot much less noise than the every day gauges. The weekly chart illustrates the unexpectedly sturdy momentum circumstances in January that topped in February forward of the current banking disaster.

app.VMBreakouts.com

These weekly momentum strikes additionally correspond strongly inverse to the motion of the Invesco DB US Greenback Index fund (UUP) proven beneath. Because the greenback declined into January, we had a powerful rally that peaked on the finish of February. As Might involves an in depth with the greenback index on the highest ranges since March, we is likely to be headed towards one other rebound off the lows of this cycle.

FinViz.com VMBreakouts.com

Why do finance firms admit that “timing is all the pieces,” however in the case of investing your cash, the bulk inform their purchasers to “simply purchase/maintain and attempt to ignore the downturns?” I submit most traders would depend on timing indicators, however with no mannequin just like the gauges they’re pressured to attempt to hold their purchasers in purchase/maintain positions for twenty-four months with no positive aspects, or worse.

If timing helps you achieve simply 1% every week, you’ll considerably outperform all of the long-term market averages.

Very long time members know, we are able to constantly beat the markets by avoiding essentially the most adverse weeks and loading up throughout essentially the most constructive indicators. Solely the monetary trade has incentives to make you to remain within the markets 12 months spherical.

FinViz.com VMBreakouts.com

2023 Market Outlook

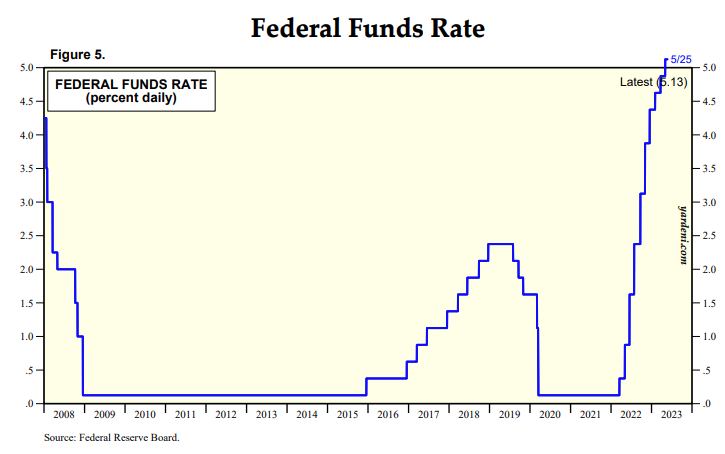

The Fed has delivered its tenth consecutive fee hike within the quickest sequence of will increase since 1977. The S&P 500 (SPX) (SPY) are nonetheless adverse for the reason that Fed started its tightening program on March ninth, 2022 and started mountain climbing charges early final 12 months. After the most recent PCE inflation unexpectedly elevated once more, the chances of an eleventh hike in June jumped to 66.5% and have fallen again to 25% on the CME FedWatch Instrument. Traditionally, such excessive charges have led to a market correction after each fee mountain climbing cycle in US historical past. Though I’m happy to report present constructive momentum, the most important QT program in historical past continues to be ongoing to scale back the Fed’s stability sheet on the quickest fee ever carried out, with goal ranges of -$95 billion per 30 days.

Yardeni.com

My technique for 2023 is to remain typically bearish whereas adjusting for big bear bounces in anticipation of sturdy similarities to the August topping sample final 12 months. Financial information, inflation, manufacturing productiveness, house gross sales, and the most recent banking disaster proceed to indicate recessionary weak point into rising rate of interest hikes on the highest ranges since Sep 2007.

Mid-year 2023 is almost right here and issues could get fascinating with potential for a Fed pivot. Dip-buyers will proceed to attempt to pull this anticipated pivot occasion ahead in time, extending excessive market volatility whereas the Fed hikes charges.

The brand new June Russell Reconstitution anomaly report will probably be launched once more in June with the most recent shares for 2023 FTSE Russell Reconstitution Anomaly Examine – Robust +22.7% Distinction After 5 Months

A few of my forecast articles for 2023 are right here in your profit.

Sector Momentum

For this text, I wish to spotlight simply two of the eleven sector gauges particularly. The variations between these two sectors additionally accounts for a lot of the acute chop within the markets lately.

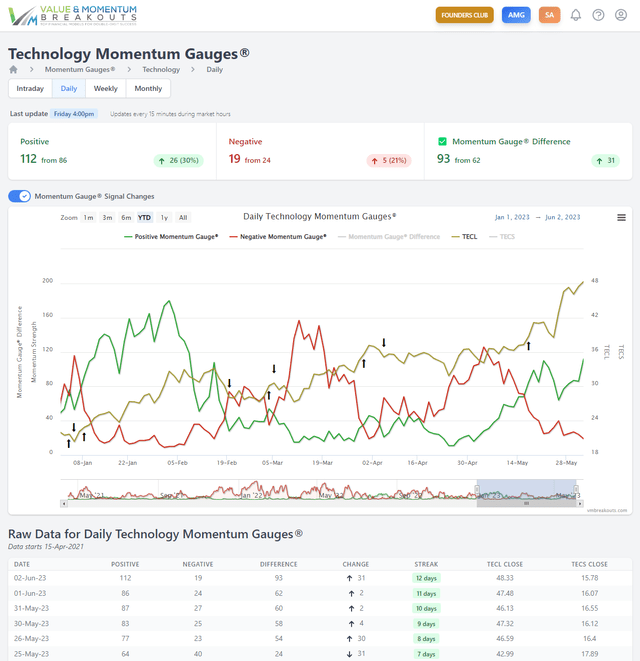

Know-how Momentum Gauges proceed for a 3rd week to be the breakout sector. Unfavorable gauges proceed to drop sharply from the height of adverse momentum on Might 4th. The (TECL) 3x Direxion Each day Know-how bull fund has gained +41.7% from Might 4th and will proceed towards January peak constructive momentum ranges at 180. The expertise sector is the very best weighted and largest sector on the most important market indices, particularly the Nasdaq and associated index fund (QQQ). So long as expertise momentum will increase it’ll profit expertise funds like (SOXL) 3x Direxion Each day Semiconductor bull fund and the Mega cap bull funds comprised principally in expertise like MicroSectors FANG+ and FANG Innovation 3x funds (FNGU) (BULZ).

app.VMBreakouts.com

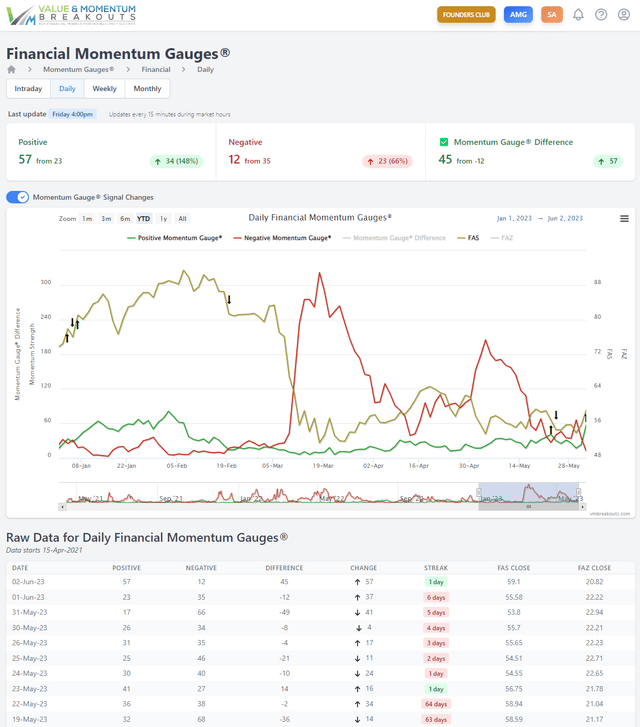

Monetary Momentum Gauges have been essentially the most adverse sector this 12 months from the February 21 sign upfront of the March banking disaster. This previous Friday gave us solely the 2nd and most constructive sign in over 71 days. Since that adverse market and sector gauge sign, the (FAZ) -3x Monetary bear fund has gained +29.8%. This new constructive sector sign may mark the beginning of an extended rebound in banks, with the (FAS) 3x Monetary bull fund and associated (BNKU) (DPST) for sturdy potential positive aspects.

app.VMBreakouts.com

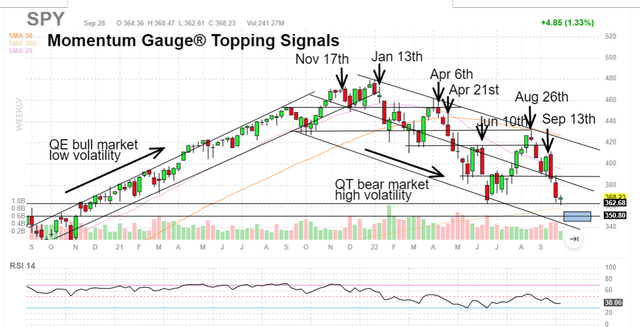

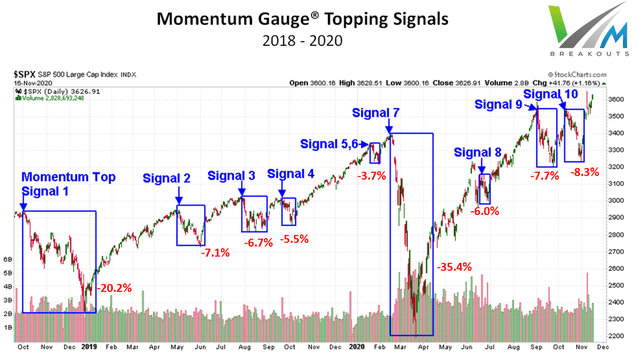

Prior Unfavorable Indicators In Advance Of Main Downturns

One of the vital fashionable makes use of for the gauges is to get superior warning indicators forward of main market downturns to be able to shield your investments. Examples of prior main market topping indicators together with the 2018 quantitative tightening (QT) correction and the 2020 Covid correction are proven beneath.

VMBreakouts.com

The purpose of this illustration is {that a} majority of all of the indicators detected to this point had been occasions exceeding -5% S&P 500 declines to as a lot as -35%, together with one of many worst one-month declines in historical past. I at all times publish many extra present examples and sign articles all year long for anybody curious about following my market updates.

Evaluate Of Prior Indicators

Sign 19 (November seventeenth, 2021) Momentum Gauge Topping Sign: The Second Largest 2021 Unfavorable Sign To Date

Sign 16 (June seventeenth, 2021) Momentum Gauge Topping Sign June 17: The Largest Unfavorable Sign In 2021 Sign 11 (January 29, 2021): First Unfavorable Momentum Gauge® Sign For 2021: Reviewing The Indicators | In search of Alpha Market Sign 9-10 (September 13, 2020): An Election 12 months Correction Sign And Solely The third Unfavorable Weekly MG Sign In 2020 Sign 8 (June 24, 2020): Evaluating The eighth Market Correction Sign On June twenty fourth That Has Preceded Each Latest Decline Sign 7 (March 23, 2020): Revisiting The Indicators That Forecasted Each Latest Decline, In Search Of Early Restoration Indicators Indicators 4-6 (Jan 28, 2020) : Revisiting The Indicators That Forecasted Each Main Downturn Since “Volmageddon”: What’s Subsequent Indicators 1-3 (Aug 8, 2019): These 3 Measures Forecasted Each Main Downturn Since QT Began: What’s Subsequent

Conclusion

The Momentum Gauges proceed as a part of an energetic analysis challenge that has delivered extremely worthwhile outcomes to many readers of my revealed monetary articles. I proceed to boost the mannequin as we collect extra information over many extra months and years. The present market circumstances with growing fee hikes and the most important Fed quantitative tightening program in historical past could contribute to weaker than common efficiency for 2023.

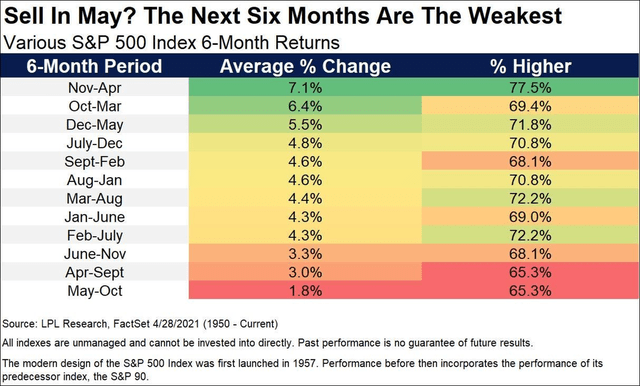

Traditionally, from 1950, the six-month interval between Might to October delivers the bottom common returns for the S&P 500 relative to all six-month intervals. The present Fed tightening circumstances and method of a possible recession are usually not factored and should additional improve the market dangers this 12 months.

LPL Analysis

I hope this evaluation supplies you with further market perception that advantages your buying and selling within the days forward.

All the perfect to you!

JD Henning, PhD, MBA, CFE, CAMS