In 2013, for those who’d ventured into the world of Canada’s oil and fuel sector with a $5,000 funding in Pembina Pipeline (TSX:PPL) inventory, your portfolio would look considerably totally different as we speak, albeit for the higher.

This sector is a well known playground for many who perceive the cyclical nature of the trade, which oscillates alongside international financial tendencies and commodity value fluctuations.

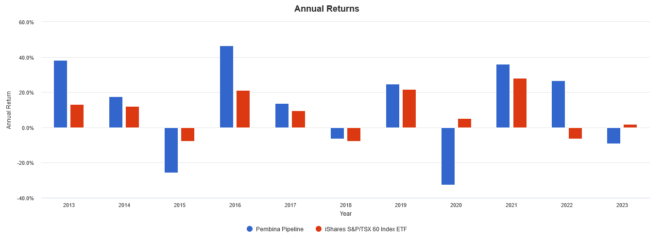

Pembina epitomizes the trade’s ups and downs. Its efficiency during the last decade has been a risky journey, exhibiting the resilience amid inflationary pressures, but in addition vulnerability to modifications in commodity costs.

Right here’s a have a look at how a historic $5,000 funding in Pembina at the beginning of 2013 would have labored out almost 10 years later and the way I’d invested as an alternative.

The Pembina curler coaster

Right here’s the underside line up entrance. When you’d invested $5,000 in Pembina at the beginning of 2013, your funding would have grown to $12,459 by Might 2023 for an annualized return of 9.16%. This beat the market, because the benchmark S&P/TSX 60 index solely returned an annualized 8.05%.

There’s a catch although: volatility. Pembina’s normal deviation was 25.63% in comparison with the index at 11.87%. In different phrases, on common the inventory skilled ups and downs over twice as steep because the market.

This translated into an general poorer risk-adjusted return, with Pembina sporting a Sharpe ratio of 0.45 versus the index at 0.64. Objectively, Pembina has been a poorer funding in comparison with the broad market.

This volatility was placed on full show in the course of the 2020 COVID-19 pandemic, which led to unprecedented worldwide lockdowns, vital drops in demand for oil, and plummeting costs. Throughout this time, Pembina skilled a brutal -47.31% drawdown, making 2020 one in every of its worst years but.

What I’d spend money on as an alternative

Given these outcomes, I’d not purchase a big stake in Pembina. For my part, the excessive volatility of Canadian power sector shares requires diversification, at the least amongst just a few gamers if not with different sectors.

An excellent exchange-traded fund (ETF) different to think about is BMO Equal Weight Oil & Gasoline Index ETF (TSX:ZEO), which holds Pembina, together with 9 different main Canadian oil and fuel shares in equal weights by monitoring the Solactive Equal Weight Canada Oil & Gasoline Index.

At the moment, this ETF pays an annualized dividend yield of 5.01% in opposition to a 0.61% expense ratio. General, I believe ZEO is a significantly better decide for betting on the Canadian oil & fuel sector in comparison with simply shopping for Pembina.

The put up If You’d Invested $5,000 in Pembina Pipeline Inventory in 2013, Right here’s How A lot You’d Have At present appeared first on The Motley Idiot Canada.

Ought to You Make investments $1,000 In Pembina Pipeline?

Earlier than you take into account Pembina Pipeline, you’ll need to hear this.

Our market-beating analyst group simply revealed what they imagine are the 5 greatest shares for buyers to purchase in Might 2023… and Pembina Pipeline wasn’t on the checklist.

The web investing service they’ve run for almost a decade, Motley Idiot Inventory Advisor Canada, is thrashing the TSX by 23 share factors. And proper now, they suppose there are 5 shares which are higher buys.

See the 5 Shares

* Returns as of 5/24/23

(operate() {

operate setButtonColorDefaults(param, property, defaultValue) {

if( !param || !param.contains(‘#’)) {

var button = doc.getElementsByClassName(“pitch-snippet”)[0].getElementsByClassName(“pitch-button”)[0];

button.type[property] = defaultValue;

}

}

setButtonColorDefaults(“#5FA85D”, ‘background’, ‘#5FA85D’);

setButtonColorDefaults(“#43A24A”, ‘border-color’, ‘#43A24A’);

setButtonColorDefaults(“#fff”, ‘coloration’, ‘#fff’);

})()

Extra studying

Pembina Pipeline Inventory: A Dividend Darling or a Potential Entice?

4 Protected Dividend Shares With Yields Over 4%

The Very Most secure Shares for Constructing Retirement Wealth

Traders, Donât Miss Out on These Prime Dividend Shares!

TFSA Passive Revenue: 2 Excessive-Yield Canadian Shares With Nice Dividend Progress

Idiot contributor Tony Dong has no place in any of the shares talked about. The Motley Idiot recommends Pembina Pipeline. The Motley Idiot has a disclosure coverage.