JHVEPhoto

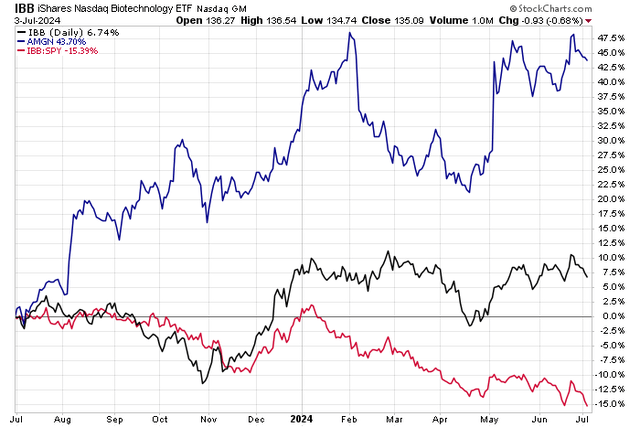

Amgen (NASDAQ:AMGN) has been a standout within the biotech area up to now yr. Shares are up greater than 40% over the previous 12 months, sharply outperforming the iShares Biotechnology ETF (IBB), of which AMGN is a holding. Although the $166 billion market cap biotech trade firm has been a efficiency chief in its area of interest, the speculative biotech slice of the US inventory market has underperformed the S&P 500. Large pharma, similar to Eli Lilly (LLY) and Novo Nordisk (NVO) appear to seize all the eye, however I see bullish fundamentals and robust technicals with AMGN that buyers ought to take into account.

Amgen develops, manufactures, and markets biologic therapies for oncology, irritation, and uncommon illness, and I’ve a purchase score on the inventory. It is also making strides within the profitable weight-loss space.

Amgen Shares Sharply Outperforming IBB

Stockcharts.com

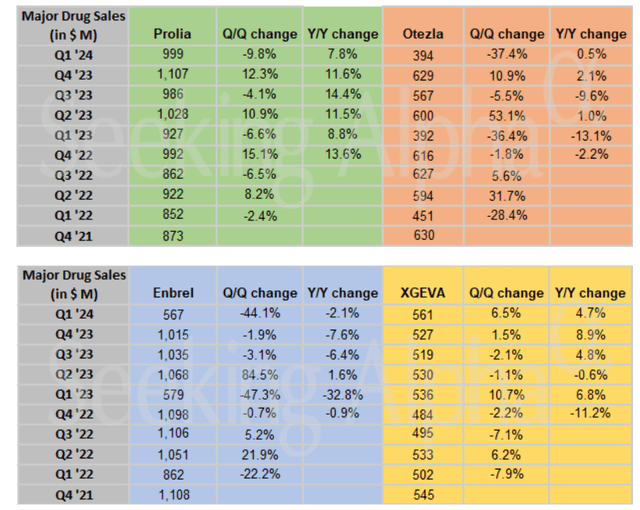

Again in early Could, Amgen reported a powerful set of quarterly outcomes. Q1 non-GAAP EPS of $3.96 topped the Wall Road consensus forecast by a nickel whereas $7.45 billion of income, up 22% from year-ago ranges, was about in-line with expectations. The administration crew guided FY 2024 working EPS of $19 to $20.20 with a full-year high line of $32.5 billion to $33.8 billion, each materials will increase and with midpoints above consensus.

Amgen’s robust first quarter was pushed by strong efficiency from its key medication, together with Repatha, Aranesp, and Epogen. Enbrel, Otezia, and Neulasta gross sales weren’t as spectacular, although. Altogether, although, the Q1 numbers had been met with applause from buyers as shares rose 11.8% the next session – the perfect earnings-day efficiency in at the very least the final three years, in accordance with information from Possibility Analysis & Know-how Companies (ORATS).

Waiting for the Q2 report, the choices market has priced in a 3.8% earnings-related inventory value swing when analyzing the at-the-money straddle expiring soonest after the August 6 launch. That is the most affordable straddle because the Q2 report final yr.

Slower Embrel Gross sales YoY

Searching for Alpha

It is going to be key to search for updates on Amgen’s weight problems portfolio and AMG 133 which confirmed promising interim section 2 outcomes earlier this yr. All eyes are on its MariTide medicine which might go up in opposition to Wegovy and Ozempic. However Lilly and Novo are powerful opponents, and rising entrants into the GLP-1 area is a key threat. Moreover, Amgen’s legacy drug portfolio might start to weigh on gross sales progress within the quarters forward. One other threat is an absence of profitable product launches or disappointing medical trial outcomes.

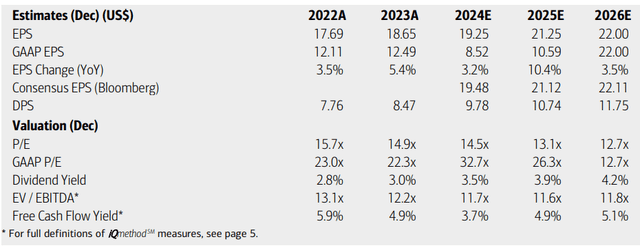

On earnings, analysts at BofA see working EPS rising simply 3% this yr with an earnings acceleration into the out yr. By 2026, per-share earnings might attain $22. The present Searching for Alpha consensus numbers are barely much less sanguine, displaying steadier bottom-line advances within the mid-single-digit vary by 2026 whereas income is forecast to leap 17% this yr.

Dividends, in the meantime, are projected to extend at a ten% annual fee over the following handful of quarters, probably leading to a rising yield if the inventory value holds the place it’s in the present day. And with only a mid-teens earnings a number of and constant free money move, the operational backdrop seems favorable in my opinion.

Amgen: Earnings, Valuation, Dividend Yield, Free Money Circulate Yield Forecasts

BofA International Analysis

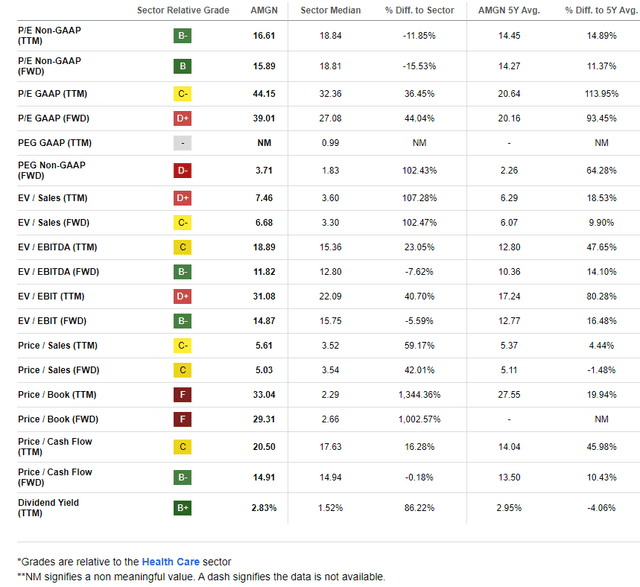

I do not see Amgen as a deep-value concept or perhaps a standout GARP play but. Take into account that its 5-year common ahead non-GAAP price-to-earnings ratio is simply 14.3. If we assume $20.10 of working EPS over the approaching 12 months, about the place the consensus is in the present day, and apply a 14.3 a number of, then shares ought to commerce close to $287.

However I assert {that a} P/E nearer to the sector median is acceptable given the potential of its weight-loss drug. Apply a 17x a number of, nonetheless greater than 4 turns cheaper than that of the broader market, and the truthful worth is nearer to $342, making the inventory a purchase on valuation.

Amgen: Enticing on Earnings, Close to-Common P/S Metrics

Searching for Alpha

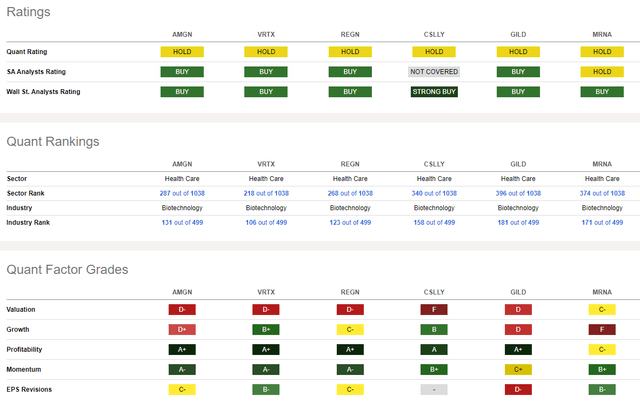

In comparison with its friends, Amgen sports activities a delicate valuation score however the earnings image is engaging given the place the inventory trades in the present day. Whereas the expansion trajectory has been lackluster, the agency’s personal earnings estimates have bumped up, probably resulting in an improved revenue image come 2025.

What’s extra, the corporate’s profitability metrics are compelling because it stands in the present day regardless of a weak ratio of sellside EPS downgrades to upgrades up to now 90 days. Traders proceed to carry AMGN inventory greater, although, and the technical state of affairs and share-price momentum tendencies are optimistic, which I’ll element later.

Competitor Evaluation

Searching for Alpha

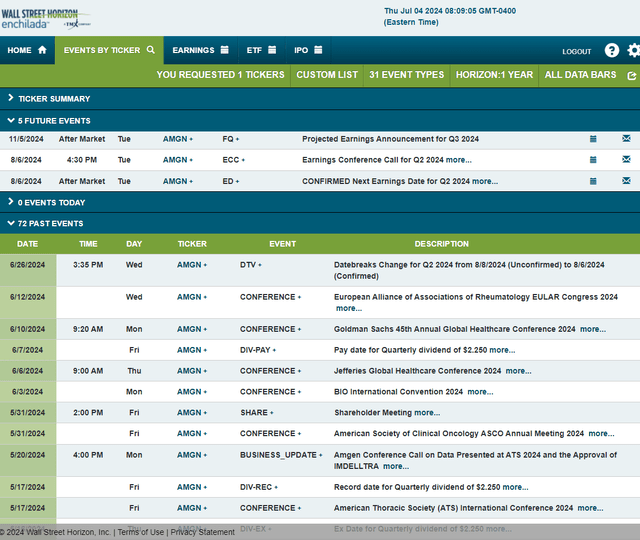

Trying forward, company occasion information offered by Wall Road Horizon present a confirmed Q2 2024 earnings date of Tuesday, August 6 BMO with a convention name instantly after the outcomes cross the wires. You may pay attention stay right here. No different volatility catalysts are seen on the calendar.

Company Occasion Threat Calendar

Wall Road Horizon

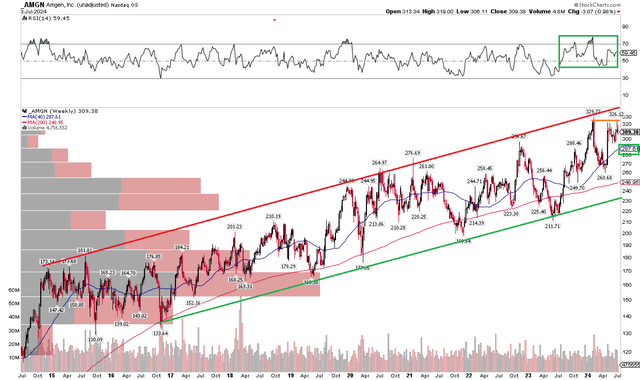

The Technical Take

With an honest valuation and progress prospects, AMGN’s technical state of affairs is spectacular. Discover within the chart beneath that shares have been in a protracted uptrend going again a decade. I usually analyze value motion on a three-year zoom, however potential buyers and present shareholders ought to admire the massive image right here.

I see assist on the uptrend assist line which at the moment resides within the $230 to $240 vary. Resistance is at about $340 – above the double-top of $326 to $329 that was just lately put in. However with a rising long-term 40-week shifting common (similar to a 200-day shifting common), the bulls management the first development. Moreover, check out the RSI momentum oscillator on the high of the graph – it has been ranging in a bullish space between 40 and 80.

Whereas we might see the inventory drift nearer to the uptrend assist line, the development is up and shares should not overbought in the present day. Thus, the technicals are strong in the present day forward of bullish July and August seasonal tendencies.

AMGN: Bullish Lengthy-Time period Uptrend

Stockcharts.com

The Backside Line

I’ve a purchase score on Amgen. I see this massive biotech firm as intriguing because it makes headway into the GLP-1 weight reduction drug market. AMGN has additionally been a constant long-term winner in a unstable trade because the inventory’s momentum stays robust.