Maksim Luzgin/iStock by way of Getty Photos

Introduction

In my earlier articles, I known as Acomo (OTCPK:ACNFF) a contemporary model of the East India Firm within the Netherlands. Certainly, Acomo is likely one of the largest buying and selling homes in spices in Europe and thus enjoys a dominant place on the European market. The corporate has been listed on Euronext Amsterdam since 1908.

Yahoo Finance

Acomo’s principal itemizing is on Euronext Amsterdam, the place it’s buying and selling with ACOMO as its ticker image. The typical every day quantity in Amsterdam is roughly 17,500 shares per day, which represents roughly 310,000 EUR per day, and that makes the Dutch itemizing clearly superior by way of quantity. The corporate presently has a share depend of roughly 29.6M shares, leading to a market capitalization of roughly 525M EUR primarily based on the present share value of 17.72 EUR.

2023 wasn’t the better of years

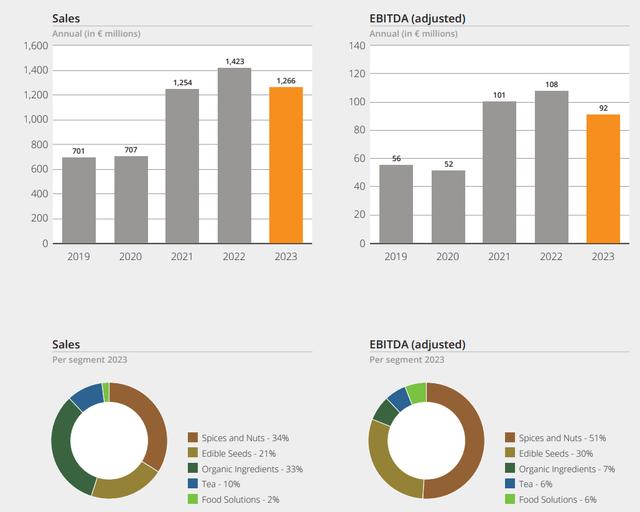

After just a few very robust years, the corporate’s monetary consequence needed to retreat in 2023. As you’ll be able to see within the picture under, the full income decreased to only below 1.27B EUR, leading to an adjusted EBITDA of 92M EUR. Whereas that is nonetheless a fairly first rate EBITDA, leading to an adjusted EBITDA margin of seven.27% in comparison with 7.59% in FY 2022, it’s clear Acomo’s monetary efficiency was retreating in comparison with 2022.

Acomo Investor Relations

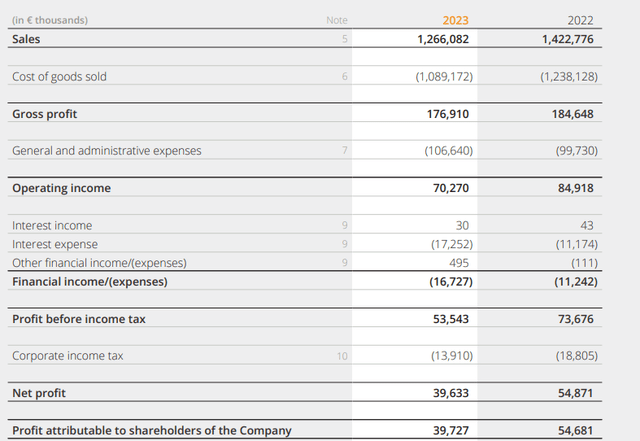

Because the revenue assertion under reveals, the full income was certainly 1.27B EUR, leading to a gross revenue of 177M EUR, which was simply 7M EUR decrease than the FY 2022 gross revenue, indicating Acomo’s gross margins remained fairly strong. Sadly, the G&A bills elevated which put extra strain on the working revenue, which decreased to 70.3M EUR.

Acomo Investor Relations

Moreover, the curiosity bills elevated and that is the primary motive why the pre-tax revenue fell from just below 74M EUR to 53.5M EUR. The underside line consequence was a internet revenue of 39.7M EUR, which represents an EPS of 1.34 EUR per share.

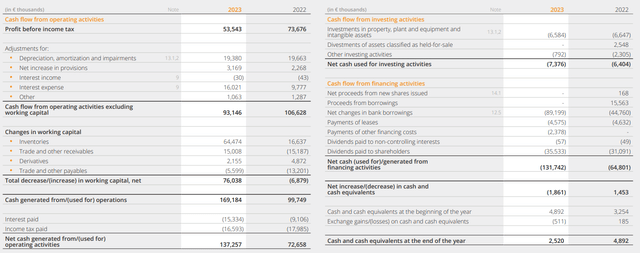

And because the money circulate assertion under reveals, the corporate generated about 137M EUR in working money circulate, however this features a 76M EUR contribution from adjustments within the working capital place. Adjusted for the working capital adjustments and after deducting the lease funds, non-interest finance prices and the distinction between taxes owed and taxes paid, the adjusted working money circulate was 57M EUR.

Acomo Investor Relations

The overall capex was simply 6.6M EUR, leading to a internet attributable free money circulate of roughly 51M EUR. That is about 30% greater than the reported internet revenue, primarily as a result of distinction in depreciation and amortization bills (19.4M EUR) versus the mixed capex and lease funds (lower than 11M EUR).

This additionally implies that primarily based on the present share depend of 29.6M, Acomo’s underlying free money circulate consequence was 1.72 EUR per share.

The vast majority of the earnings and free money circulate have been paid out as a dividend, as Acomo declared a remaining dividend of 0.75 EUR, bringing the full-year dividend to 1.15 EUR per share. This represents a dividend yield of 6.5% on the present share value.

It seems to be like 2024 could also be one other yr of stagnation as Acomo reported on its AGM the full income within the first quarter of this yr have been marginally decrease than in Q1 of final yr. The cocoa value spike had a destructive affect on the profitability of the enterprise, however Acomo hasn’t supplied any monetary particulars but and can possible solely achieve this when it publishes its H1 report later this summer time.

Acomo continues to pursue bolt-on acquisitions

Acomo introduced earlier this month it has reached an settlement with a 3rd get together to amass its nuts and dried fruit enterprise in Northern Europe. The newly acquired enterprise can be built-in into Acomo’s spices and nuts phase, and can enable the corporate to increase its attain within the Nordic margins, which may very well be a really fascinating geographically growth for the Amsterdam firm. Not solely does this acquisition make sense from a geographical viewpoint, let’s not overlook the spices & nuts division is Acomo’s most worthwhile division, so it does make sense the corporate if specializing in M&A in that particular phase.

Caldic operates a manufacturing facility in Sweden, and it exports its merchandise to Scandinavian international locations, Finland and Germany. Sadly, Acomo has not supplied any particulars on the acquisition (just like the EBITDA multiples it’s paying to amass the nuts and dried fruit division of Caldic) however hopefully the administration will present extra data when Acomo publishes its H1 outcomes. The acquisition is anticipated to shut within the present quarter.

The acquisition is sensible, and it should not be a shock to see the spices & nuts division is being strengthened as this was already outlined as one of many priorities at its annual common assembly in April. I am additionally inspired by the corporate’s plans to be extra clear, as Acomo has promised to host a Capital Markets Day in early 2025 subsequent to the publication of its FY 2024 outcomes.

Funding thesis

Whereas we nonetheless have to attend for Acomo to publish its H1 report, the corporate ended final yr with a complete internet debt of round 193M EUR (excluding lease liabilities). Whereas that’s comparatively excessive, let’s not overlook the working capital necessities are comparatively excessive too, however the steadiness sheet indicated a constructive working capital place of 285M EUR, primarily tied up in inventories. With an adjusted EBITDA of 92M EUR and roughly 87.5M EUR adjusted for lease amortization, the web debt represents roughly 2.2 instances the EBITDA, which is affordable. And on the present market cap of 525M EUR, the corporate is valued at an EV/EBITDA of round 8.2 which may be very cheap given Acomo’s fame.

2024 is probably not the simplest yr, however I count on Acomo to proceed to carry out nicely, and decreasing the web debt must also have a constructive affect on the curiosity funds. I presently don’t have any place in Acomo, however could provoke an extended place within the close to future.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.