grandriver

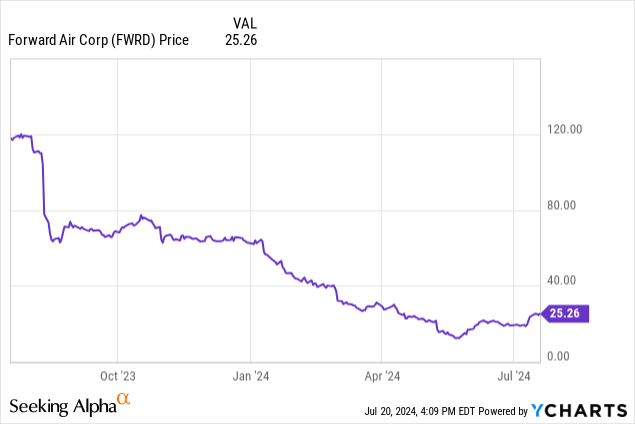

As you possibly can see, Ahead Air Company (NASDAQ:NASDAQ:FWRD) has gone down precipitously from the place it was this time final yr. The corporate has gone from a comparatively worthwhile floor freight firm to a disappointingly dangerous Q1 loss, worse than even the worst estimates anticipated.

As we speak we’ll be taking a more in-depth take a look at Ahead Air, with an eye fixed towards the place the corporate stands after the acquisition of Omni Logistics in January, and whether or not its prospects for development can overcome current and future losses. Is that this a worth play or too huge a danger? Hopefully we’ll discover out.

Ahead Air’s Steadiness Sheet

Price and Equivalents

$152 million

Whole Present Property

$569 million

Whole Property

$3.96 billion

Whole Present Liabilities

$445 million

Lengthy-Time period Debt

$1.6 billion

Ahead Air Shareholder Fairness

$926 million

Click on to enlarge

(supply: most current 10-Q from SEC)

Ahead Air took on a good quantity of debt with the acquisition of Omni Logistics. Nonetheless, the corporate is nicely capitalized, and may maintain a brief interval of not being worthwhile because it tries to develop again to profitability.

The factor I actually respect by means of is the shareholder fairness, which supplies us a worth/ebook worth of 0.72. That’s a pleasant low cost to ebook at these costs, which isn’t shocking for a corporation whose inventory worth has declined a lot up to now yr. It does make me need to take a more in-depth take a look at Ahead Air from a worth perspective.

The brand new debt will not be an enormous concern, as the corporate is massive sufficient to service its debt as crucial going ahead. Nonetheless, as soon as profitability returns, paying down that debt would go a great distance towards exhibiting the corporate’s energy.

The Omni Logistics Acquisition

In January, Ahead Air accomplished its acquisition of Omni Logistics LLC. The corporate took on a good bit of debt, as talked about above, however the acquisition got here it a good bit decrease of a worth than was initially agreed to.

Ahead Air paid $20 million and 35% of the frequent fairness of the corporate for Omni Logistics. The unique phrases have been reported as $150 million and 37.7%, however activist buyers rose up and resisted the acquisition at this worth.

Ahead Air mentioned that the purpose was to turn into the premier supplier of freight transportation, and for the mixed firm to save lots of prices. Analysts of the trade counsel the true goal conflict lower than truckload (“LTL”) enterprise, which is one in all their premium choices,

Being a premier LTL enterprise could be favorable for normal development and as a premium providing one in all its higher margin companies. Certainly, LTL was on the rise, rising weight per cargo 11% despite the overall lower in demand for delivery companies.

The one actual draw back, moreover the overall decline in demand that probably would have occurred with or with out the acquisition, is the including of $1.4 billion of debt to the stability sheet. That’s not a terrifying quantity of debt for the corporate, however once more its loads to be paid given the market being what it’s.

The Dangers

So debt poses a danger for Ahead Air, however the firm faces a number of different dangers that are price mentioning, and that are documented within the firm’s SEC filings.

Ahead Air could be very economically delicate. Shipments are much more constant in a powerful financial system, and inflation would improve working bills, which might have a adverse impression on the underside line.

Ahead Air is dependent upon third social gathering transportation suppliers, and the price of attracting and retaining them may very well be substantial, and trigger a major problem if the competitors begins making an attempt to draw them away.

The corporate can also be dependent extremely on its largest prospects, with the highest ten prospects amounting to 26% of their general income in 2023.

The acquisition of Omni Logistics is a key to the corporate’s future, with the mixed firm making an attempt to be in a greater place to compete going ahead. Coping with the difficulties of working the brand new, mixed firm is non-trivial, and failure to take action may very well be a severe hindrance to the way forward for Ahead Air.

Statements of Operations and the Q1 Failure

2021

2022

2023

2024 Q1

Working Income

$1.38 billion

$1.68 billion

$1.37 billion

$542 million

Working Earnings

$147 million

$247 million

$88 million

($66 million)

Internet Earnings

$106 million

$193 million

$167 million

($62 million)

Diluted EPS

$3.85

$7.14

$6.40

($2.81)

Click on to enlarge

(supply: 10-Ok from SEC)

The working outcomes from the final three years are spectacular for an roughly $25 inventory. The newest diluted EPS provides us a P/E ratio of slightly below 4.0. That’s extraordinarily promising for a worth inventory, and there needs to be loads to love right here between that and the sub 1 worth/ebook ratio. So what occurred?

Sadly the primary quarter occurred, with the corporate coming in nicely beneath their estimates. The market was anticipating a 14¢, however non-GAAP EPS got here in at 64¢ loss. Income additionally got here in $62.2 million beneath what the estimates have been purported to be.

That’s an issue, however going ahead issues aren’t going to get instantly higher. The Q2 loss is anticipated at 21¢ with a income of $651.39 million. For the total yr we’re to anticipate $1.11 loss on $2.54 billion.

2025 appears to be like higher, at the least considerably, as estimates are for a full yr income of $2.83 billion and constructive earnings of $1.02. That provides us a return to profitability, one thing that’s extraordinarily necessary for Ahead Air.

Conclusion

Usually an organization that has fallen so dramatically off of its 52-week excessive after years of profitability is one thing I prefer to search for as a long-term purchase and maintain. That mentioned, there are too many questions for me to view this as something however a maintain, even that the depreciated costs.

There are simply too many questions on the highway to the return to profitability for Ahead Air, and even for the projected 2025 earnings of $1.02 per share its simply not sufficient worth to justify the dangers taken by the corporate after the acquisition of Omni Logistics.

I like Ahead Air’s enterprise, and I need to prefer it at some worth. Sadly, even after dropping from $120 to $25 the worth continues to be too excessive. It’s an organization price maintaining a tally of, as a result of the market has soured on it, however except the worth drops precipitously additional, I’d keep away.