Over the past yr, traders have turned to the “Magnificent Seven” shares seeking outsized positive factors, and for good cause.

Mega-cap tech firms resembling Nvidia, Microsoft, Alphabet, and Meta Platforms have all outperformed the S&P 500 and Nasdaq Composite during the last 12 months. A lot of those positive factors may be attributed to a rising curiosity in synthetic intelligence (AI), a market dominated by the Magnificent Seven.

But regardless of the spectacular performances of the businesses above, I see one other member of the Magnificent Seven as a superior selection for long-term traders.

E-commerce and cloud computing large Amazon (NASDAQ: AMZN) has underperformed the Nasdaq during the last yr and has principally generated returns in keeping with these of the S&P 500.

With shares down roughly 14% during the last month, I believe now’s a major alternative to purchase the dip in Amazon.

Let’s dig into how Amazon is quietly disrupting the AI panorama and assess why now appears like a profitable alternative to scoop up shares at a dirt-cheap valuation.

Do not name it a comeback

One of many greatest alternatives surrounding AI is cloud computing. Amazon faces fierce competitors within the cloud infrastructure market from Microsoft Azure and Alphabet’s Google Cloud Platform (GCP).

Over the past 18 months or so, Microsoft has swiftly augmented the Azure platform due to the corporate’s $10 billion funding in OpenAI — the developer of ChatGPT. Furthermore, Alphabet has completed a decent job of breaking into the cloud realm due to a collection of acquisitions, together with MobiledgeX, Forseeti, Siemplify, and Mandiant.

These strikes by Microsoft and Alphabet initially seemed to be taking a toll on Amazon’s cloud income development and its profitability. Nonetheless, the desk beneath illustrates some newfound encouraging tendencies from Amazon’s cloud section, Amazon Internet Companies (AWS).

Class

Q1 2023

Q2 2023

Q3 2023

This fall 2023

Q1 2024

Q2 2024

AWS Income 12 months over 12 months % Development

16%

12%

12%

13%

17%

19%

AWS Working Earnings 12 months over 12 months % Development

(26%)

(8%)

30%

39%

83%

72%

Information supply: Investor Relations

The figures above showcase a very constructive narrative for Amazon. Over the past yr, AWS has transitioned from a enterprise experiencing constant deceleration to at least one that has now grown in three consecutive quarters, all whereas considerably rising working revenue.

Amazon is a money-printing machine

Seeing a return to income and revenue development is good to see, but it surely’s just one a part of the higher story for Amazon.

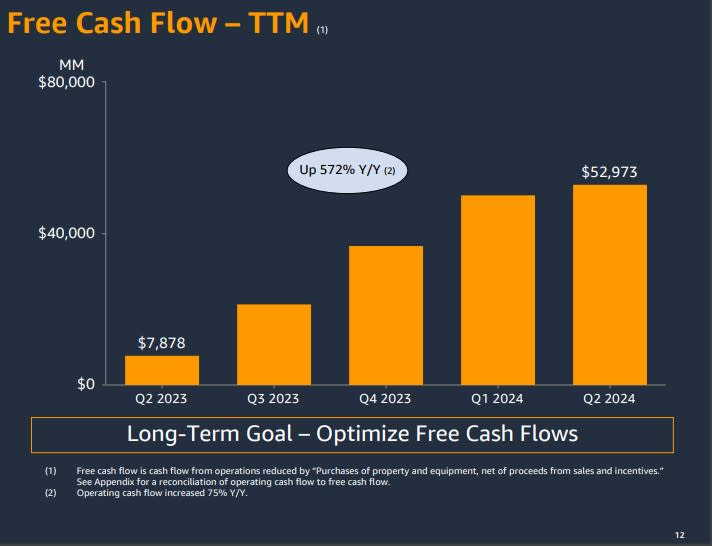

The vast majority of Amazon’s working earnings stem from AWS. For that reason, the reacceleration of the cloud enterprise has immediately impacted Amazon’s general money move profile. For the quarter ended June 30, Amazon generated $53 billion of free money move on a trailing-12-month foundation. Moreover, with a steadiness sheet boasting $86 billion of money and equivalents, Amazon has just about no scarcity to take a position aggressively and provides its rivals a run for his or her cash.

Story continues

One of many catalysts sparking renewed development in AWS is Amazon’s $4 billion funding in generative AI start-up Anthropic.

This relationship is especially necessary as a result of Anthropic is coaching its AI fashions on Amazon’s in-house semiconductor chips — Trainium and Inferentia. This offers Amazon with a direct line to compete towards Nvidia as demand for semiconductor chips continues to increase.

Furthermore, the corporate can be investing $11 billion into an information middle undertaking in Indiana. To me, these investments solidify Amazon’s ambitions to compete all throughout the AI panorama as AWS enters a brand new part of its evolution.

For these causes, I believe the income development and renewed earnings from AWS, as proven above, are solely the start.

A primary valuation for traders

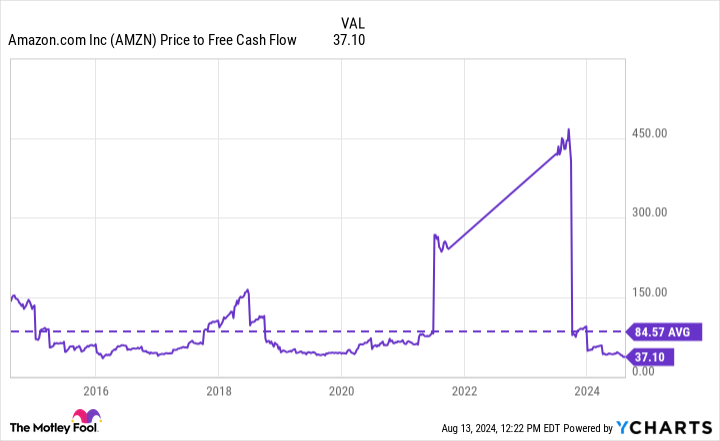

Amazon presently trades at a price-to-free-cash-flow (P/FCF) a number of of 37.1, which is lower than half its 10-year common. I discover this peculiar, contemplating that Amazon is a a lot bigger and way more subtle enterprise at this time than it was a decade in the past.

To me, traders are both overlooking or unappreciative of Amazon’s dive into the AI realm. I believe AI’s future potential could also be baked into a few of Amazon’s Magnificent Seven compatriots, on condition that a lot of them have handily outperformed the markets during the last yr.

In contrast, Amazon is already reaping the rewards from these AI-driven initiatives, and the corporate has a boatload of money to maintain funding the expansion for fairly a while. For these causes, I believe Amazon is essentially the most profitable alternative amongst mega-cap tech shares proper now. In my eyes, this is a wonderful alternative to purchase Amazon inventory hand over fist.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Amazon wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 12, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

If I May Solely Make investments In 1 “Magnificent Seven” Inventory Over the Subsequent Decade, This Would Be It was initially revealed by The Motley Idiot