Khanchit Khirisutchalual

Inflation is right here to remain. It is going to most likely cool, however we won’t return shortly to the two% FED-target. It’s a wise thought to spend money on a diversified and actively managed actual return ETF just like the SPDR SSGA Multi-Asset Actual Return ETF (NYSEARCA:RLY). Diversifying lowers the dangers and the energetic administration is useful as a result of not all inflation hedging investments are working as anticipated given their historic inflation betas. Commodities and vitality shares are performing properly, however TIPS and REITs should not. RLY is presently chubby commodities and vitality shares and underweight TIPS and REITs. Good!

Inflation right here to remain?

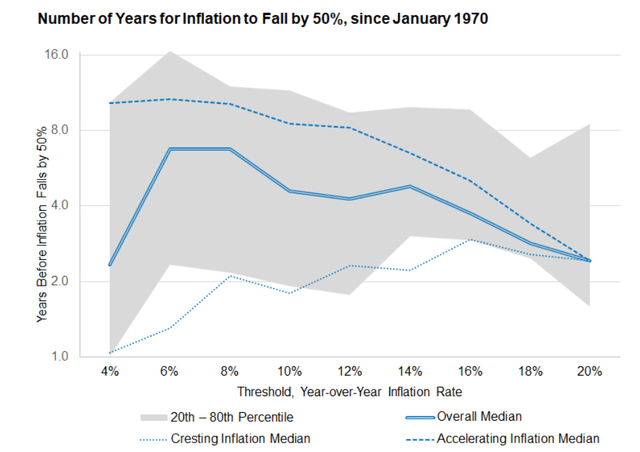

Analysis Associates just lately investigated how shortly inflation returns again to an appropriate degree as soon as it crossed sure thresholds. They make a distinction between cresting inflation and accelerating inflation. Cresting inflation crosses the 4% degree, however doesn’t attain the 6% inflation degree. Accelerating inflation does cross the 6% degree. The historic report is like this:

If inflation is cresting, inflation ranges revert by half in a couple of yr. If inflation is accelerating, 6% inflation reverts to three% in a median of about seven years. Above 8%, reverting to three% normally takes 6 to twenty years, with a median of over 10 years.

Determine 1: Years for inflation to fall by 50% (Analysis Associates)

Inflation hedges

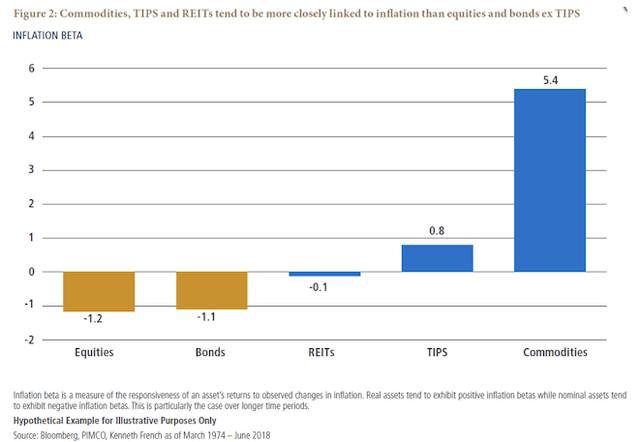

The most effective Inflation hedging asset lessons are well-known: commodities TIPS, actual property.

Determine 2: Inflation Beta (PIMCO)

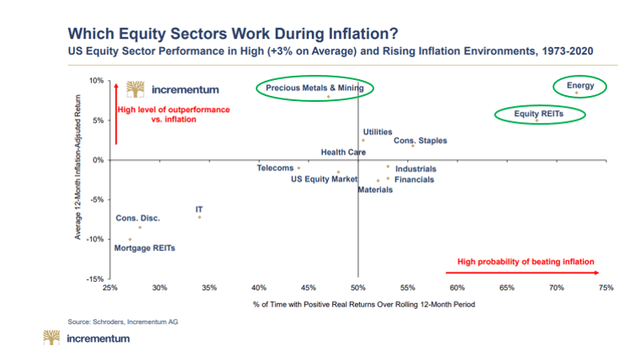

Additionally some sure fairness sectors hedge in opposition to inflation: vitality, REITs and Metals & Mining are one of the best performing fairness sector in inflationary environments.

Determine 3: Fairness sectors and inflation (Incrementum)

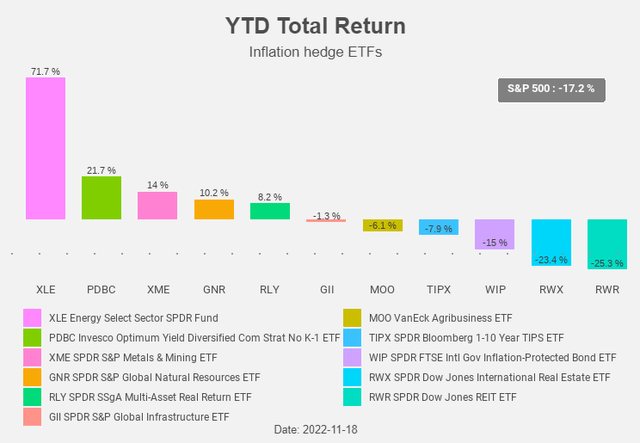

However, not all of them are “working” within the present inflation cycle!

Determine 4: Whole return chart (Yahoo! Finance, Creator)

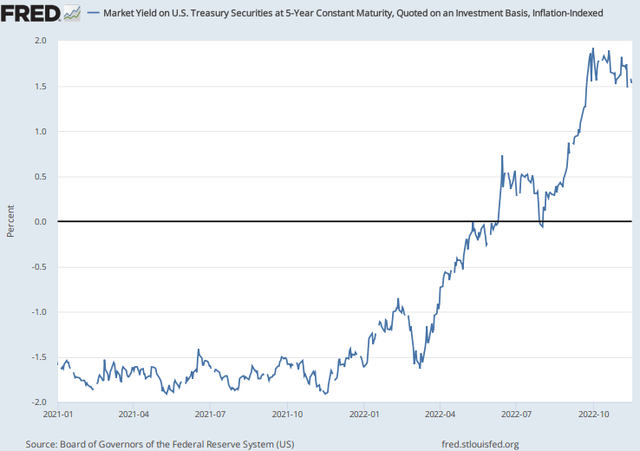

Commodities, vitality and infrastructure shares do carry out as anticipated, however the identical can’t be mentioned of TIPS and REITs. For TIPS this doesn’t come as a shock given the rise in actual yields.

Determine 5: Actual yields (FRED)

We don’t count on these yields to rise a lot additional and one can’t deny that the present yield is extra enticing than e.g. one yr in the past (while you had been assured of a destructive actual yield).

RLY

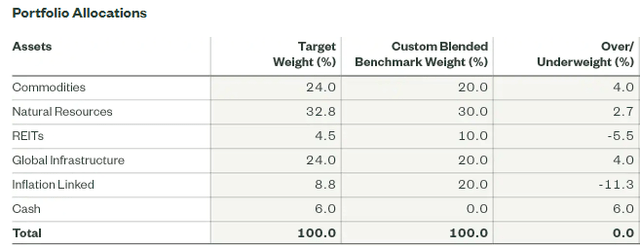

RLY is an actively managed ETF that’s presently chubby commodities, pure sources and infrastructure. Pure sources accommodates the sectors agriculture, vitality, and metals & mining. RLY is underweight the inflation hedges that aren’t working: TIPS and actual property.

We like this energetic administration method and the positions the fund managers take.

We’ve written earlier than positively about inflation hedging investments like (vitality) commodities ( right here and right here), vitality infrastructure and oil companies shares.

We’re much less outspoken optimistic about actual property, however we see alternatives brewing in actual property as soon as the FED ends it fee hikes.

San Francisco Federal Reserve President Mary Daly mentioned this week that pausing fee hikes is just not presently on the desk and that the Fed funds fee might find yourself within the 4.75%-5.25% vary (versus a present fee of three.75%-4.00%). This could indicate an finish to the speed hikes in February or March subsequent yr.

Determine 6: Portfolio Allocations (SSGA)

RLY can be chubby money.

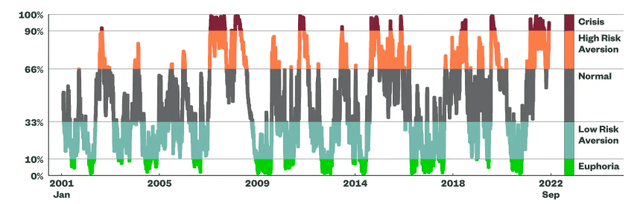

RLY makes use of a proprietary threat sentiment indicator (the Market Regime Indicator). The indicator employs a quantitative framework and forward-looking market indicators, together with equity- and currency-implied volatility, in addition to credit score spreads, to establish the present market threat surroundings. The indicator is pointing to a excessive threat aversion and that’s why the fund grew to become extra defensive and constructed up a money place.

Determine 7: Market Regime Indicator (SSGA)

RLY is a fund-of fund with two benchmarks. The first benchmark is Bloomberg U.S. Authorities Inflation-Linked Bond Index and the secondary benchmark is DBIQ Optimum Yield Diversified Commodity Index Extra Return. Although the first benchmark is an inflation linked bonds benchmark, TIPS are solely 20% of the customized blended benchmark weight.

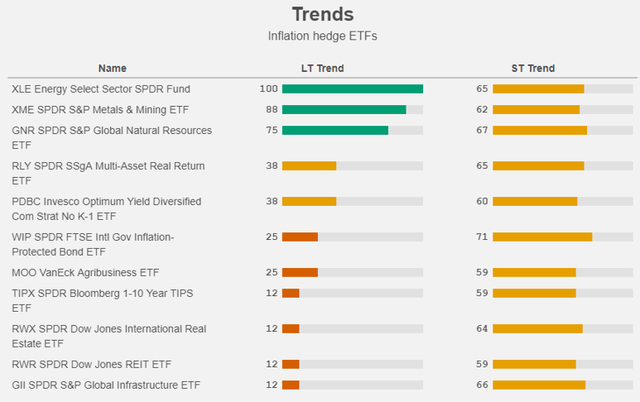

RLY invests within the ETFs that you may see in Determine 4. The most important investments are:

the SPDR S&P World Pure Sources ETF (GNR) with a weight of 25%, the SPDR S&P World Infrastructure ETF (GII) with a weight of 24%, and the Invesco Optimum Yield Diversified Commodity Technique No Okay-1 ETF (PDBC) with a weight of 23%.

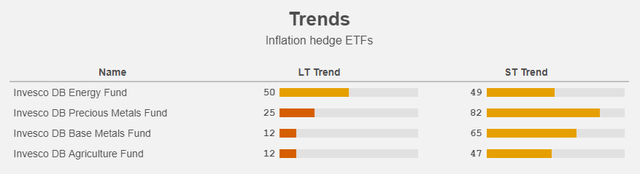

Let’s check out the long run tendencies of the funds during which RLY invests. As one might count on from a diversified ETF the pattern of RLY is a mean of the underlying funds and is in impartial territory. Funds which might be in a transparent uptrend, in a downtrend and in impartial territory are every roughly one third of the fund. Particularly GII, the second greatest place within the fund, is a drag on the general pattern of RLY. GII invests within the transportation, utilities, and vitality infrastructure sub-industries.

Determine 8: Pattern (Yahoo! Finance, Creator)

We stay optimistic on the vitality commodities as a result of they are going to stay supported by the present under-investment. Regardless of the transition to renewable vitality the world wants oil & gasoline for years to come back.

Determine 9: Pattern (Yahoo! Finance, Creator)

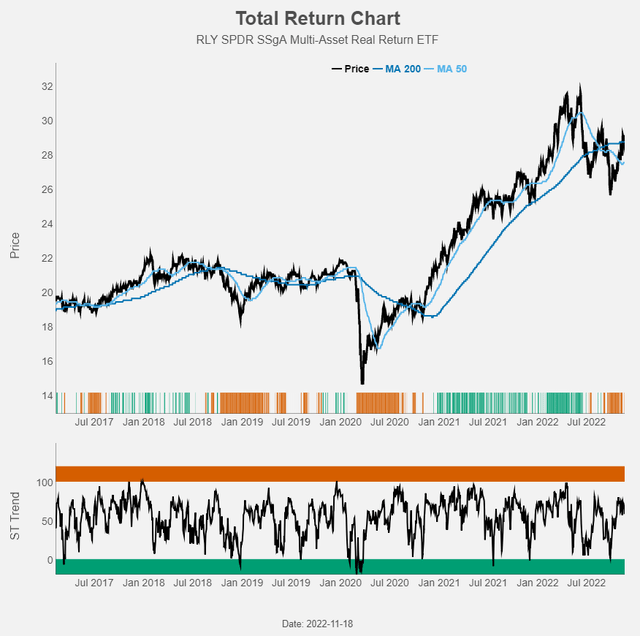

Determine 10: Whole return chart (Yahoo! Finance, Creator)

Dividend coverage

Dividends from web funding earnings, if any, are typically declared and paid quarterly by RLY. On the finish of final yr RLY obtained an enormous dividend from PDBC which resulted in a pleasant dividend for RLY shareholders. Whereas we can’t exclude that RLY would obtain extra juicy dividends from its underlying funds, you shouldn’t purchase RLY for the excessive yield, however for the excessive anticipated complete return.

What might go incorrect?

The primary factor that might go incorrect is a tough world recession that may crush inflation numbers and even result in deflation. This would cut back world vitality demand and have a destructive influence on vitality costs. We can’t exclude such a situation but it surely’s not our most possible situation. The top of fee hikes is in sight, China might re-open and the warfare in Ukraine might transfer to a diplomatic resolution. All three might assist world development.

Conclusion

It’s all the time a good suggestion to spend money on a diversified manner in an attention-grabbing theme. In a diversified portfolio some investments do higher than others and this asks for an energetic administration.

RLY affords all of that: a diversified and energetic method to an attention-grabbing theme. We consider inflation hedging is certainly interesting as a result of inflation is right here to remain. The energy-related a part of the portfolio is performing effectively. Actual property is just not, however when the FED stops climbing charges they could stage a comeback. Inflation linked bonds endure(ed) from rising actual yields. On the one hand we don’t count on these yields to rise a lot additional and alternatively is the present yield extra enticing than e.g. one yr in the past.

Inflation is right here to remain and RLY affords a one cease store for an investor searching for inflation beating returns: purchase!