FOMC Assembly Key Takeaways

Merchants and economists confidently anticipate the Fed to scale back rates of interest by 25bps to the 4.25-4.50% vary.

The Abstract of Financial Projections and any Powell feedback a few extended “pause” to the rate of interest slicing cycle would be the potential market shifting releases.

EUR/USD has carved out a slender vary between 1.0470 and 1.0600 and until the Fed delivers a significant shock of some kind, that vary might carry over.

When is the FOMC Assembly?

The December 2024 will conclude on Wednesday, December 18th at 2:00 ET.

Fed Chairman Powell’s will start at 2:30 ET.

What are the FOMC Curiosity Charge Expectations?

Merchants and economists confidently anticipate the Fed to scale back rates of interest by 25bps to the 4.25-4.50% vary.

As of writing noon Wednesday, Funds futures merchants are pricing in 99% odds of a 25bps rate of interest reduce per CME FedWatch:

Supply: CME FedWatch

With a 25bps rate of interest reduce basically totally discounted, this facet of the FOMC assembly won’t be a major market mover in and of itself; as an alternative, merchants will key in on the central financial institution’s financial coverage assertion, Abstract of Financial Projections (together with the notorious “dot plot” of rate of interest expectations), and Fed Chairman Powell press convention.

FOMC Assembly Forecast

As famous above, a lot of the market-moving “oomph” from this month’s rate of interest determination has been discounted, however that doesn’t imply that merchants ought to tune out from the FOMC assembly. Particularly, the largest query merchants shall be asking is “Will the Fed pause its rate of interest slicing cycle and for the way lengthy?”

Heading into the assembly, merchants are pricing in a extremely doubtless pause in January (~80%+ per CME FedWatch), however lower than coinflip odds that the Fed will go away rates of interest unchanged in March (~40% implied chance).

One massive uncertainty for Jerome Powell and firm is the potential adjustments that Donald Trump’s second time period will carry. Particularly, the potential for expansionary fiscal coverage from an extension of the tax cuts, simpler regulation, protectionist commerce coverage, and diminished immigration might all impression inflation and the roles market, and by extension, Fed coverage within the years to return. On the margin, this uncertainty might push the committee to be extra cautious with future selections till the proverbial “lay of the land” is best understood, and it might result in a slower discount in rates of interest to keep away from a possible acceleration of inflation.

One other key facet of the assembly to observe would be the FOMC’s Abstract of Financial Projections (SEP). The so-called “terminal charge,” which represents the final word rate of interest goal for Jerome Powell and firm, might rise from 2.9% on the final assembly to nearer to three% this time round; one key theme (and a possible shock for 2025) is the continued transfer greater within the terminal charge, implying fewer rate of interest cuts to get again a “impartial” rate of interest within the US. Exterior of the terminal charge, anticipate the committee to scale back its projections for unemployment whereas upgrading its forecast for progress and inflation in an acknowledgement of the resilience of the US financial system.

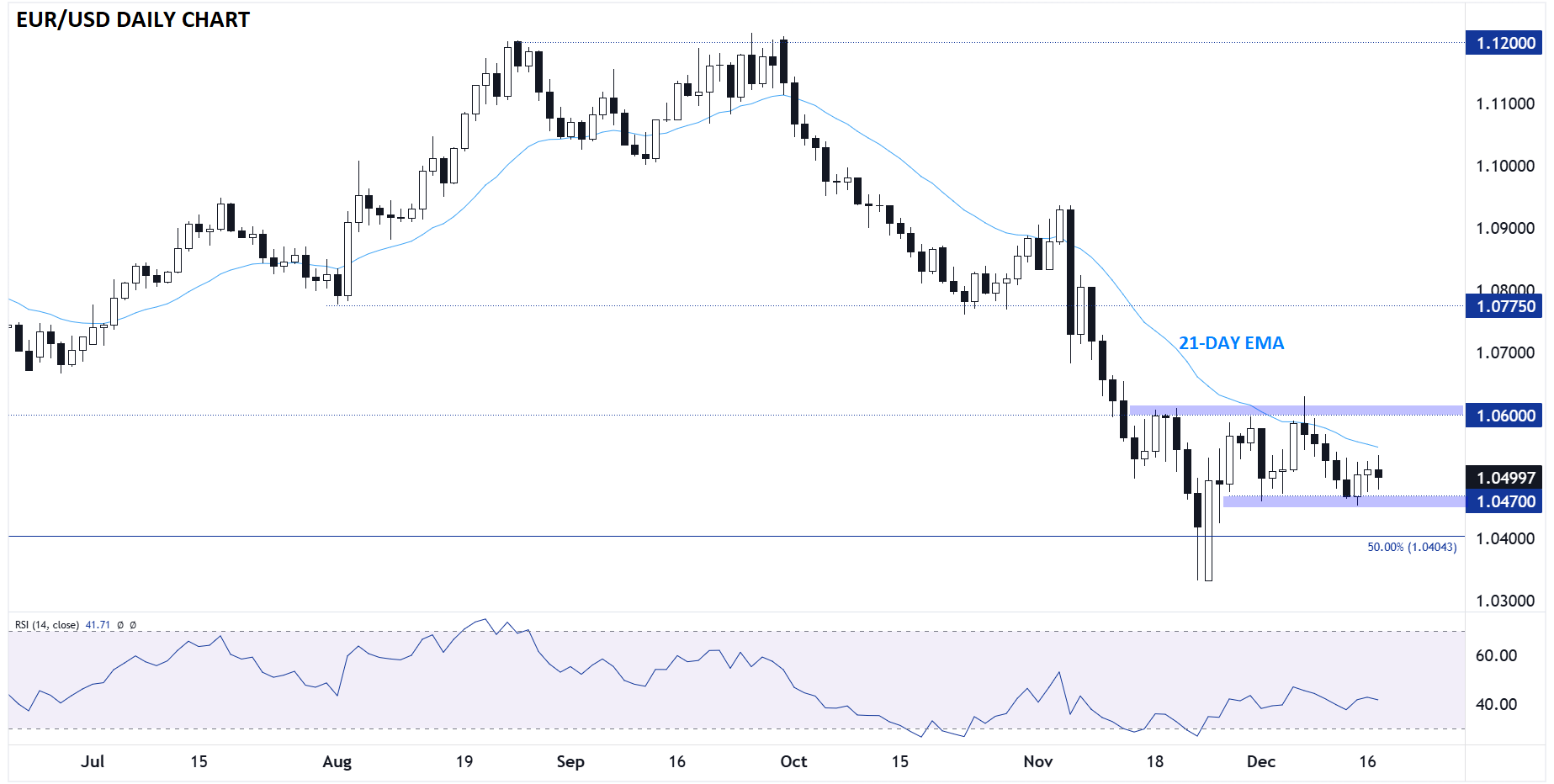

US Greenback Technical Evaluation – EUR/USD Day by day Chart

Supply: TradingView, StoneX

From a technical perspective, has been trending decrease because the begin of This autumn, although the draw back momentum has principally stalled thus far in December. The world’s most widely-traded foreign money pair has carved out a comparatively slender vary between 1.0470 assist and resistance at 1.0600 over the past couple of weeks, and until the Fed delivers a significant shock of some kind, that vary might carry over into the lower-liquidity vacation circumstances subsequent week.

If we do see a draw back break, a fast transfer towards at the least 1.0400 is feasible, with the potential for extra fundamentally- and technically-driven draw back heading into the brand new yr. In the meantime, a bullish response to the Fed assembly might effectively be restricted to 1.0600 given the final outperformance of the US financial system and lack of further catalysts.

Authentic Submit