Analysts spotlight sturdy progress potential, with Wells Fargo and BlackRock main forecasts.

Excessive-interest charges and M&A exercise might drive additional features for the banking sector.

Kick off the brand new yr with a portfolio constructed for volatility – subscribe now throughout our New 12 months’s Sale and stand up to 50% off on InvestingPro!

The stage is ready for the This autumn earnings season, as U.S. monetary heavyweights put together to unveil their fourth-quarter outcomes. JPMorgan (NYSE:), Citigroup (NYSE:), Wells Fargo (NYSE:), Goldman Sachs (NYSE:), and BlackRock (NYSE:) will launch their numbers on Wednesday, with Financial institution of America (NYSE:) and Morgan Stanley (NYSE:) following on Thursday.

In accordance with FactSet estimates, earnings for the are projected to rise 12% year-over-year, marking the quickest progress since 2021. A lot of this success hinges on monetary giants delivering sturdy performances, fueled by a sturdy banking sector.

Banks Main From the Entrance

Monetary shares surged 28% in 2024, outpacing the broader S&P 500’s 23.3% achieve. Analysts count on this momentum to hold into earnings, with trade income projected to climb practically 40% within the fourth quarter. These tailwinds might place banks to soar even larger in 2025, supplied macroeconomic situations maintain regular.

Banks have loved a big benefit from the high-interest-rate surroundings. Moneyfarm analysts level out that web curiosity margins—the distinction between what banks earn on loans and pay on deposits—have expanded, boosting profitability.

However rates of interest aren’t the one issue sparking optimism. Specialists see further catalysts, together with a possible uptick in mergers and acquisitions, a revival of IPOs, loosened laws, and enticing valuations. “Though nonetheless undervalued, the sector might current compelling funding alternatives in 2025 if the economic system stays secure,” Moneyfarm suggests.

Optimism Dominates Analysts’ Forecasts

Earnings projections for main banks have improved for six out of seven gamers over the previous 90 days. Even Financial institution of America, which noticed estimates dip barely, is anticipated to report year-over-year earnings progress. This confidence underlines the assumption that U.S. banks are well-positioned to profit from a powerful near 2024.

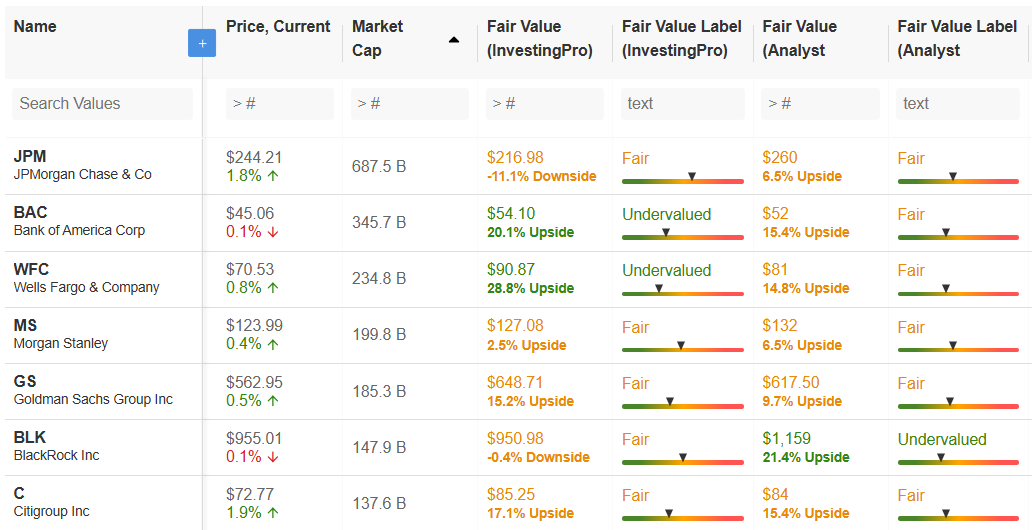

Supply: InvestingPro

After a banner yr for monetary shares, a decline in rates of interest might strain margins, growing the probability of market corrections if earnings fall in need of expectations.

Which Financial institution Inventory Is Poised for the Largest Progress in 2025?

As markets anticipate sturdy outcomes, the query stays: Which huge financial institution is primed for essentially the most progress within the yr forward?

InvestingPro knowledge highlights BlackRock as the highest contender, with analysts forecasting a 21.4% potential value improve.

Supply: InvestingPro

Citigroup and Financial institution of America comply with intently, every with a 15.4% upside. When contemplating honest worth, Wells Fargo stands out with an estimated 28.8% progress potential, whereas Financial institution of America and Citigroup additionally present promise.

Traders will likely be watching this week’s earnings reviews intently, as they might set the tone for monetary shares in 2025. Whereas the sector affords engaging alternatives, staying alert to financial shifts and earnings surprises will likely be essential for navigating what lies forward.

***

Curious how the world’s high buyers are positioning their portfolios for the yr forward?

You’ll find that out utilizing InvestingPro.

Don’t miss out on the New 12 months’s supply—your last likelihood to safe InvestingPro at a 50% low cost.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or suggestion to speculate as such it’s not supposed to incentivize the acquisition of belongings in any method. I wish to remind you that any sort of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding choice and the related threat stays with the investor.