Key Statistics:

Supply: Bureau of Labor Statistics, US Division of Labor

Launch Interval: December 2024

Final Launch Date: December 11, 2024,

Precise: 2.7% vs Forecast: 2.7%. Earlier: 2.6%

DECEMBER FORECAST = 2.9%

Launch Date: January 15, 2024, at 08:30 AM ET.

Objective:

It measures adjustments within the worth of products and companies bought by customers. Shopper costs account for many of the total inflation. Inflation is vital to the central financial institution to lift rates of interest out of respect for his or her inflation containment mandate.

Key Highlights:

US expectation is between 2.80 (vary low) to 2.93% (vary excessive) YoY headline inflation, 3.3% YoY “” inflation.

Headline inflation 12-month trailing common is 3.0.

US10Y yields have surged to 14-month peak at 4.799% on Monday Jan 13 just a few days forward of Trump taking White home.

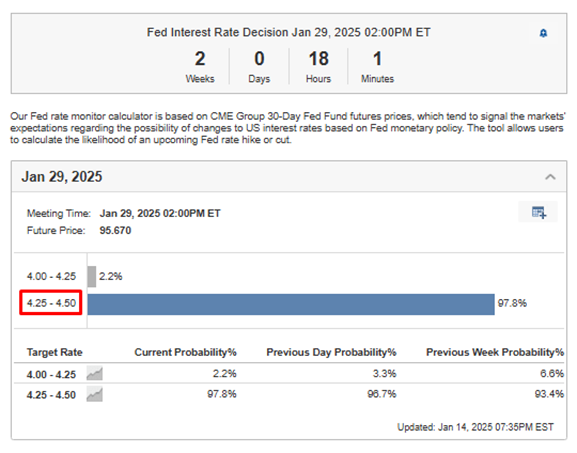

Investing.com reveals 97.8% chance of no fee lower on Jan 29 by Fed.

The skilled a slight improve, whereas the declined following a turbulent buying and selling session on Tuesday. Traders evaluated inflation information and ready for upcoming quarterly earnings reviews to validate inventory valuations and assess the energy of the U.S. economic system.

US Treasury & Bond Yields

(Supply: Investing.com):

FED Fee Monitor

(Supply: Investing.com):

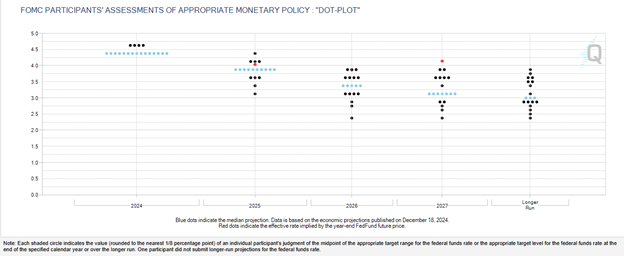

FOMC Projections (DOT-PLOT)

The Fed’s dot plot information every Fed official’s projection for the Fed Fund fee on a quarterly foundation.

Blue dots point out the median projections.

[Source: CME FedWatch]:

US 10Y Yields Technical View:

US 10Y Yields rose in a channel from December 2023 to April 2024 for 17 weeks.

Yields have been imitating the same channel-like state of affairs since September 2024 which is now in seventeenth week.

As chart practitioners say “historical past repeats itself” if that turns into a actuality this time then a decline to three.60% for 20 weeks is within the offing.

Technical Evaluation Perspective:

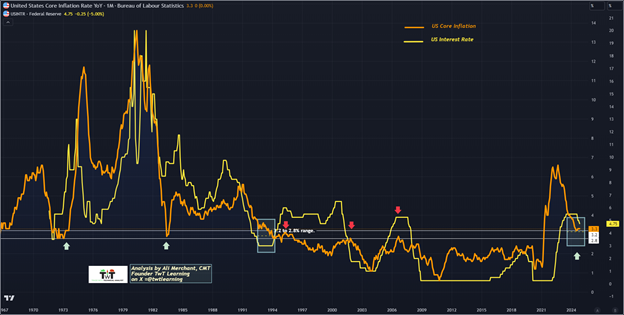

The US Core inflation YoY has remained above 3.2% since August 2024.

A key statement from the next chart means that if the core inflation rises larger from 3.2% to three.3% like in August 1992, it takes a few months earlier than it goes decrease.

From September 1992 the Fed stored the charges unchanged for a few months to carry the inflation down beneath 3% and raised charges as soon as the inflation dropped to 2.8% in April 1994.

Since August 2024 Core inflation has been sustaining 3.2 to three.3% suggesting that Fed should be affected person earlier than the inflation meets their goal of two%.

Fed might preserve the charges unchanged for the following couple of conferences in 2025.

The US Core Inflation YoY chart overlayed with US Curiosity Charges:

Conclusion:

yields counsel that the rate of interest will drop within the medium-term, whereas core inflation staying above 3.2 to three.3% in August 1992 compelled Fed to carry the speed for fairly a very long time. We want extra information to have a greater understanding of the long run Fed motion.

A phrase of knowledge:

“The market can stay irrational longer than you may stay solvent”

This quote by economist John Maynard Keynes emphasizes the unpredictable nature of monetary markets. The quote implies that traders mustn’t guess in opposition to the market, even once they imagine it’s mispriced or irrational, as a result of it’s tough to foretell when the market will right itself.