Firms with strong fundamentals, progressive methods, and clear progress drivers are well-positioned to ship outsized returns.

These 5 high quality progress shares every signify compelling funding alternatives for 2025.

Searching for extra actionable commerce concepts? Subscribe right here for 50% off InvestingPro!

As 2025 will get off to a unstable begin, buyers are on the hunt for high-quality progress shares with strong fundamentals, progressive methods, and clear paths to capitalize on rising tailwinds.

Among the many best-positioned names are Cheniere Power (NYSE:), Uber Applied sciences (NYSE:), Robinhood Markets (NASDAQ:), Royal Caribbean Cruises (NYSE:), and TJX Firms (NYSE:). These firms, spanning various sectors, boast near-perfect InvestingPro Monetary Well being Scores and robust progress metrics, making them standout picks for outsized returns within the yr forward.

For buyers in search of huge returns in 2025, these names stand out as top-tier alternatives.

1. Cheniere Power – LNG Export Chief

Sector: Power

Monetary Well being Rating: 3.53/5

Market Cap: $56.9 Billion

Cheniere Power is a number one producer and exporter of liquefied (LNG), primarily serving world vitality markets. As America’s largest LNG exporter, Cheniere stands on the forefront of the worldwide vitality transition.

With world vitality demand projected to rise, the Houston-based firm is poised to capitalize on its place as a high LNG exporter. Cheniere’s multi-year contracts with worldwide consumers present income stability, whereas enlargement tasks guarantee capability progress.

Supply: InvestingPro

Boasting a stellar Monetary Well being Rating of three.53, the U.S. LNG big maintains a robust monetary place. The transition to cleaner vitality sources is driving elevated adoption of pure fuel as a bridge gasoline, boosting Cheniere’s long-term progress prospects.

With a modest dividend yield of 0.79% and a pretty P/E ratio of 16.2x, Cheniere gives worth alongside progress.

The rising demand for LNG, pushed by the worldwide shift to cleaner vitality, mixed with its monetary self-discipline positions Cheniere as a key beneficiary in 2025, as per analysts at each Barclays and Bernstein SocGen Group.

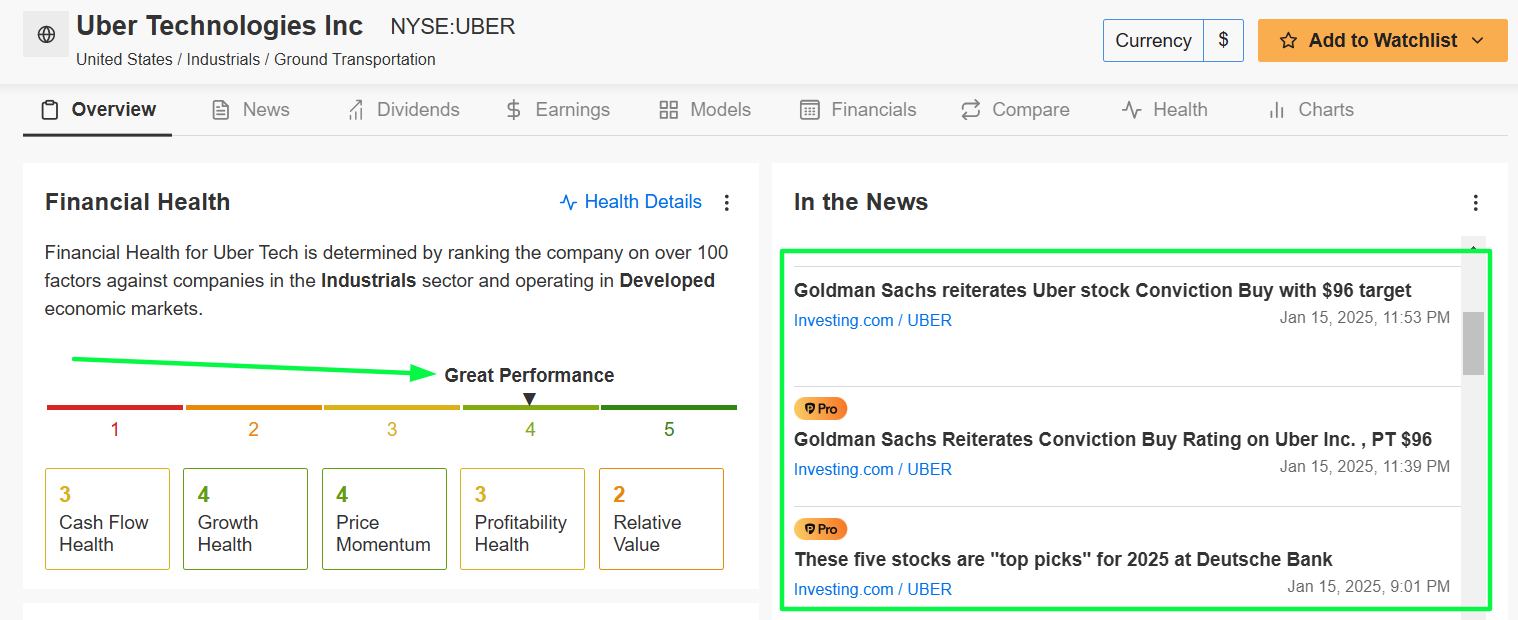

2. Uber Applied sciences – Journey-Hailing & Supply Large

Sector: Industrials

Monetary Well being Rating: 3.16/5

Market Cap: $144.8 Billion

Uber operates a world platform for ride-hailing, meals supply (Uber Eats), and freight companies. The San Francisco-based firm has developed past its ride-hailing roots to change into a multi-faceted mobility and logistics powerhouse.

In 2025, Uber is anticipated to profit from continued restoration in city mobility, the expansion of its meals supply enterprise, and robust demand for its freight options. Moreover, strategic investments in autonomous driving and partnerships within the electrical automobile (EV) house present long-term tailwinds.

Supply: InvestingPro

With a sturdy Monetary Well being Rating of three.16, the worldwide ride-hailing and supply big demonstrates sturdy operational execution. The corporate’s transformation from a growth-at-all-costs mannequin to a worthwhile enterprise is clear in its enhancing working metrics.

Uber’s dominant market place and increasing profitability make it a compelling progress story, with the inventory buying and selling at $68.58 and analysts setting a imply value goal of $89.17 – signaling 30% upside potential.

Professional additionally factors out that analysts at Goldman Sachs reiterated their Conviction Purchase score on UBER, citing the corporate’s deal with increasing markets, enhancing profitability, and leveraging platform cross-sell alternatives to spice up investor returns.

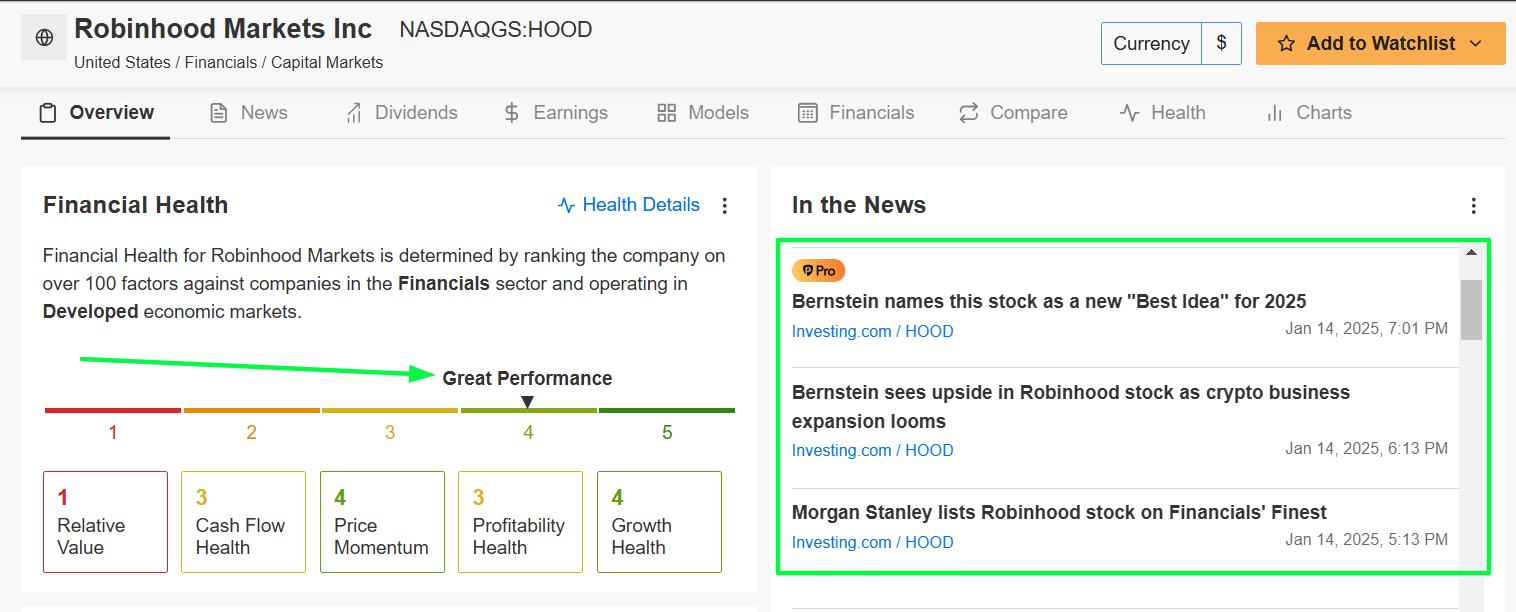

3. Robinhood Markets – Subsequent-Gen Buying and selling Platform

Sector: Financials

Monetary Well being Rating: 3.08/5

Market Cap: $40.8 Billion

Robinhood Markets offers a commission-free buying and selling platform for shares, ETFs, choices, and cryptocurrencies. The Menlo Park, California-based retail brokerage agency is well-positioned to thrive as retail buying and selling exercise stays strong and monetary literacy continues to develop amongst youthful generations.

A positive macroeconomic setting, coupled with Robinhood’s progressive platform and robust person engagement, is anticipated to drive vital progress in each energetic customers and property underneath administration. The corporate is increasing its product choices, together with high-yield financial savings accounts and retirement planning companies, which can broaden its income base.

Supply: InvestingPro

With a Monetary Well being Rating of three.08, Robinhood exhibits sturdy elementary stability. The inventory has already delivered a 316.8% return over the previous yr, reflecting its operational progress and market acceptance.

Analysts are optimistic about its trajectory, with a imply value goal of $49.24. Professional additionally factors out that HOOD inventory was lately named as a brand new ‘Finest Thought’ for 2025 at Bernstein, whereas Morgan Stanley included it on its prestigious ‘Financials’ Best’ checklist.

Robinhood’s enlargement into new monetary services and products, coupled with its rising person base, units the stage for continued success as retail investing positive aspects traction in 2025.

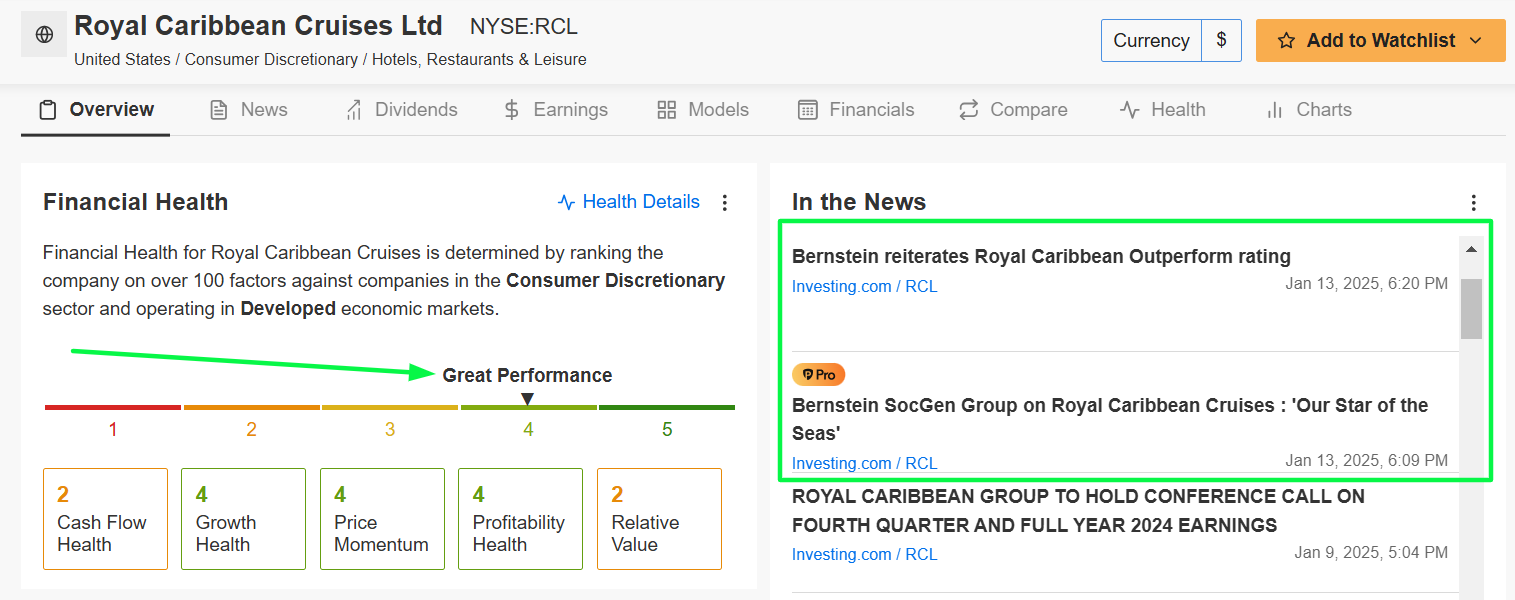

4. Royal Caribbean Cruises – Cruise Trade Chief

Sector: Client Discretionary

Monetary Well being Rating: 3.07/5

Market Cap: $62.7 Billion

Royal Caribbean Cruises operates one of many world’s largest cruise line firms, providing trip experiences throughout world locations. As world journey continues to get well, Royal Caribbean is ready to journey a wave of pent-up demand for leisure and tourism.

A surge in worldwide journey, significantly in Asia and Europe, is anticipated to supply sturdy tailwinds for income progress in 2025. Moreover, price administration initiatives and strong ahead bookings sign a wholesome restoration trajectory.

Supply: InvestingPro

With a Monetary Well being Rating of three.07, the cruise business chief is on stable monetary floor. Based on InvestingPro knowledge, RCL has demonstrated outstanding momentum with an 88% return over the previous yr.

Royal Caribbean seems well-positioned for continued progress, with analysts setting a imply value goal of $250.61.

It needs to be talked about that RCL has been recognized as a high decide to leverage the continued momentum within the cruise business, in keeping with Bernstein analysts, reflecting operational excellence and demand resurgence.

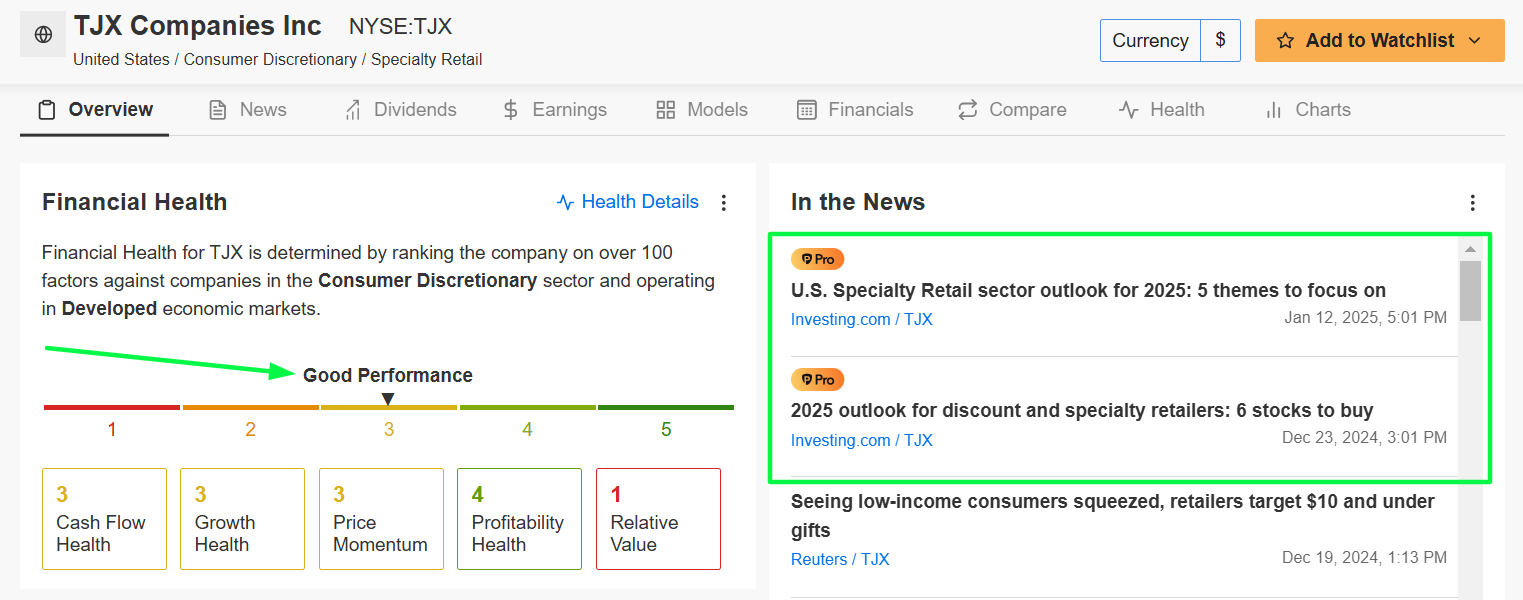

5. TJX Firms – Off-Value Retail Champion

Sector: Client Discretionary

Monetary Well being Rating: 2.95/5

Market Cap: $136.7 Billion

TJX operates off-price retail chains, together with T.J. Maxx, Marshalls, and HomeGoods, providing discounted attire, residence items, and equipment. The value-conscious clothes and residential decor chain has confirmed its resilience in numerous financial cycles, benefiting from its value-focused enterprise mannequin.

As customers proceed to prioritize affordability amid financial uncertainty, TJX is anticipated to see sturdy foot visitors and gross sales progress. The discount retailer can also be increasing its on-line presence and retailer footprint, capturing extra market share within the retail sector.

Supply: InvestingPro

With a stable Monetary Well being Rating of two.95, TJX demonstrates constant operational execution. With sturdy stock administration and a popularity for providing high quality merchandise at aggressive costs, TJX is well-positioned for sustained progress.

Analysts are bullish, with a imply value goal of $130.73, signaling additional upside. TJX was named as one in every of six high retail shares to purchase for 2025 by analysts at Jefferies, citing alternatives for worldwide progress and a promising enlargement of its residence items phase.

As customers proceed to prioritize worth in unsure financial occasions, TJX’s well-established model and aggressive pricing technique make it a robust contender for sustained progress.

Make sure you try InvestingPro to remain in sync with the market pattern and what it means to your buying and selling. Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now to get 50% off all Professional plans with our New 12 months’s vacation sale and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed observe document.

InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for one of the best shares primarily based on a whole lot of chosen filters, and standards.

Prime Concepts: See what shares billionaire buyers comparable to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 through the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco Prime QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.