Amazon signage through the 2024 CES occasion in Las Vegas, Nevada, on Jan. 10, 2024.

Bridget Bennett | Bloomberg | Getty Pictures

Take a look at the businesses making headlines in prolonged buying and selling:

Amazon — The e-commerce large fell 2% after issuing weaker-than-expected steering for the present quarter. Amazon mentioned it forecasts gross sales within the first quarter between $151 billion and $155.5 billion. Analysts surveyed by LSEG had been on the lookout for $158.5 billion. In the meantime, the corporate’s fourth-quarter earnings and income had been above consensus expectations.

Take-Two Interactive Software program — The online game firm jumped practically 7% regardless of posting fiscal third-quarter income of $1.37 billion. Analysts polled by LSEG had anticipated $1.39 billion. Take-Two sees its current-quarter income, primarily based on web bookings, coming in between $1.48 billion and $1.58 billion versus the estimated $1.54 billion.

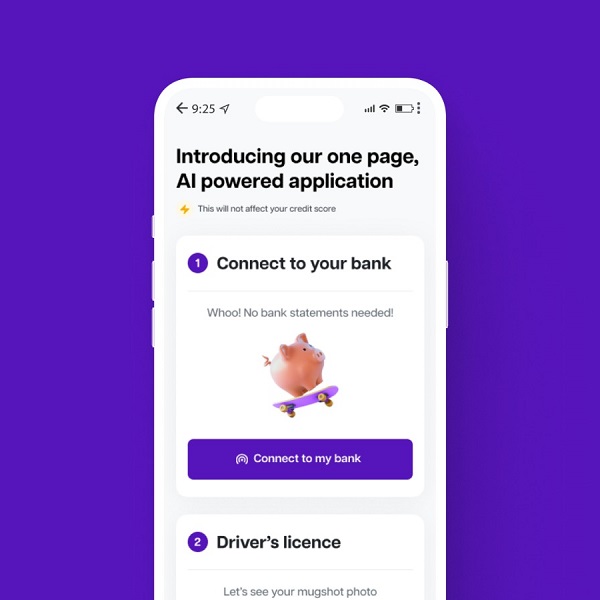

Affirm Holdings — Shares of the fee firm jumped greater than 9% following a top-line beat for the fiscal second quarter. Affirm reported $866 million in revenues, whereas analysts anticipated $807 million, per LSEG. Gross merchandise quantity grew 35% year-over-year within the prior quarter.

Pinterest — Shares of the social media firm popped 18%. Income for the fourth quarter got here in at $1.15 billion, barely forward of analysts’ estimates of $1.14 billion, per LSEG. Pinterest additionally mentioned it expects income of $837 million to $852 million within the first quarter, whereas analysts sought $833 million.

Expedia — The inventory gained 11% after the corporate’s fourth-quarter outcomes topped Wall Road expectations. Expedia posted adjusted earnings of $2.39 per share on income of $3.18 billion. That’s greater than the $2.04 per share on $3.07 billion in income that analysts had penciled in, in accordance with LSEG. The corporate additionally reinstated its quarterly dividend at 40 cents per share.

Invoice Holdings — Shares plunged about 32% after the billing software program firm issued disappointing fiscal third-quarter income steering. Invoice Holdings expects for that interval to generate income between $352.5 million and $357.5 million, beneath the $360.4 million that analysts surveyed by LSEG had been anticipating. Nonetheless, earnings and income for the second quarter beat analysts’ expectations.

Fortinet — The cybersecurity inventory rallied 11%. Fortinet posted better-than-expected outcomes for the fourth quarter, along with robust steering for the total 12 months. Fortinet sees full-year revenues falling between $6.65 billion and $6.85 billion, topping the $6.63 billion estimate from analysts, per LSEG.

E.l.f. Magnificence — The cosmetics firm tumbled 23% after slashing its steering for the total fiscal 12 months. E.l.f now sees gross sales starting from $1.3 billion to $1.31 billion, in need of consensus estimates of $1.34 billion, per StreetAccount. Adjusted earnings for the third quarter additionally narrowly missed expectations, coming in at 74 cents per share versus analysts’ forecast for 75 cents a share, per LSEG.

Monolithic Energy Techniques — The semiconductor inventory soared 16% following robust fourth-quarter outcomes. Monolithic Energy Techniques reported adjusted earnings of $4.09 per share on income of $621.7 million. Analysts surveyed by FactSet had referred to as for earnings of $3.98 per share on $608.1 million in income. The corporate additionally issued better-than-expected income steering for the present quarter and a $500 million inventory repurchase program. Administration additionally elevated the quarterly dividend by practically 25%.

— CNBC’s Sean Conlon, Lisa Kailai Han and Darla Mercado contributed reporting.