Your assist helps us to inform the story

From reproductive rights to local weather change to Huge Tech, The Unbiased is on the bottom when the story is creating. Whether or not it is investigating the financials of Elon Musk’s pro-Trump PAC or producing our newest documentary, ‘The A Phrase’, which shines a light-weight on the American girls preventing for reproductive rights, we all know how necessary it’s to parse out the info from the messaging.

At such a vital second in US historical past, we want reporters on the bottom. Your donation permits us to maintain sending journalists to talk to either side of the story.

The Unbiased is trusted by People throughout all the political spectrum. And in contrast to many different high quality information retailers, we select to not lock People out of our reporting and evaluation with paywalls. We imagine high quality journalism ought to be obtainable to everybody, paid for by those that can afford it.

Your assist makes all of the distinction.

Learn extra

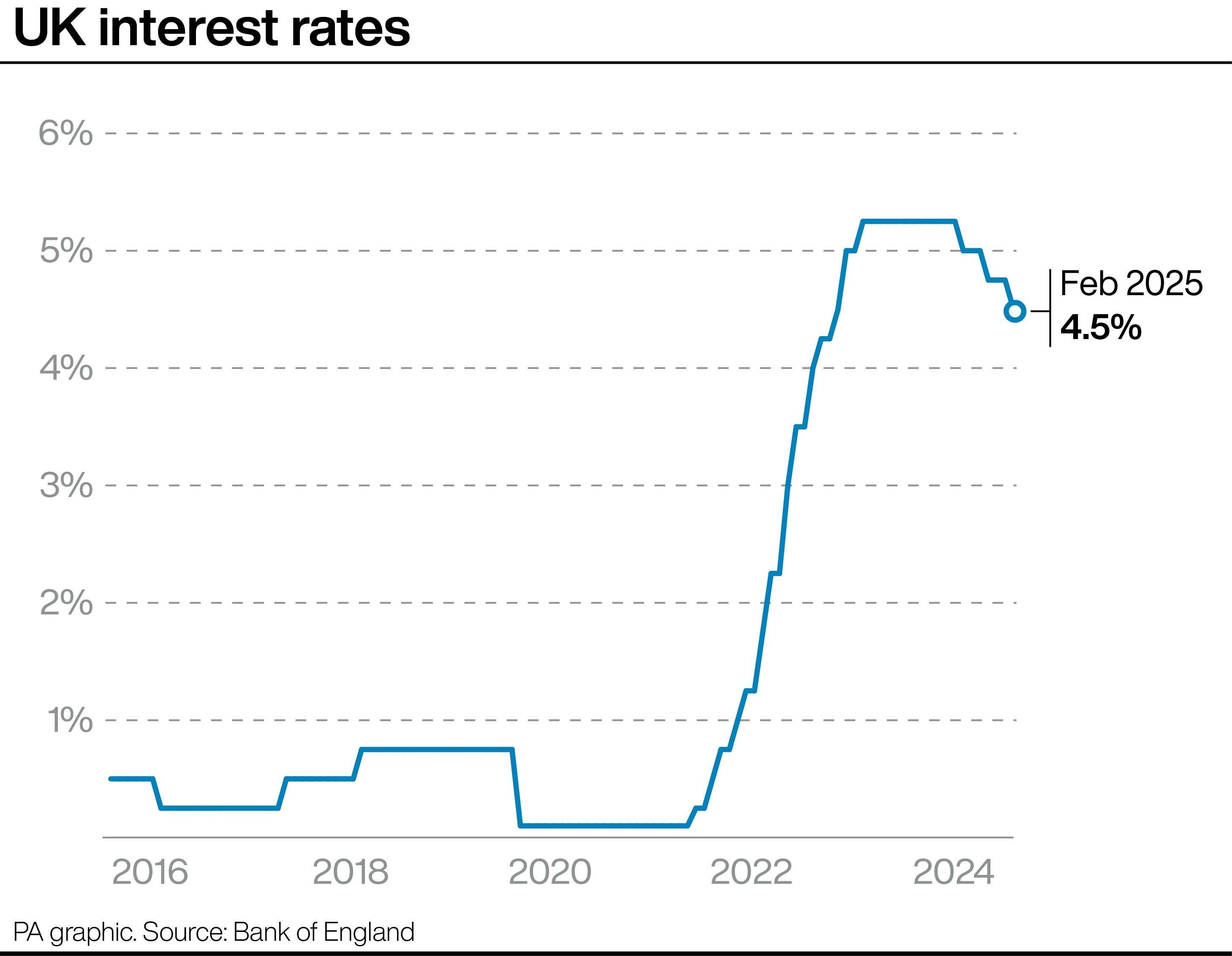

Rachel Reeves has acquired a a lot wanted enhance in her push for financial progress after the Financial institution of England introduced a lower in rates of interest however was dealt an instantaneous blow over projections that inflation is about to rise.

In addition to offering reduction for a lot of companies, the lower will assist 1000’s of individuals on mortgages who will see there month-to-month funds fall. A house owner with a £300,000 tracker mortgage will see month-to-month repayments fall round £43 from £1,710 to £1,667.

Nevertheless, in a blow to the chancellor progress expectations have been halved due to the additional NHS spending in Ms Reeves’ Funds final yr and inflation is now anticipated to rise to three.7 per cent, increased than beforehand estimated.

Ms Reeves was warned the “putrid” new progress forecast “must be a get up name” with requires her to do extra to assist companies fighting the fallout of her Funds.

open picture in gallery

The speed lower is the primary piece of excellent information for a chancellor who has been beset by poor financial figures since taking workplace seven months in the past and has additionally been the topic of hypothesis about whether or not she will survive within the Treasury.

The announcement follows Ms Reeves’ main speech final week the place she doubled down on her financial progress agenda in a bid to relaunch her financial plan with proposals to unleash huge constructing initiatives throughout the UK together with a brand new runway at Heathrow Airport.

Downing Avenue backed the chancellor, repeating a pledge that she’s going to keep within the function for the entire of this Parliament.

However shadow chancellor Mel Stride mentioned that whereas the lower in rates of interest “will likely be welcome information” for households and companies who’ve been “hit arduous by Labour’s appalling mismanagement…” he warned the Financial institution of England’s weaker-than-expected progress predictions confirmed “confidence is falling and Labour’s Funds is fuelling inflation”.

Labour’s “disastrous Funds is more likely to imply fewer fee cuts this yr than beforehand anticipated”, he added.

Liberal Democrat Treasury spokesperson Daisy Cooper mentioned the brand new progress forecast ought to be a ”get up name for the chancellor“ and referred to as on her to scrap her “misguided nationwide insurance coverage hike” on employers subsequent month and drop her refusal to “negotiate a bespoke UK-EU Customs Union”.

Anna Leach, chief economist of the Institute of Administrators, urged Ms Reeves to rethink “extra burdens” positioned on companies final yr, specifically “pernicious tax modifications affecting household companies, farms and non-doms” and employment rules.

Ms Reeves’ Funds choices had “considerably undermined” enterprise momentum “and can have an effect on ranges of personal funding for years to return,” she mentioned.

And he or she added that the forecasts offered a “worrying outlook for the UK”, with inflation up and progress down “stagflation dangers stay on the desk”.

Talking after the speed change was confirmed, the Financial institution of England’s governor, Andrew Bailey mentioned: “It is going to be welcome information to many who now we have been in a position to lower rates of interest once more at present.

“We’ll be monitoring the UK economic system and international developments very carefully, and taking a gradual and cautious method to lowering charges additional.

“Low and steady inflation is the muse of a wholesome economic system and it is the Financial institution of England’s job to make sure that.”

The Financial institution’s fee setting Financial Coverage Committee (MPC) voted by 7 to 2 to convey charges down. Two members of the MPC voted for a much bigger 0.5 % lower.

open picture in gallery

Nevertheless, in much less excellent news for Ms Reeves, the Financial institution downgraded its forecasts for progress projecting that GDP fell 0.1 per cent within the fourth quarter of 2024 and can rise by simply 0.1 per cent within the first quarter of 2025.

The Financial institution halved its progress forecast for the UK economic system to 0.75 % for this yr, down from earlier estimates of 1.5 %, earlier than accelerating once more in 2026 and 2027

The rate of interest lower has been welcomed throughout the political spectrum in addition to by companies and commerce unions.

TUC common secretary Paul Nowak mentioned: “This fee lower is badly wanted to assist raise the economic system out of stagnation. The Financial institution should now preserve transferring with additional cuts to assist households and companies within the months forward.

“Decrease borrowing prices will ease pressures on households, serving to households with their weekly budgets and leaving them with extra to spend. And it’ll make it extra inexpensive for companies to take a position and develop.”

Alpesh Paleja, deputy chief economist, CBI, mentioned: “Right now’s lower to rates of interest was according to our expectations and reinforces our view of a gradual loosening in financial coverage over this yr.”

However he warned: “Nevertheless, the Financial Coverage Committee are more and more having to steadiness conflicting goals. The CBI’s surveys present that enterprise’ progress and hiring expectations have weakened. However inflation expectations are choosing up, exacerbated by the rise in employment prices arising from October’s Funds.

“Due to this fact, whereas we nonetheless anticipate a number of extra fee cuts this yr, dangers to this forecast are actually balanced in both route. Incoming information over the approaching months will likely be key in figuring out how the MPC will transfer subsequent.”

In response to the Financial institution’s bulletins, Downing Avenue mentioned investing within the NHS was “good for the economic system and good for progress”.

On the projected inflation rise, No 10 pointed to the newest forecast by the Workplace for Funds Duty (OBR) that it will stay near the goal of two per cent.