Keep knowledgeable with free updates

Merely signal as much as the Equities myFT Digest — delivered on to your inbox.

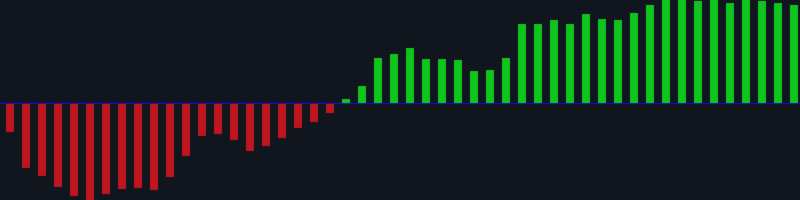

Wall Avenue shares sank on Tuesday, briefly pulling the S&P 500 right into a so-called correction, as Donald Trump’s newest commerce broadside in opposition to Canada fanned investor fears over the financial fallout from his protectionist agenda.

The S&P 500 was down as a lot as 1.5 per cent by mid-afternoon, taking the benchmark’s losses because it hit an all-time excessive lower than three weeks in the past to greater than 10 per cent. It later rebounded to commerce 0.6 per cent decrease.

The current Wall Avenue sell-off had briefly paused on Tuesday morning, however was reignited after Trump took to social media to announce an extra 25 per cent tariff on metal and aluminium imports from Canada, one of many US’s greatest buying and selling companions.

The Vix index, a measure of anticipated volatility in US shares, rose above 29, its highest level since August.

“There’s an enormous reset occurring proper now and quite a lot of trepidation available in the market,” stated Dec Mullarkey, managing director at fund supervisor SLC Administration. “Recession danger is getting actual, it’s amping up.”

The Nasdaq Composite reversed earlier declines to commerce flat, a day after it fell 4 per cent in its worst session in two-and-a-half years.

In Europe, the Stoxx Europe 600 closed down 1.7 per cent, whereas Germany’s Dax fell 1.3 per cent.

The US greenback, which has been dragged decrease by issues over the well being of the world’s greatest economic system, fell 0.7 per cent in opposition to a basket of six buying and selling companions and is down practically 5 per cent for the reason that begin of the yr.

The euro rose 1 per cent to $1.094, that means it has now recovered nearly all of its losses for the reason that US election, as buyers continued to guess on a greater development image for Europe on the again of Germany’s “no matter it takes” spending plan introduced final week.

The one foreign money was helped by the beginning of talks between US and Ukrainian delegations in Saudi Arabia that Kyiv hopes can pave the best way for peace, and hopes {that a} defence deal in Germany shall be sealed quickly, stated analysts.

Really helpful

Buyers “simply need to commerce the constructive narrative for euro in the intervening time”, stated Kamal Sharma, an FX strategist at Financial institution of America.

The euro has had a lightning rally this month and noticed its greatest week in opposition to the greenback since 2009 final week, as buyers have elevated development expectations for the Eurozone and trimmed expectations for rate of interest cuts by the European Central Financial institution.

Extra reporting by Ray Douglas

.jpeg?itok=3shgbiVf'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-03/AdobeStock_DOGE%20(2).jpeg?itok=3shgbiVf)