Your assist helps us to inform the story

From reproductive rights to local weather change to Huge Tech, The Impartial is on the bottom when the story is creating. Whether or not it is investigating the financials of Elon Musk’s pro-Trump PAC or producing our newest documentary, ‘The A Phrase’, which shines a light-weight on the American ladies combating for reproductive rights, we all know how necessary it’s to parse out the information from the messaging.

At such a crucial second in US historical past, we’d like reporters on the bottom. Your donation permits us to maintain sending journalists to talk to each side of the story.

The Impartial is trusted by Individuals throughout your complete political spectrum. And in contrast to many different high quality information retailers, we select to not lock Individuals out of our reporting and evaluation with paywalls. We imagine high quality journalism ought to be accessible to everybody, paid for by those that can afford it.

Your assist makes all of the distinction.

Learn extra

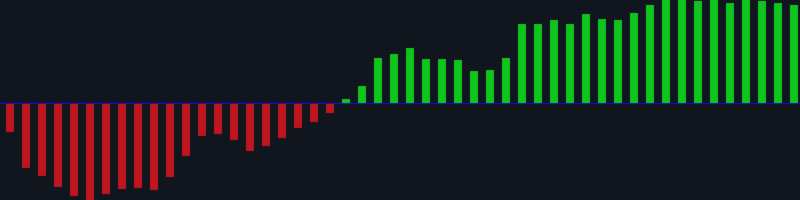

A dramatic fall in US shares on Monday means lots of the world’s largest firms are out of the blue far cheaper to purchase than they have been per week in the past, as buyers fear a few doable recession.

The benchmark S&P 500 – the index of a few of the US’s largest publicly listed organisations – fell round 2.7 per cent throughout the day, with the tech-heavy Nasdaq inventory market dropped a full 4 per cent, its worst day in three years.

That sharp drop will unfold elsewhere, not simply in share value phrases however in investor confidence ranges and considerations over the skills of firms to do enterprise and full gross sales in the US. So what would possibly halt the decline and which firms have survived to date?

What has occurred to the US inventory market – and what about elsewhere?

The S&P 500 is down nearly 7.5 p.c throughout the final month and ripples have already been felt. In Asia, in a single day buying and selling noticed benchmarks take a nosedive, with Japan down 1.7 per cent, Australia nearly one per cent down and extra.

In the meantime in Europe, as of 11am GMT on Tuesday, buying and selling was largely flat on each the London Inventory Change for the FTSE 100 (-0.15 per cent) and France’s CAC 40 (+0.16 per cent) – however Germany’s DAX had risen 0.4 per cent.

The resilience of the European markets is probably as a result of reality there are fewer extremely valued tech firms and extra stable staples equivalent to shopper items and banks – plus valuations have been decrease to start with.

Over in America, giant elements of the rationale for the inventory market decline have been the phrases and actions of president Donald Trump.

What sparked the sell-off and the way low may it go?

Mr Trump asserting tariffs – in addition to repeatedly delaying, suspending or overriding them – has triggered uncertainty over which companies will thrive and which can wrestle to promote as soon as tariffs are added to the prices of their items and companies.

In flip, reciprocal tariffs and political uncertainty – modifications in authorities in Germany and Canada for instance – contribute to the general instability, which impacts investor confidence. When that confidence stage is low, one strategy is to take away cash from riskier belongings – equivalent to shares and shares – and that sell-off can ship costs decrease.

open picture in gallery

Funding and asset managers at aberdeen at the moment are pricing in only a 15 per cent probability that Mr Trump focuses on “market-friendly points of his agenda”, as an alternative anticipating to see extra tariffs – although Lizzy Galbraith, aberdeen’s political economist, nonetheless sees the “fundamentals of the financial system as sound”. The expectation there may be that there shall be “progress and inflation headwinds to the US financial system”.

By way of the inventory market itself, funding director at AJ Bell, Russ Mould, was extra blunt:

“There may be an previous saying that ‘shares go up the escalator and are available down within the elevator,’ and like most sayings there may be greater than a grain of reality in it – we appear to be seeing one other instance proper now,” he informed The Impartial.

“Mr Trump is set to ‘Make America Nice Once more’ however as far as buyers are involved, America is already nice. The S&P 500 and the most important indices have outperformed their worldwide counterparts to such a level that the S&P500 represents greater than 60 per cent of world inventory market capitalisation.

“Throw within the historical past of presidents providing assist throughout prior episodes of market strife, all the best way again to the LTCM hedge fund disaster of 1998, and you may see why buyers have been bullish to the purpose of complacency as they anticipated an extra clean trip up that escalator.

“And that’s the place the elevator is available in, ought to excessive valuations and excessive expectations meet any surprising issues.”

Is a rebound doubtless any time quickly?

It’s not simply feedback from the president which may affect particular person inventory costs in fact. When valuations are excessive and investor confidence is flying, the slightest miss in reported earnings or surprising adverse information – such because the DeepSeek furore earlier this 12 months – can ship sky-high costs tumbling in brief order.

However for a wider market correction, it’s typically uncertainty of that sturdy financial progress which is behind it.

Subsequently, to halt or reverse a decline, on this case it’d want political steerage on what occurs subsequent – however the Trump administration appears extra involved with nationwide debt than market efficiency proper now, added Mr Mould.

open picture in gallery

“You may see why, given the $36tn (£27tn) federal debt and $1.1tn (£850bn) annual curiosity invoice, a sum that gobbles up a fifth of the tax take.

“That’s why the administration is on the lookout for income (tariffs, extra jobs and output at dwelling) and spending cuts (smaller authorities). On this respect, the plan is working, because the yield on benchmark 10-year Treasuries is down since 5 November, in distinction to the modest improve seen within the yield on 10-year Gilts within the UK and large leaps in Authorities borrowing prices in Japan and Germany.”

In the end, the inventory market primarily capabilities by sorting itself out – a minimum of in a super world of effectivity – price-wise, so when the underside is hit, it’s as a result of that’s the purpose buyers imagine threat to be eliminated as soon as extra.

Whether or not it is a correction or begin of an extended recession will solely be proven in time, in fact.

The hidden winners to date – and will buyers purchase the dip?

Not everybody has seen their shares fall in fact. Unhealthy information for a lot of remains to be a possibility for some.

We’ve seen above how Europe has to date initially averted such a inventory market drop, whereas particular person firms – on this continent and Stateside – have seen rises.

The $156bn (£120bn) vitality firm NextEra rose 4.5 per cent, monetary companies change CME Group rose three per cent, prescription drugs organisation Bristol-Myers Squibb Firm was up 3.3 per cent.

Selecting short-term particular person winners at a time like this isn’t for the faint of coronary heart, however taking a look at the long term, ought to, or will, buyers be tempted to take a look at drops of serious ranges in costs – Tesla down 15 per cent Monday alone, Coinbase down 17 per cent, RobinHood 19 per cent and extra – and assume particular person firms may be ripe for leaping again into?

In different phrases, is that this purchase the dip territory?

“That’s a courageous query after an enormous bull run, fuelled by meme shares, SPACs, a increase in one-day choices, levered ETFs and heaven is aware of what else, together with a crypto participant shopping for a banana for $6.2 million as artwork after which consuming it,” cautions AJ Bell’s Mr Mould.

“You don’t see that on the backside of markets. Some threat off and earnest contemplation could also be no unhealthy factor.”

Then again, there’s no getting away from the truth that when it comes to share value measured in opposition to the same old metrics of earnings and so forth, firms are cheaper now than they have been only some weeks in the past – if, importantly, that earlier charge of doing enterprise – earnings, income, prices and so forth – was to be maintained.

“Enterprise fashions haven’t modified. Value has and temper follows value, on the best way up and on the best way down. It will likely be fascinating to see if this emboldens the bears and short-sellers who’ve been largely hibernating or run out of city for the final 5 years,” Mr Mould added.