HTX is likely one of the finest crypto exchanges and ranks among the many high 10 buying and selling platforms on the earth by buying and selling quantity. It’s extremely safe and supplies superior buying and selling instruments for each learners and skilled merchants. However is it value selecting on your buying and selling wants?

This HTX evaluate will cowl what HTX (Huobi) is, what its buying and selling charges and options are, and whether or not it’s a protected and legit crypto change for purchasing cryptocurrencies.

HTX Alternate Evaluate: At a Look

Based2013Authentic IdentifyHuobi WorldRebrandedHTX (September 2023)HeadquartersSeychellesBuying and selling ChoicesSpot, margin buying and selling, perpetual futures contracts, copy buying and selling, choices buying and selling, staking, buying and selling bots, and extraCryptocurrencies Supported700+Spot Buying and selling Payment0.2% (Maker & Taker)Payment ReductionsHT Token Holdings, Buying and selling QuantityMax Leverage200x (Perpetual Futures Contracts)Day by day Buying and selling Quantity$4 Billion+Withdrawal Restrict0.06 BTC Day by day (no KYC) and 200 BTC (primary KYC)Safety Options2FA, Chilly Storage, Multi-Sig Wallets, Anti-phishing code, withdrawal handle whitelisting, PoR knowledge, and extraRestricted International locationsUnited States, China, the UK, Japan, and extra

What’s HTX (Previously Huobi)?

HTX is a number one international cryptocurrency change based in 2013 by Leon Li, initially named Huobi World, and rebranded to HTX in 2023 to mark its tenth anniversary. Based mostly in Seychelles, it serves over 45 million customers throughout 160+ international locations, providing a strong platform for buying and selling, investing, and studying about digital property. You may commerce over 700 cryptocurrencies.

The change helps spot buying and selling, futures with as much as 200x leverage, and margin buying and selling at 5x leverage. The platform affords various monetary merchandise by way of HTX Earn, comparable to Versatile and Fastened staking, Shark Fin, Twin Funding, and On-chain Staking, letting you earn passive revenue on idle property. The person interface is intuitive on desktop and cell, providing superior charting instruments and social buying and selling options.

HTX operates underneath strict regulatory compliance with licenses in Lithuania (Digital Foreign money Alternate Operator), Dubai (FMP License by way of VARA), and the British Virgin Islands (SIBA Funding Enterprise License). Nonetheless, it restricts companies in international locations just like the United States, mainland China, Russia, Iran, and the UK as a result of native rules.

Professionals of HTX

Extensive Vary of Cryptocurrencies: HTX affords over 700 cryptocurrencies, together with main cash like Bitcoin and Ethereum, in addition to an enormous number of altcoins.Superior Buying and selling Options: The platform supplies instruments like margin buying and selling, futures contracts with as much as 200x leverage, and duplicate buying and selling.Excessive Liquidity: HTX constantly ranks among the many high exchanges for buying and selling quantity and this ensures fast order execution with minimal value slippage.Sturdy Safety Measures: HTX employs strong safety practices, together with two-factor authentication, chilly storage for many funds, PoR knowledge, and SSL encryption.Passive Earnings Choices: You may stake your supreme crypto property or take part in applications like Twin Funding and SharkFin to earn curiosity.

Cons of HTX

Restricted Entry in Some Areas: HTX is unavailable in international locations like america, China, and Japan as a result of regulatory restrictions.Larger Buying and selling Charges: Base buying and selling charges begin at 0.2% for each makers and takers, which is larger than some rivals (usually 0.1% on Binance and Bybit) except discounted with HTX token holdings.

HTX Buying and selling Options Defined

Futures Buying and selling

HTX futures buying and selling helps you to commerce contracts primarily based on the longer term value of digital currencies like BTC or ETH. It permits you to generate income by predicting if the worth will go up or down. Right here, you don’t personal the precise cryptocurrency; as an alternative, you’re betting on its value motion.

HTX affords numerous futures contracts primarily based on length and settlement sort. Two key classes are USDT-M (USDT-Margined) and Coin-M (Coin-Margined) futures.

USDT-M Futures: These contracts use USDT (Tether), a stablecoin pegged to the U.S. greenback, because the margin and settlement foreign money. You deposit USDT to commerce, and earnings or losses come again in USDT. They’re simpler to know as a result of your beneficial properties or losses keep in a secure worth, not a fluctuating cryptocurrency.Coin-M Futures: These use the cryptocurrency itself (like BTC or ETH) because the margin and settlement foreign money. As an example, in a BTC-margined contract, you set up BTC, and in case you win, you get extra BTC.

Order Varieties

HTX supplies a number of order varieties that will help you management how and when your trades occur. Every one matches totally different methods:

Restrict Order: You set a selected value and quantity to purchase or promote. The commerce solely occurs if the market hits your value. It’s nice for getting deal however won’t fill if the worth doesn’t attain your goal.Set off Order: You have to decide a set off value, and when the market hits it, your pre-set purchase or promote order prompts. It’s helpful for establishing automated trades, like stopping a loss if the worth drops too far.Trailing Cease Order: You could set an activation value and a callback charge. The order triggers when the worth strikes in your favor after which pulls again by your set charge. It helps lock in earnings throughout huge value swings.

HTX affords leverage from 1x (no borrowing) as much as 200x for perpetual futures contracts. Nonetheless, 200x leverage is barely out there for BTC and ETH pairs, and different altcoins stand up to 125x leverage.

Margin Buying and selling

HTX margin buying and selling is a manner for customers to borrow funds from the HTX platform to commerce cryptocurrencies with extra shopping for energy than they’ve of their accounts. The borrowed funds act like a mortgage, and you need to repay them with curiosity later.

You should utilize a most of 5x leverage in margin buying and selling. HTX margin buying and selling has two essential modes that resolve how your cash (margin) is used to cowl your trades. These modes have an effect on how a lot threat you are taking:

Cross Margin Mode: This mode makes use of all the cash in your account as a security web for all of your trades. If one commerce loses cash, the system can pull funds out of your different earnings or unused money to maintain it going.Remoted Margin Mode: This mode limits the cash for every commerce to what you set in for that particular contract. If a commerce goes unhealthy, you solely lose what you assigned to it, not your complete account. It’s safer however wants extra planning because you cut up your funds.

You may change between these modes on the buying and selling web page, even whereas holding positions, so long as no open orders are pending.

Buying and selling Bots

HTX buying and selling bots are automated instruments that provide help to commerce cryptocurrencies. They work 24/7 to purchase and promote property primarily based on guidelines you set, so that you don’t have to observe the market on a regular basis. It helps a well-liked sort referred to as the “Grid Buying and selling Bot.” This bot units up a spread of costs and locations purchase and promote orders inside that vary. It buys low and sells excessive repeatedly to make small earnings as the worth strikes.

HTX buying and selling bots are safe as a result of they use your account by way of an API (a protected connection), however they don’t maintain your cash – the funds keep in your HTX account. You keep in management and might cease the bot anytime.

Copy Buying and selling

HTX copy buying and selling helps you to mechanically copy the trades of skilled merchants. You have to decide a talented dealer, observe their strikes, and your account mirrors their trades. The lead dealer earns a share of your earnings as a reward, when you hold the remainder.

Right here’s the way it works in easy phrases: You could browse from a listing of lead merchants and verify their stats, like how a lot revenue they’ve made or how many individuals observe them. You select one you want, set how a lot cash you wish to use, and hit “Comply with”. After that, HTX copies each commerce the lead dealer makes – like shopping for or promoting Bitcoin – into your account. You may cease following anytime, however when you’re in, their wins or losses grow to be yours too.

HTX copy buying and selling is nice as a result of it saves time and makes use of skilled abilities. You don’t want to observe the market all day – your chosen dealer does the work. The lead dealer takes 10-25% of your earnings (they set the speed), so that you share the wins.

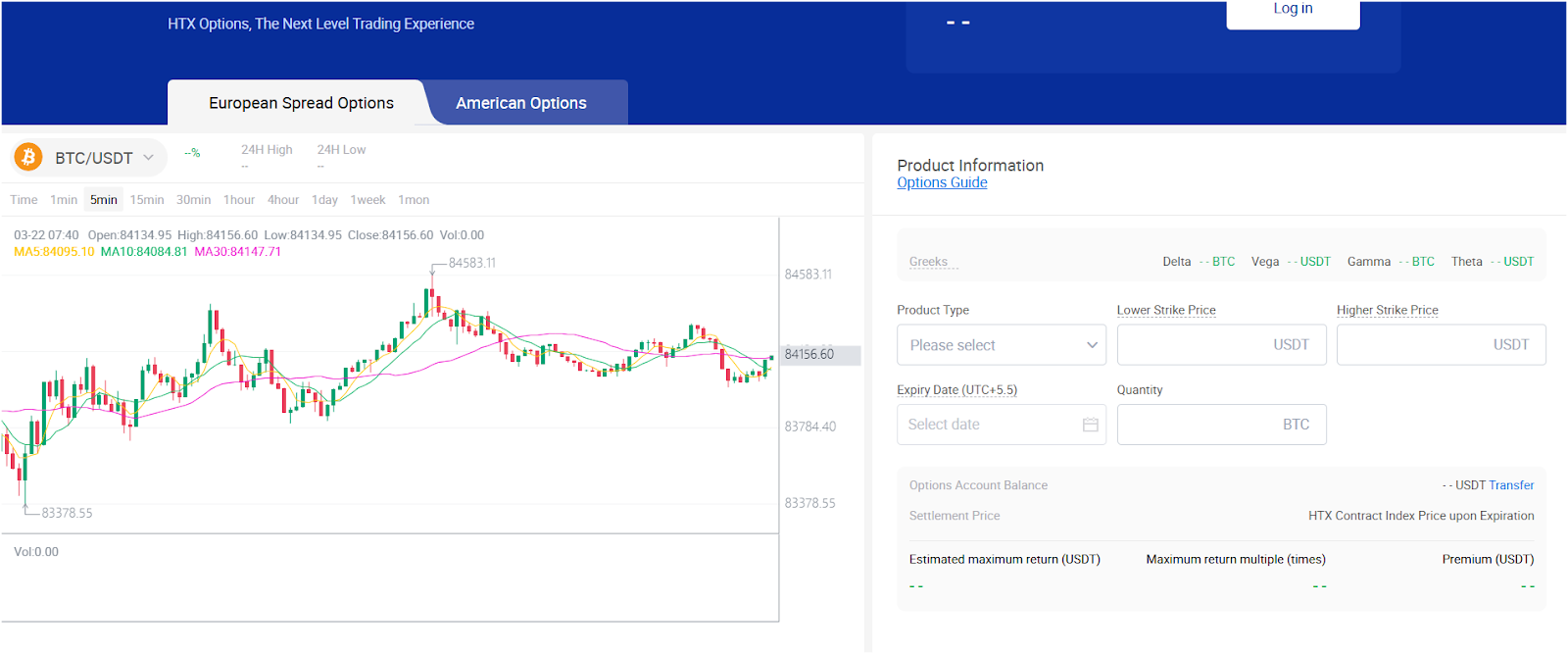

Choices Buying and selling

HTX choices buying and selling permits you to purchase or promote an asset at a set value inside a selected time with out proudly owning the asset itself. The HTX change affords two essential types: American and European choices. American choices allow you to money out anytime earlier than the deadline, supplying you with flexibility. European choices solely settle on the finish, which could be cheaper however much less versatile.

Right here’s the way it works step-by-step:

You select an choice sort: HTX affords “name” choices (betting the worth goes up) and “put” choices (betting it goes down).You set the phrases: You decide the crypto (like BTC/USDT), the strike value, and the way lengthy the contract lasts—generally minutes, generally months.The system units a premium: That is the price you pay to purchase the contract, primarily based on the present market.You win or lose: If the worth hits your goal earlier than time’s up, you revenue. If not, you lose the premium.

HTX Launchpool

HTX Launchpool is a characteristic that lets customers earn rewards by staking their $HTX tokens. It’s a manner for individuals to lock up their tokens for a set time and get new tokens from upcoming initiatives as a reward. The HTX platform makes use of this to assist new blockchain initiatives get funding whereas giving customers an opportunity to earn further revenue. You merely lock your $HTX tokens on the platform, and through that point, you earn these new tokens primarily based on how a lot you stake.

HTX Earn

HTX permits customers to generate passive revenue on their digital property by way of a number of structured merchandise. Its Earn program supplies tailor-made choices like Versatile, Fastened, Shark Fin, ETH 2.0, Staking, Twin Funding, and On-chain Staking to fulfill various funding wants.

Versatile and Fastened Staking: HTX Earn’s Versatile product helps you to deposit and withdraw property anytime, incomes each day rewards whereas maintaining liquidity intact. The Fastened product affords larger returns for locking property till a set redemption date, although early withdrawal forfeits all rewards. You may decide from over 100 fashionable cryptocurrencies, comparable to PEPE and BOME, to achieve secure returns on idle property. At the moment, it affords 10% APY on USDT and 6% APY on ETH.Shark Fin: HTX’s Shark Fin product ensures no principal loss and supplies a primary return, with potential APYs starting from 5.5% to 35% over 3-7 days. It thrives in any market situation, providing larger yields if value predictions align inside a set vary, like 6% to 36% for BTC between $30,000 and $33,000.ETH 2.0: HTX ETH 2.0 introduces one-click staking for Ethereum’s proof-of-stake improve, distributing BETH (a 1:1 staking certificates) with out slashing dangers. Staked ETH stays locked in a wise contract till the Shanghai improve permits gradual withdrawals.Staking: HTX Staking lets you lock Proof-of-Stake (PoS) cash like SOL and ADA and earn excessive rewards by validating blockchain transactions. You can too verify our detailed information on the finest crypto staking platforms.Twin Funding: Twin Funding targets superior customers by mixing stablecoins and cryptocurrencies for higher yields tied to market costs at maturity. You could decide a goal value and date for property like BTC or ETH and obtain both foreign money primarily based on the end result.On-chain Staking: On-chain Staking on HTX helps non-custodial staking with top-tier initiatives like DOT and ETH 2.0 by way of institutional-grade programs. You may hold management of your property whereas incomes rewards by way of blockchain validation with HTX’s reliable node help.

HTX Loans

HTX Loans is a service that lets you borrow cryptocurrency through the use of your current digital property as collateral. You could full Know Your Buyer (KYC) verification in your HTX account earlier than you’ll be able to start. After that, you choose a cryptocurrency to borrow—comparable to USDT, BTC, or ETH—and select a collateral asset like BTC, ETH, USDT, or HTX’s native token, HTX.

You may go for a Versatile time period, which helps you to repay at any time, or mounted phrases of seven days, 30 days, 45 days, or 90 days. Curiosity accrues hourly at charges round 0.0005%.

You repay the mortgage manually, but when the loan-to-value (LTV) ratio—calculated as your borrowed quantity divided by your collateral’s worth—reaches roughly 80%, HTX might liquidate your collateral. Your collateral stays locked till you totally repay the mortgage, although you face no penalty for paying it off early. HTX additionally helps OTC loans to institutional merchants.

Just lately, HTX reported a each day borrowing quantity of $100 million, reflecting robust demand for this service. This selection works effectively in case you want liquidity with out promoting your property.

HTX Study

HTX Study is a free instructional platform designed to show you the basics of cryptocurrency and blockchain expertise. You may discover concise classes and take quizzes that make studying partaking and interactive.

As an example, the “Crypto Loans Fundamentals” quiz explains borrowing choices like USDT or ETH and the way the LTV ratio capabilities, rewarding you with small quantities—comparable to 0.04 USDT or 0.5 HTX—upon completion. The platform targets learners and verified account holders, providing classes on subjects like staking advantages or securing your crypto pockets in easy language.

Some programs spotlight HTX-specific perks, such because the 1% cashback on peer-to-peer (P2P) trades. You want a verified HTX account to take part, and any rewards you earn are credited on to your pockets. This service is right in case you are new to cryptocurrency or wish to sharpen your abilities whereas gathering minor crypto bonuses.

Deposits and Withdrawals at HTX

Deposits and Withdrawals Limits

The minimal deposit quantity varies by cryptocurrency and community. Depositing Bitcoin requires solely a small threshold to cowl community prices, however HTX doesn’t specify a common minimal, leaving it versatile. Fiat deposits, comparable to USD or EUR by way of financial institution switch minimums rely on the fee methodology (e.g., $10-$50 usually).

Withdrawal limits differ primarily based on verification standing. Unverified customers, with out Know Your Buyer (KYC) completion, can withdraw as much as 0.06 BTC per day. For verified customers who full KYC, the restrict rises considerably to 200 BTC each day.

Verification LevelRequired Information24-Hour Withdrawal Restrict (BTC)Stage 1 (Fundamental)Private knowledge (first and final identify, nationality, nation of residence, date of beginning)5 BTCStage 2 (Fundamental Verification)Picture of a government-issued ID (passport, driver’s license, or ID card)200 BTCStage 3 (Superior Verification)Facial recognition and extra ID verification3,000 BTC

Deposits and Withdrawals Strategies

HTX withdrawal strategies embody Financial institution Switch (SEPA), Financial institution Switch (SWIFT), Credit score/Debit Card (Visa), Credit score/Debit Card (Mastercard), PayPal, Skrill, Neteller, AdvCash, Payeer, Excellent Cash, WebMoney, Revolut, Payoneer, and P2P Buying and selling. You can too withdraw cryptocurrency by way of community transactions.

Cryptocurrencies Obtainable on HTX

HTX provides you entry to over 700 cryptocurrencies, making it a best choice for selection. You may commerce huge names like Bitcoin (BTC), Ethereum (ETH), and USDT, in addition to fashionable altcoins comparable to Dogecoin (DOGE), Shiba Inu (SHIB), Solana (SOL), and Cardano (ADA).

The platform additionally options its native token, HTX, which you need to use to decrease buying and selling charges or stake for rewards. When you’re into newer initiatives, HTX lists tokens like PEPE and BOME too.

HTX Alternate Supported/Restricted International locations

HTX serves you in over 160 international locations, together with locations like France, Australia, and Germany. You get help in 15 languages—suppose English, Spanish, or Russian—and might deposit over 100 fiat currencies for comfort.

That stated, some international locations are off-limits as a result of rules. When you’re within the United States, mainland China, Japan, Iran, or North Korea, you’ll be able to’t use HTX due to authorized restrictions or sanctions. Different no-go zones embody Taiwan, Israel, Iraq, Bolivia, Pakistan, Spain, the UK, and New Zealand for derivatives buying and selling.

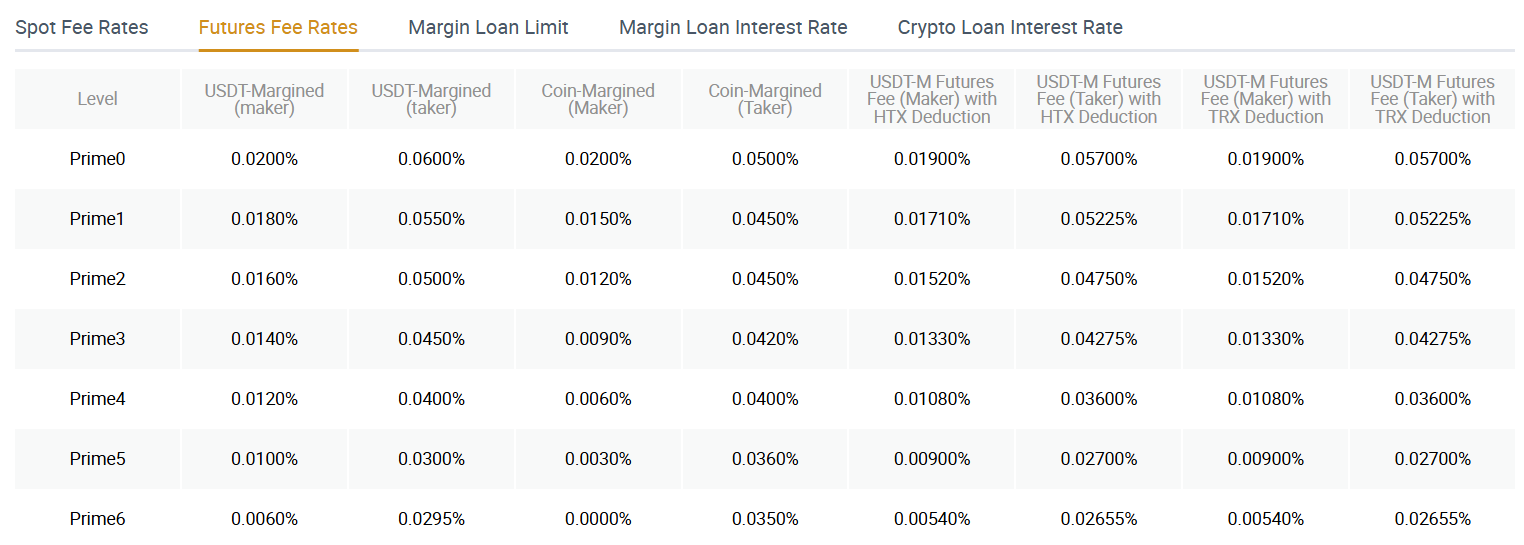

HTX Charges

Beneath is an in depth breakdown of all HTX charges, protecting buying and selling charges, deposit and withdrawal charges, and extra prices for specialised companies like futures and margin buying and selling.

Buying and selling Charges

For spot buying and selling, HTX employs a maker-taker price mannequin, which is frequent amongst cryptocurrency exchanges. Makers, who add liquidity to the order ebook by inserting restrict orders that aren’t instantly crammed, usually pay decrease charges than takers, who take away liquidity by executing market orders or restrict orders that fill immediately.

The bottom price for each makers and takers begins at 0.2% of the commerce worth. This is applicable to all crypto-to-crypto buying and selling pairs and is calculated primarily based on the whole transaction quantity. Nonetheless, HTX affords a tiered price construction that reduces these charges for customers with larger 30-day buying and selling volumes or these holding HTX tokens (HTX).

The buying and selling charges for margin trades align with the spot buying and selling price construction, beginning at 0.2% for each makers and takers. Nonetheless, margin buying and selling introduces an extra price: curiosity on the borrowed funds. Rates of interest are calculated hourly and range relying on the cryptocurrency being borrowed.

For coin-margined futures, the usual maker price is 0.02%, and the taker price is 0.05%. USDT-margined swaps observe an identical mannequin however with excessive taker charges, with maker charges at 0.02% and taker charges at 0.06%.

Deposit and Withdrawal Charges

HTX doesn’t cost a deposit price. Nonetheless, you need to be conscious of community charges (also referred to as mining or fuel charges), that are paid to the blockchain community. For fiat deposits, comparable to by way of third-party fee strategies like PayPal or financial institution playing cards, HTX itself doesn’t impose a direct price, however the fee supplier might cost processing charges, which rely on the strategy and foreign money (e.g., USD, EUR, GBP).

Withdrawals do incur charges, and HTX has shifted to a dynamic price mannequin to account for cryptocurrency value volatility and community prices. Quite than a set quantity, the withdrawal price is calculated each day primarily based on the blockchain community’s price divided by the day before today’s common value of the cryptocurrency.

HTX Safety

HTX is a safe crypto change with a number of security measures in place. Here’s a fast overview of its security measures:

Two-Issue Authentication (2FA): You may set it up utilizing Google Authenticator or SMS, which generates a singular code you need to enter alongside your password when logging in or withdrawing funds. This ensures that even when somebody will get your password, they can’t entry your account with out the second code.Merkle Tree Proof of Reserves (PoR): HTX makes use of the Merkle Tree Proof of Reserves to show it holds sufficient property to cowl all of your deposits. You may confirm this by way of month-to-month stories displaying reserve ratios, like 101% for BTC and 100% for ETH.Chilly Storage for Belongings: HTX shops most of your cryptocurrency in chilly wallets, that are offline and protected from on-line hackers. Solely a small portion stays in scorching wallets for each day buying and selling wants.Multi-Signature Wallets: HTX employs multi-signature wallets, that means a number of keys are wanted to authorize transactions. You profit from this as a result of it prevents any single particular person or hacker from shifting funds with out further approvals.Anti-Phishing Codes: You may create a singular anti-phishing code in HTX’s safety settings to identify actual emails from the platform. Each reliable HTX electronic mail will embody your code, so you’ll be able to inform if a message is faux if it’s lacking. This helps you keep away from scams the place fraudsters fake to be HTX to steal your particulars.Blacklisted Deal with Monitoring: HTX tracks and blocks dangerous addresses linked to scams or criminality. In January 2025 alone, it added 189 new blacklisted addresses and stopped deposits from reaching the platform. This retains your buying and selling setting clear and shields you from tainted funds.Common Safety Audits: HTX conducts frequent safety checks to seek out and repair weaknesses in its system. These audits make sure the platform stays forward of latest threats and retains your knowledge and property protected.

HTX Licenses and Regulatory Standing

HTX additionally holds a number of licenses to make sure authorized operations throughout numerous areas. In Lithuania, it has the Deposit Digital Foreign money Pockets Operator and Digital Foreign money Alternate Operator Registration. Dubai granted HTX Preliminary Approval of a Full Market Product (FMP) License by way of VARA. The British Virgin Islands issued the SIBA Funding Enterprise License for Custody and Operation of Funding Alternate. Moreover, it affords fee and remittance companies in South America.

Person Interface and Expertise

HTX affords you a clear buying and selling interface on each desktop and cell. The desktop model fits lively merchants with instruments like detailed charts, technical indicators, and buying and selling bots. You’ll discover it simple to leap between spot buying and selling, futures, or HTX Earn options like staking when you log in.

The cell app is obtainable for iOS and Android and retains issues less complicated for buying and selling anyplace, including social options like following crypto consultants or becoming a member of chats. You may keep up to date with trending subjects proper on the app’s residence display. Navigation feels intuitive, however in case you’re new, the numerous choices may take a second to understand.

Buyer Help

HTX supplies you with 24/7 buyer help primarily by way of electronic mail at [email protected]. You gained’t get a stay chat or telephone assist, which could really feel restricted in comparison with some rivals. Responses can come inside hours, however throughout busy instances, you may wait longer.

After logging in, you’ll be able to submit questions by way of the “Help” tab about account points, withdrawals, or KYC hiccups. HTX additionally affords a stable FAQ and information base on their website, answering fundamentals like resetting 2FA or checking charges directly.

When you’re caught, we advise pinging them on X, although it’s not official. You’ll discover multilingual assist in languages like English or French in case you’re in a supported area. Begin with the self-help instruments on-line and electronic mail if wanted.

Conclusion

In a nutshell, HTX is the most effective change for crypto merchants, packing in every thing from spot buying and selling to futures with hefty withdrawal caps—3,000 BTC in case you’re totally verified—and a bunch of the way to deposit and withdraw funds, like SEPA, SWIFT, and even P2P offers. Its decade-long observe report, robust safety measures like 2FA and chilly storage, and no main hacks improve its reliability.

Nonetheless, drawbacks embody its inaccessibility within the US as a result of regulatory restrictions, excessive buying and selling charges, and withdrawal charges that may fluctuate with community prices, and a decrease 0.06 BTC each day restrict for unverified accounts, which can frustrate some.

FAQs

Is HTX protected to make use of?

Sure, HTX is mostly protected to make use of, because of its strong safety measures and long-standing popularity. Based in 2013, HTX (previously Huobi) has operated for over a decade with no main safety breach, showcasing its reliability. The platform employs two-factor authentication (2FA), chilly storage for many person funds, and multi-signature wallets to guard property.

Can I take advantage of HTX within the US?

No, you can not legally use HTX within the US as a result of regulatory restrictions. It doesn’t maintain the mandatory licenses to function totally in america. Right here, crypto exchanges should adjust to strict federal and state rules, together with registration with the Monetary Crimes Enforcement Community (FinCEN).

Whereas HTX as soon as had a US presence by way of Huobi US, it ceased operations in 2019 as a result of compliance challenges. The platform’s phrases of service now exclude US residents, and trying to entry it by way of VPN violates these phrases, risking account suspension.

What’s the withdrawal restrict on HTX with out KYC?

The withdrawal restrict on HTX with out KYC is 0.06 BTC per day for unverified accounts. HTX permits customers to enroll and commerce with out identification verification, however this comes with restrictions to adjust to anti-money laundering (AML) insurance policies.

How does HTX work?

HTX works as a centralized cryptocurrency change the place customers commerce, purchase, and promote digital property like Bitcoin and Ethereum. You begin by creating an account, optionally finishing KYC for full entry, and depositing funds—both crypto or fiat by way of supported strategies like financial institution playing cards.

The platform affords spot buying and selling for direct asset swaps, margin buying and selling with borrowed funds (as much as 5x leverage), and futures buying and selling with as much as 200x leverage for amplified positions. HTX calculates charges dynamically (e.g., 0.2% for spot trades, reducible with HTX tokens) and processes withdrawals to exterior wallets, charging network-based charges.

Is HTX authorized within the UK?

No, HTX shouldn’t be authorized to make use of within the UK. As soon as, The FCA additionally issued a warning towards HTX (and Huobi World), stating that the agency shouldn’t be approved to advertise monetary companies within the UK.