imaginima

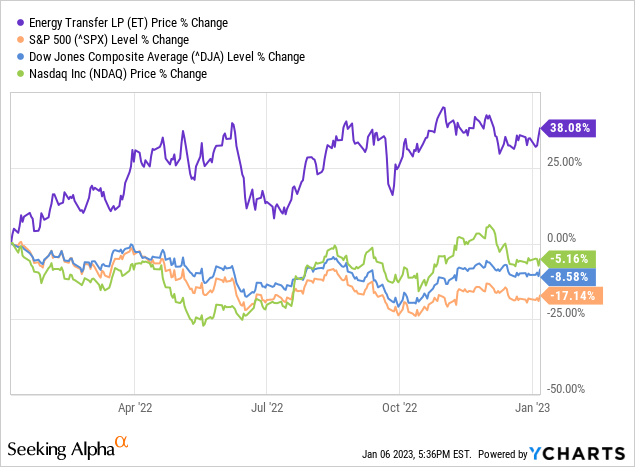

Power Switch (NYSE:ET) has been a long-standing funding for me. Within the face of great market turmoil, together with materials drops within the S&P, Dow Jones, and Nasdaq indices, ET has proved to be a dependable supply of stability. Over the previous 12 months or so, ET has generated a return of round 40%, whereas the Nasdaq, Dow Jones, and S&P 500 indices have declined by 5.2%, 8.6%, and 17.1%, respectively.

What a large outperformance, particularly within the face of assorted financial challenges together with inflation, rising rates of interest, uncertainty about an financial recession, in addition to ongoing issues about power safety as a result of battle between Russia and Ukraine.

The partnership provides a horny distribution yield of practically 9%, supported by a powerful distribution protection ratio. In truth, the distribution yield is sort of 6 instances the S&P dividend yield of round 1.5%. All of that is supported by sturdy fundamentals, with the corporate constantly setting new data. Particularly, ET achieved file intrastate pure fuel transportation volumes in Q3 2022, Midstream gathered volumes reached a brand new file in Q3 2022, Nederland and Marcus Hook Terminals set new data for ethane exports in Q3 2022 and NGL fractionation volumes reached a brand new file in Q3 2022. What’s extra, ET just lately accomplished the development of the Gulf Run Pipeline with compression modifications anticipated to be accomplished by the tip of 2022 and has signed new LNG offtake agreements for the Lake Charles LNG undertaking. In different phrases, ET is firing on all cylinders. That is mirrored within the partnership’s financials. In consequence, Power Switch has elevated its 2022 steering for the third time. The anticipated adjusted EBITDA is now within the vary of $12.8-$13.0 billion, up from the earlier vary of $12.6-$12.8 billion, and development capital stays between $1.8 and $2.1 billion.

For Q3 2022, it’s anticipated that distributable money move will attain $1.6 billion, a rise of about 20% from the identical interval within the earlier 12 months. Moreover, extra money move after distribution funds is predicted to be round $760 million. Because of this on an annualized foundation, Power Switch is setting apart over $3 billion after distribution funds. That is notably spectacular contemplating the partnership’s market capitalization stays under $40 billion.

What’s extra, Power Switch is making progress on quite a few strategic initiatives. For instance:

In August 2022, ET accomplished the beforehand introduced sale of ET Canada for money proceeds of ~$302 million. The sale decreased ET’s consolidated debt by ~$850 million. On December 5, 2022, ET priced $1 billion of 5.55% senior notes due 2028, and $1.5 billion of 5.75% senior notes due 2033. The partnership intends to make use of web proceeds to repay excellent indebtedness and for basic functions. In September 2022, ET accomplished the Woodford Categorical bolt-on acquisition for $485 million. In 2022, ET executed six long-term LNG SPAs to provide 7.9 million tonnes of LNG each year. It will increase ET’s contracted money move.

At this level you will need to spotlight that the overwhelming majority (practically 90%) of Power Switch’s earnings are derived from fee-based contracts, which implies that fluctuations in commodity costs have little impact on the partnership’s earnings. Regardless of this, power demand is booming. Home pure fuel demand is at all-time excessive, having elevated by practically 65% during the last 20 years and the Lake Charles LNG Export Terminal is receiving growing curiosity as international LNG demand grows (ET is now concentrating on FID by finish of Q1 2023).

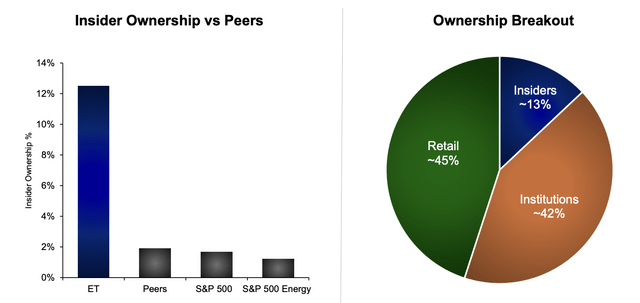

It’s evident that ET is heading the correct course on all fronts. That is supported by insider exercise. Since January 2021, ET insiders in addition to unbiased board members have bought roughly 29.4 million models, totaling roughly $265 million. This contains purchases of roughly $37 million by Kelcy Warren, the corporate’s Government Chairman in November 2022.

Power Switch December 2022 Investor Presentation

It’s honest to say that Administration and Insiders are considerably aligned with frequent unitholders. All that is extraordinarily constructive.

For my part, what issues essentially the most to ET traders is the engaging and secure earnings. In any case, ET is an MLP (grasp restricted partnership), which is predominantly an earnings automobile. As talked about above, ET is a promising funding alternative because of its engaging distribution yield of round 9%, and the distribution is effectively lined, leaving ample money available for company priorities similar to M&A, debt compensation, in addition to distribution will increase.

For Q3 2022, ET paid a quarterly money distribution of $0.265 per frequent unit, which is equal to $1.06 on an annualized foundation. This represents a rise of greater than 70% in comparison with Q3 2021 and a 15% improve over Q2 2022. The distribution improve is in step with the partnership’s plan to return worth to unitholders whereas sustaining its goal leverage ratio of 4.0x-4.5x debt-to-EBITDA. The final word purpose is to return to the earlier pre-COVID stage of $0.305 per quarter, or $1.22 on an annual foundation, whereas contemplating the partnership’s leverage goal, development alternatives, and unit buy-backs.

Briefly, an investor in ET as we speak can lock in a distribution yield of virtually 9% and a pro-forma yield exceeding 10%. It’s my perception that the partnership will ultimately surpass its pre-COVID distribution stage of $1.22 per unit on an annual foundation by a large margin. Together with its sturdy distributions, ET is investing in excessive development areas similar to LNG export terminals and has a devoted Different Power Group engaged on renewable initiatives like photo voltaic and carbon seize. In different phrases, ET is now not a conventional oil and fuel pipeline firm and there are thrilling instances forward for its traders.