Ink Enterprise Premier is the newest enterprise card from Chase. It’s not the best enterprise card from Chase.

No, it’s not a horrible product. It’s an excellent match for enterprise homeowners with comparatively excessive spending wants, significantly those that make massive purchases all year long. However it has some key disadvantages to different Chase enterprise playing cards, together with a excessive annual charge and a wonky rewards program that gives much less worth than it ought to.

Had been I available in the market for a brand new enterprise card, I wouldn’t apply for Ink Enterprise Premier. You would possibly, although — so let’s stroll by way of its upsides and disadvantages collectively.

What Is the Ink Enterprise Premier Card?

The Ink Enterprise Premier Card is a small-business cost card with a beneficiant cash-back rewards scheme and a very good sign-up bonus. Its spending restrict is greater in case you pay in full every month, however many purchases are eligible for Chase’s Flex for Marketing strategy, which helps you to pay for purchases over time (with curiosity).

Like different Chase cash-back playing cards, Ink Enterprise Premier participates within the Final Rewards program, which helps you to redeem for money, Amazon purchases, journey, present playing cards, and extra.

Nonetheless, you possibly can’t mix factors earned together with your Ink Enterprise Premier card with factors earned on different Chase playing cards. Which means you possibly can’t earn a redemption bonus on them in case you have an eligible Chase card like Chase Sapphire Reserve or Sapphire Most popular. You can also’t switch factors earned with Premier to Chase journey companions, the place they’re typically value extra at redemption.

Ink Enterprise Most popular has a $195 annual charge, greater than different Chase enterprise playing cards. There’s no charge for extra worker playing cards, nevertheless.

What Units the Ink Enterprise Premier Card Aside?

Ink Enterprise Premier stands out from the remainder of Chase’s spending card lineup — and from most different issuers’ too — for 3 causes:

Pay in Full By Default. Ink Enterprise Premier is Chase’s solely cost card, and certainly one of only some well-known cost playing cards available on the market proper now. That’s definitely a promoting level in case you have the money movement to keep away from carrying balances from month to month.Greater Money-Again Charge on Large Purchases. Ink Enterprise Premier pays 2.5% money again on particular person purchases over $5,000 (versus 2% on purchases beneath $5,000). If your corporation tends to make fewer, bigger purchases or simply greater purchases usually, this makes a significant distinction over time.Glorious Cell Telephone Safety Profit. This profit isn’t distinctive to Ink Enterprise Premier, however its worth is healthier than another enterprise playing cards’. It’s value as much as $1,000 per declare, minus a $100 deductible per declare, and applies to as many as three claims per 12 months. Regular limits are extra like $600 per declare and not more than two claims per 12 months.

Key Options of the Ink Enterprise Premier Card

These are an important options of the Ink Enterprise Premier card. Notice the wonderful sign-up bonus, above-average cash-back incomes price, and the foundations round paying your steadiness in full vs. carrying balances from month to month.

Signal-Up Bonus

Ink Enterprise Premier has a superb sign-up bonus for brand spanking new cardmembers: Earn $1,000 bonus money again after making $10,000 in purchases within the first three months from account opening.

You’ll have to spend about $3,334 per thirty days to earn it, however that ought to be doable in case you run a rising enterprise with numerous stock or tools wants.

Incomes Money-Again Rewards

Ink Enterprise Premier has a three-tiered rewards program that’s significantly beneficiant for enterprise vacationers and massive spenders:

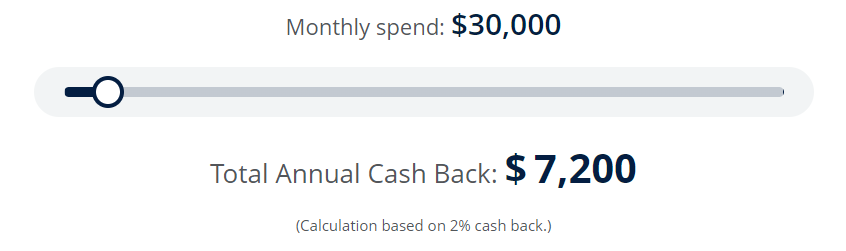

Earn limitless 5% money again on journey bought by way of the Final Rewards journey portal (Chase Journey)Earn limitless 2.5% money again on particular person purchases totaling $5,000 or moreEarn limitless 2% money again on all different eligible purchases

Money again accrues as Final Rewards factors, that are value as much as $0.01 apiece at redemption. Factors don’t expire so long as your account stays open and in good standing.

Redeeming Money-Again Rewards

One of the simplest ways to redeem your factors is for money, both as assertion credit or checking account deposits. This feature values your factors at $0.01 apiece.

Different choices embody journey, present playing cards, and Amazon purchases. Keep away from Amazon redemptions if potential, as they lower level values to $0.008 apiece.

Pay-in-Full Possibility

Ink Enterprise Premier is technically a cost card, which suggests the default possibility is to pay your invoice in full every month. Your credit score restrict is greater on pay-in-full purchases, so you must attempt to do that in case you can afford it. And in case you desire to hold balances from month to month as a result of insufficient or uneven money movement, take into account one other bank card.

Flex for Enterprise Possibility (Carried Balances)

Chase could elect to put aside a portion of your credit score restrict as “Flex for Enterprise.” You possibly can pay for Flex for Enterprise purchases over time, as you’d with an everyday bank card. Like an everyday bank card, Flex for Enterprise purchases accrue curiosity, so attempt to decrease its use if in any respect potential.

Cell Telephone Safety Profit

Cellular phone safety is not a novelty within the bank card world, however Ink Enterprise Premier goes above and past. Its safety plan guarantees as much as $1,000 in protection per declare (minus a $100 deductible per declare) on as much as three claims per 12 months.

This profit applies to no matter units your Ink Enterprise Premier card pays the payments on. For those who problem telephones to all of your workers, throw them on the cardboard and take full benefit of the coverage.

Journey Advantages

Ink Enterprise Premier has a regular lineup of journey advantages and protections:

Journey cancellation and interruption insuranceTrip delay reimbursementBaggage delay insuranceRental automotive collision injury waiver Journey and emergency help providers, like roadside dispatch

To say the insurance coverage and reimbursement advantages, together with rental automotive protection, you’ll have to cost related bills to your card. Which means private journey bills are out of attain except you cost them to a private bank card with related advantages.

Vital Charges

Ink Enterprise Premier’s annual charge is $195. Worker playing cards don’t price further, regardless of what number of you order, and there’s no international transaction charge.

Credit score Required

The Ink Enterprise Premier Card requires good to wonderful credit score. If your corporation is comparatively new, you could want to use utilizing your private credit score rating, which means you’ll have to personally assure your prices.

Benefits of the Ink Enterprise Premier Card

These are Ink Enterprise Premier’s prime promoting factors.

Excellent Signal-Up Bonus. Ink Enterprise Premier has the most effective sign-up bonuses within the enterprise bank card area. It’s not too tough to acquire for moderate-spending companies, both.5% Money Again on Eligible Chase Journey Purchases. Like most different Chase playing cards, Ink Enterprise Premier earns 5% money again on eligible Chase Journey bookings. That’s a perk for frequent enterprise vacationers (and comfort for the dearth of journey switch companions right here).2.5% Money Again on Purchases Larger Than $5,000. Ink Enterprise Premier actually shines on massive purchases. You’ll earn 2.5% money again on all purchases over $5,000, with no limits on how a lot you possibly can earn.Sturdy Baseline Money-Again Charge. Ink Enterprise Premier additionally earns limitless 2% money again at a baseline, in keeping with different prime enterprise bank cards.Glorious Cell Telephone Safety Profit. Ink Enterprise Premier has the very best cellular phone safety good thing about any enterprise bank card I’ve seen. If your corporation has a number of cell telephones, three claims per 12 months isn’t unreasonable.Choice to Pay in Full or Carry a Stability. Ink Enterprise Premier is “pay in full” by default, nevertheless it gives the pliability to hold a steadiness on particular purchases with the Flex for Marketing strategy. The tradeoff: Your spending restrict is decrease with Flex for Enterprise.No Charge for Worker Playing cards. You by no means must pay further for worker playing cards with Ink Enterprise Premier. Good news in case you belief your workers sufficient to cost on the corporate’s dime.

Disadvantages of the Ink Enterprise Premier Card

Contemplate these drawbacks earlier than you apply for the Ink Enterprise Premier Card. Clearly, it’s not for everybody.

$195 Annual Charge. Ink Enterprise Premier has a $195 annual charge. That’s a cinch to offset in case you spend greater than $10,000 annually and pay your steadiness in full every month. If your corporation funds is smaller, take into account a no-annual-fee enterprise card.Doesn’t Play Good With Different Chase Playing cards. Ink Enterprise Premier stands alone within the Chase ecosystem. You possibly can’t switch factors earned right here to different Chase playing cards, the place they could be value as much as 50% extra at redemption. Your factors’ redemption worth tops out at 1% right here.No Journey Switch Companions. You can also’t switch your factors to any of Chase’s greater than 15 journey companions, which embody main airways and hospitality households. The fitting switch can increase your factors’ redemption worth by 200% or extra and slash your corporation journey prices within the course of.

How Ink Enterprise Premier Stacks Up

See how Ink Enterprise Premier compares to a different widespread Chase enterprise card: the Chase Ink Enterprise Money Credit score Card.

Different Alternate options to Contemplate

For those who’re unsure Ink Enterprise Premier or Ink Enterprise Money are best for you, take into account these different small-business card choices.

Last Phrase

The Chase Ink Enterprise Premier Card is good for individuals who personal rising companies with pretty excessive spending necessities. For those who make a number of purchases of $5,000 extra annually and might afford to pay your prices in full every month, you possibly can’t do higher throughout the Chase ecosystem.

Which is the opposite aspect of the coin. In case you have a number of Chase playing cards, the truth that you possibly can’t switch Enterprise Premier factors to these accounts — or switch them out to journey companions and doubtlessly increase their redemption worth — is a serious disadvantage. So is the dearth of different journey perks past the overall journey insurance coverage coverages you’d get with any premium Visa or Mastercard.

However in case you’re centered on incomes money again within the right here and now, Premier has you lined. You make the decision.